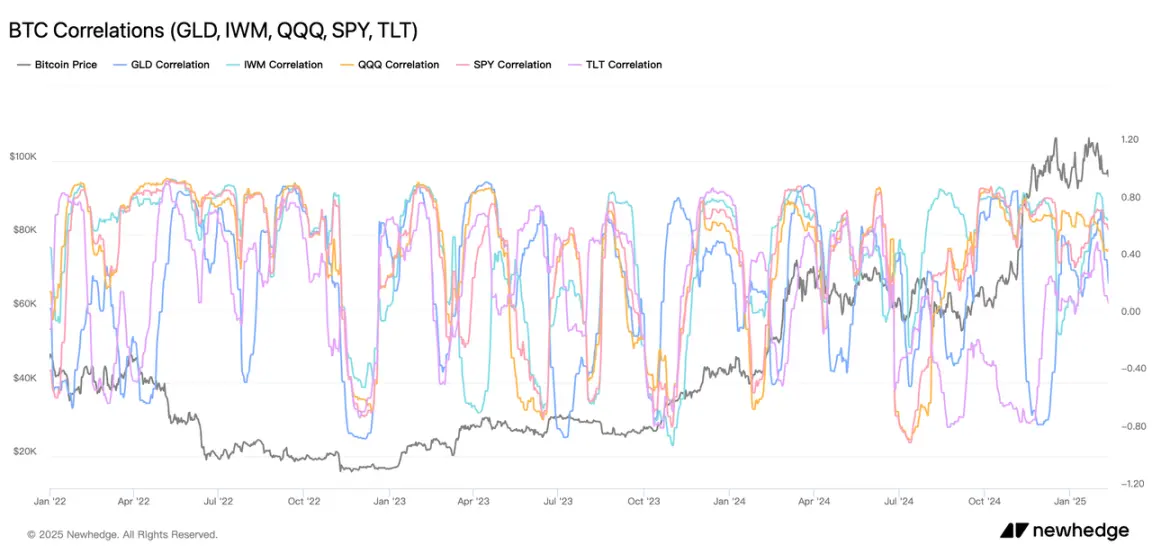

I’m expecting volatility in the market any time now. If $BTC keeps dipping and fails to hold key levels (~95k), we’re dropping toward $90k. Alts will get hit by the fall too, and sentiment will cool off as traders sit back and wait for a bottom.

In another scenario, if $BTC stabilizes here, alts will slowly recover and catch a boost. Bitcoin will hold steady around $95k-$97k, setting up a range. Meanwhile, altcoins start picking up momentum. In that case, I’m expecting $ETH to climb back above $3k quick, and other RWA alts could show some strong breakouts.

Exploring Alternative Cryptocurrencies: $ALGO , $LTC , $DOT , $LUNC

With Pi Network's mainnet launch causing market fluctuations, investors are now on the lookout for strong, fundamentally sound cryptocurrencies with promising growth potential. Among the top contenders are Algorand (ALGO), Litecoin (LTC), Polkadot (DOT), Terra Luna Classic (LUNC),each offering unique advantages in the evolving crypto landscape.

Let’s take a closer look at these alternative digital assets and their role in shaping the future of blockchain technology.

🔹 Algorand ($ALGO ) – The High-Speed Blockchain Revolution

Algorand is a cutting-edge blockchain platform designed for speed, scalability, and decentralization. Using a Pure Proof-of-Stake (PPoS) consensus mechanism, it eliminates inefficiencies seen in traditional blockchains while maintaining robust security. This makes it a top choice for financial applications and enterprise solutions.

💰 Current Price: $0.2604

✅ Why Invest in $ALGO?

Fast & Scalable: Handles high transaction volumes efficiently.

Eco-Friendly: Low energy consumption compared to traditional blockchains.

Growing Adoption: Used for DeFi, NFTs, and digital identity solutions.

🔹 Litecoin ($LTC ) – A Faster Alternative to Bitcoin

Litecoin, often referred to as "Bitcoin’s silver," offers quicker transaction times and lower fees, making it a preferred choice for daily digital payments. With its unique hashing algorithm (Scrypt) and strong network security, LTC remains one of the most trusted cryptocurrencies.

💰 Current Price: $126.39

✅ Why Consider $LTC ?

Faster than Bitcoin: 2.5-minute block times for quick transactions.

Widespread Acceptance: Used by merchants and payment gateways worldwide.

Strong Security: A reliable and battle-tested network since 2011.

🔹 Polkadot ($DOT ) – The Future of Blockchain Interoperability

Polkadot is a multi-chain network designed to connect various blockchains, allowing them to communicate and share data seamlessly. This cross-chain functionality makes Polkadot a game-changer in the industry, as it enables different ecosystems to work together efficiently.

💰 Current Price: $5.05

✅ Key Advantages of $DOT :

Scalability: Supports multiple blockchains simultaneously.

Interoperability: Bridges different networks, expanding use cases.

Governance & Upgrades: Community-driven improvements ensure long-term sustainability.

🔹 Terra Luna Classic ($LUNC ) – A Resilient DeFi Contender

Despite its past volatility, Terra Luna Classic remains relevant in the DeFi space, thanks to its stablecoin solutions and decentralized application support. LUNC continues to evolve, with community-driven efforts ensuring its survival and potential comeback.

💰 Current Price: $0.00007343

✅ Why Keep an Eye on $LUNC ?

Decentralized Finance (DeFi) Integration: Supports multiple DeFi applications.

Community-Backed Revival: Ongoing efforts to restore value and utility.

Potential Rebound: If new innovations succeed, LUNC could see renewed growth.

💡 Final Thoughts

As the cryptocurrency market continues to shift, diversifying your portfolio with well-established and innovative projects is crucial. Algorand, Litecoin, Polkadot, Terra Luna Classic, each bring unique value propositions to the table, making them worthy of consideration for investors seeking long-term potential and innovation-driven growth.

Before investing, always do your own research (DYOR) and stay updated with market trends. The crypto world moves fast—being informed is the key to making smart investment decisions.

Why I’ll Never Sell My Pi Coin – And Neither Should You**

**I will never sell my Pi Coin.** Here’s why:

**1️⃣ Pi Isn’t Just Crypto—It’s a Vision**

Pi Coin’s mission—to democratize blockchain access through mobile mining—is revolutionary. Unlike speculative tokens, Pi prioritizes building a real-world economy powered by its 35+ million users. Selling now means abandoning a project that could redefine decentralized finance.

**2️⃣ Early = Advantage**

History rewards patience. Bitcoin’s early holders became legends. Pi’s Mainnet launch is imminent, and selling prematurely risks missing its potential surge as adoption grows. Good things come to those who HODL.

**3️⃣ The Power of Community**

Pi’s global network of Pioneers isn’t just mining—they’re building marketplaces, apps, and utilities to give Pi real value. This grassroots movement is unstoppable. Why sell when the community is literally creating demand?

**4️⃣ Short-Term Gains ≠ Long-Term Wins**

Selling Pi for quick cash fuels the same greed-driven cycles crypto aims to disrupt. Holding reflects belief in a fairer financial future—not a get-rich-quick scheme.

**5️⃣ Regret Is Costly**

Pi isn’t even tradable on major exchanges yet. Offloading it now means navigating shady gray markets (hello, scams!) or watching its value soar later from the sidelines.

**Bottom Line:**

Pi Coin represents more than money—it’s faith in a decentralized, inclusive future. I’m holding because true innovation takes time. When Mainnet launches and Pi shines, I’ll be there.

*Not financial advice. Do your research. Crypto = high risk, high reward.*

BITCOIN-5.54%

MOBILE-5.20%

Ethereum developer details technical barriers to reversing $1.4b Bybit hack

An Ethereum developer provided an explanation of why the network cannot “rollback” transactions to recover Bybit’s stolen $1.4 billion.

The analysis compares the current situation with two historical cases where blockchain reversals were feasible. In 2010, Bitcoin successfully rolled back transactions when a bug created 184 billion BTC. The developer Tim Beiko stated that it was possible due to the network’s small size and clear protocol violation.

Similarly, Ethereum’s 2016 The DAO hack recovery succeeded because the stolen funds were frozen for 30 days, allowing time for community coordination.

ELI5 why we cannot "rollback" Ethereum? After yesterday's Bybit hack, crypto commentators are again asking why Ethereum cannot "rollback" the chain to reverse the hack. While experienced ecosystem actors near-unanimously agree that this is infeasible, it's worth breaking down…

Beiko mentioned that the Bybit hack has fundamentally different challenges. The theft happened through a compromised multisig interface that made malicious transactions appear legitimate to signers.

From Ethereum’s ( ETH ) perspective, these transactions followed all protocol rules, leaving no technical basis for intervention.

Beiko also pointed out that modern cryptocurrency infrastructure has also grown more complex. The stolen funds were immediately mobile and could be routed through decentralized exchanges, lending protocols, and cross-chain bridges.

This interconnectedness means any attempt to reverse transactions would create disruption across the ecosystem. This could affect legitimate trades and settlements, he says.

While Ethereum can still theoretically implement “irregular state changes” when funds are frozen and isolated, the last such proposal in 2018 faced strong opposition. That attempt aimed to recover 500,000 frozen ETH from a Parity wallet bug but was rejected due to concerns about centralization and precedent.

The technical limitations have been further highlighted by recent developments. Crypto mixer platform eXch has rejected Bybit’s request for cooperation in tracking the stolen funds.

SlowMist, a blockchain security firm, reports that hackers have already begun laundering the ETH through eXch, converting it to Bitcoin ( BTC ), Monero ( XMR ), and other cryptocurrencies.

eXch, the coin mixer platform used by North Korean hackers, rejected Bybit's request for cooperation. SlowMist pointed out that eXch was involved in multiple security incidents, exposing the personal information of industry security personnel, and all platforms should improve…

SlowMist’s founder warned that eXch has a history of hostile behavior toward security researchers and recommended exchanges increase risk controls for funds originating from the platform.

The quick movement of assets through mixing services shows why technical solutions like rollbacks are no longer viable for major thefts in today’s crypto ecosystem.

![Quickswap [New] 價格](https://img.bgstatic.com/multiLang/coinPriceLogo/23e5466969665fe7482af6bb112992ac1710263425091.png)

最低價

最低價 最高價

最高價

![購買 Quickswap [New] (QUICK)](/price/_next/static/media/HTB_step4.449f78aa.png)