News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Analysts believe Ether will see “tremendous” price action once spot ETFs build momentum, similar to Bitcoin after the launch of spot Bitcoin ETFs.

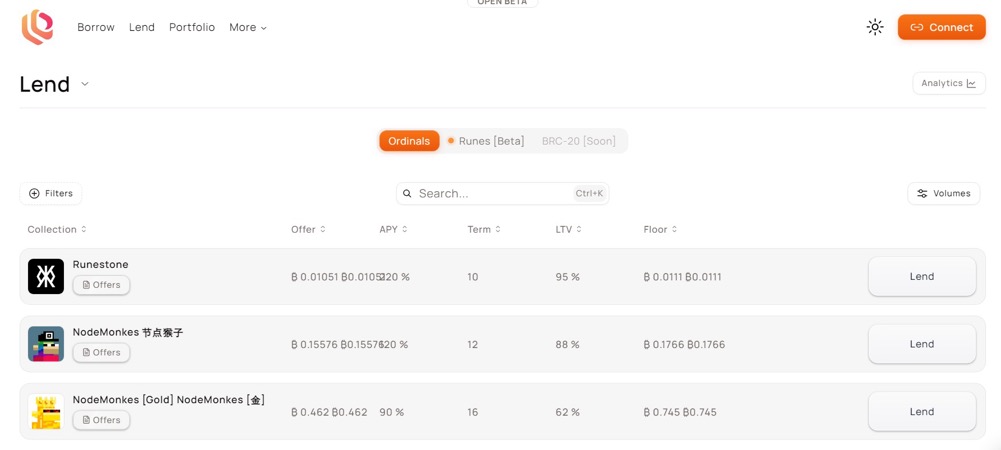

Share link:In this post: Ethereum’s spot ETF launch didn’t cause the market to explode, with inflows of $107 million on the first day. Ether is currently trading below key moving averages, indicating short-term bearish momentum despite a long-term bullish outlook. Analysts remain bullish, expecting Ethereum to break all-time highs with sustained institutional interest.Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the infor

Spot Ethereum ETFs recorded $106.7 million in net inflows on Tuesday.“I think they pretty much met expectations for me,” Bloomberg Intelligence’s James Seyffart told The Block.

Chainalysis identified that the expansion of crypto-linked disinformation campaigns by actors like SouthFront and ISWN poses risks to global elections in 2024.

- 19:52ZKsync Founder: Ethereum's Shift to RISC-V Will Enhance Its World Computer StatusZKsync founder and Matter Labs CEO Alex Gluchowski stated that Ethereum, as the "world computer," still has a clear product-market fit, with its true moat being the network itself rather than downstream applications. Gluchowski emphasized that Ethereum is the foundation of the internet of value, and its credible neutrality stems from mathematics, open-source code, and complete decentralization. He pointed out that if Ethereum can maintain its status as the world computer, the value of global transaction infrastructure and payment systems will flow directly or indirectly to ETH. Additionally, he believes that the internet of value will not operate on a single chain alone, and the future of Ethereum lies in becoming the secure base layer of a vast decentralized blockchain network. However, this vision can only be realized if Ethereum fully leverages its core advantages.

- 19:51Opinion: The Repeal of Crypto-related Banking Guidance by the Federal Reserve Could Accelerate Traditional Banks' Adoption of BTC Checking Accounts, Crypto Loans, and MoreThe Federal Reserve has announced the withdrawal of regulatory guidance concerning banks' crypto asset and USD token operations, along with updating expected standards for related services. Damilola Esebame, a contributing author for Finance Feeds, analyzes that this move by the Federal Reserve signifies a broader legitimization of Bitcoin in the eyes of regulatory bodies, surpassing mere banking policies. It may help the Federal Reserve accelerate its vision of a financial environment where Bitcoin is as accessible and safe as traditional fiat currency. This could mean that Bitcoin checking accounts, crypto-backed loans, and crypto-to-fiat conversions may be integrated into traditional banking services sooner than expected.

- 19:51Selected Republican Plan to Abolish U.S. Audit Regulator PCAOBAccording to the Financial Times, late Friday local time, the leadership of the United States House Committee on Financial Services unveiled a proposal to abolish the independent Public Company Accounting Oversight Board (PCAOB). This proposal is intended to be included in the major tax and spending bill currently under consideration by Congress. According to the draft legislation, a tax levied on public companies and broker-dealers to fund the PCAOB would be eliminated, and the duties of the agency would be integrated into the Securities and Exchange Commission. (Jinshi)