News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Arbitrum says it pulled out of accelerator program after Nvidia refused crypto association2Bitwise Registers NEAR ETF in Delaware for Crypto Access3Is BONK the Next 1000x Crypto?

Can Ethereum Meet Traders’ Bullish Expectations?

Newscrypto·2024/07/24 13:51

Ethereum has less short-term price potential than bitcoin, analysts say

Options traders are less optimistic about ether’s short-term price performance compared to bitcoin’s, QCP Capital analysts said.However, analysts maintain a positive outlook for ether in the medium to long term.

The Block·2024/07/24 13:46

Fetch.ai (FET) Traders Turn Bullish as ASI Phase 2 Nears

BeInCrypto·2024/07/24 13:26

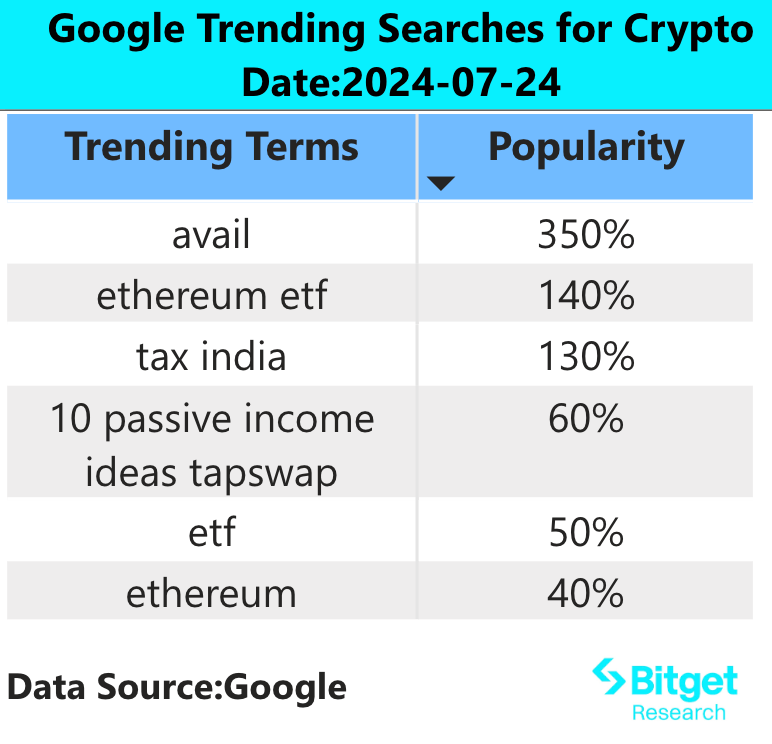

Ethereum ETFs Debut with Strong Launch, Sparking Optimism for Future Crypto Funds

Cryptodnes·2024/07/24 13:22

Worldcoin Launches Token Unlocking Program

Cryptodnes·2024/07/24 13:22

Franklin Templeton Eyes Solana for Future ETFs

Cryptodnes·2024/07/24 13:22

Airdrop success propels Bitget wallet to second most popular in Japan

Cointelegraph·2024/07/24 13:07

Firm behind Proton Mail unveils self-custodial Bitcoin wallet

Quick Take Proton, known for its privacy-focused solutions like Proton Mail and Proton VPN, has unveiled a self-custodial Bitcoin wallet solution. Proton Wallet is initially available to early access users ahead of a broader rollout.

The Block·2024/07/24 11:16

Flash

- 05:56Ripple President Confirms Company Will Not Go Public in 2025Ripple President Monica Long stated in an interview that Ripple has no plans to go public in 2025. Long pointed out that the company has sufficient cash reserves and does not need to conduct an IPO for fundraising or increasing visibility, a decision also supported by CEO Brad Garlinghouse. Previously, Ripple repurchased some shares this year at a valuation of $11.3 billion, down from a $15 billion valuation in 2022, indicating its strategic preference for maintaining independent development. (Cointelegraph)

- 05:25Solana On-Chain DEX Trading Volume Reaches $19.359 Billion in the Past Week, Ranking First WorldwideAccording to DeFiLlama data, Solana's on-chain DEX trading volume reached $19.359 billion in the past week, with a weekly increase of 23.53%. This figure surpasses Ethereum's $12.105 billion, ranking first among public chains. The BSC chain ranks third with $8.813 billion.

- 05:25Top Candidate for Fed Chair: Speak Less, Mind Your Business, Rigorously Control Monetary ExpansionDuring an event on Friday, Kevin Warsh, the top candidate considered by Wall Street to succeed the current Federal Reserve Chair Jerome Powell and former Fed governor, harshly criticized some of the Fed's practices. In a side event at the IMF and World Bank Annual Meetings, Warsh, speaking before a full house, stated that the Federal Reserve talks too much, intervenes excessively in current social issues, and has not held lawmakers accountable for their excessive spending. Warsh argued that the Fed should revert to its traditional role—maintaining a low profile as it had for most of the past hundred years, without over-explaining its monetary policy and financial stability measures to the public. Warsh's views seem to align with Trump's, who believes Powell is overly exposed in the media. On Friday, Warsh said, “The Fed leaders are better off not frequently sharing their latest thoughts.” He added that Fed officials should not publish their economic forecasts because it would “bind them to their words.” Warsh even pointed out that the Fed should not over-rely on economic data when making decisions since such "data dependency" holds little value. He emphasized that the data released by the government is often delayed and prone to subsequent revisions. In his speech, Warsh did not express specific views on inflation and interest rate prospects but rather stated that the Fed should not reveal its expectations about the future path of interest rates to the markets. He said, “Central banks should readjust to operating in an environment without applause and no audience on the edge of their seats.”