Bitget:全球日交易量排名前 4!

BTC 市占率61.00%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$94600.44 (-1.10%)恐懼與貪婪指數49(中性)

比特幣現貨 ETF 總淨流量:-$50.4M(1 天);-$626.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率61.00%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$94600.44 (-1.10%)恐懼與貪婪指數49(中性)

比特幣現貨 ETF 總淨流量:-$50.4M(1 天);-$626.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率61.00%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$94600.44 (-1.10%)恐懼與貪婪指數49(中性)

比特幣現貨 ETF 總淨流量:-$50.4M(1 天);-$626.2M(7 天)。Bitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

OneFinity 價格ONE

報價幣種:

USD

$0.06801-0.72%1D

價格走勢圖

最近更新時間 2025-02-24 17:59:19(UTC+0)

市值:$297,311.71

完全稀釋市值:$297,311.71

24 小時交易額:$12,134.82

24 小時交易額/市值:4.08%

24 小時最高價:$0.06932

24 小時最低價:$0.06651

歷史最高價:$0.8604

歷史最低價:$0.03751

流通量:4,371,636 ONE

總發行量:

25,543,088ONE

流通率:17.00%

最大發行量:

25,546,534ONE

以 BTC 計價:0.{6}7160 BTC

以 ETH 計價:0.{4}2544 ETH

以 BTC 市值計價:

$430,821.17

以 ETH 市值計價:

$73,732.57

合約:

ONE-f9...-f9954f(Elrond)

您今天對 OneFinity 感覺如何?

注意:此資訊僅供參考。

OneFinity 今日價格

OneFinity 的即時價格是今天每 (ONE / USD) $0.06801,目前市值為 $297,311.71 USD。24 小時交易量為 $12,134.82 USD。ONE 至 USD 的價格為即時更新。OneFinity 在過去 24 小時內的變化為 -0.72%。其流通供應量為 4,371,636 。

ONE 的最高價格是多少?

ONE 的歷史最高價(ATH)為 $0.8604,於 2024-03-14 錄得。

ONE 的最低價格是多少?

ONE 的歷史最低價(ATL)為 $0.03751,於 2023-12-28 錄得。

OneFinity 價格預測

什麼時候是購買 ONE 的好時機? 我現在應該買入還是賣出 ONE?

在決定買入還是賣出 ONE 時,您必須先考慮自己的交易策略。長期交易者和短期交易者的交易活動也會有所不同。Bitget ONE 技術分析 可以提供您交易參考。

根據 ONE 4 小時技術分析,交易訊號為 賣出。

根據 ONE 1 日技術分析,交易訊號為 賣出。

根據 ONE 1 週技術分析,交易訊號為 強力賣出。

ONE 在 2026 的價格是多少?

根據 ONE 的歷史價格表現預測模型,預計 ONE 的價格將在 2026 達到 $0.07372。

ONE 在 2031 的價格是多少?

2031,ONE 的價格預計將上漲 +25.00%。 到 2031 底,預計 ONE 的價格將達到 $0.1372,累計投資報酬率為 +102.10%。

OneFinity 價格歷史(USD)

過去一年,OneFinity 價格上漲了 -83.28%。在此期間, 兌 USD 的最高價格為 $0.8604, 兌 USD 的最低價格為 $0.05920。

時間漲跌幅(%) 最低價

最低價 最高價

最高價

最低價

最低價 最高價

最高價

24h-0.72%$0.06651$0.06932

7d-3.69%$0.06562$0.07769

30d-41.97%$0.05920$0.1196

90d-77.01%$0.05920$0.3748

1y-83.28%$0.05920$0.8604

全部時間-21.94%$0.03751(2023-12-28, 1 年前 )$0.8604(2024-03-14, 348 天前 )

OneFinity 市場資訊

OneFinity 持幣分布集中度

巨鯨

投資者

散戶

OneFinity 地址持有時長分布

長期持幣者

游資

交易者

coinInfo.name(12)即時價格表

OneFinity 評級

社群的平均評分

4.6

此內容僅供參考。

ONE 兌換當地法幣匯率表

1 ONE 兌換 MXN$1.391 ONE 兌換 GTQQ0.521 ONE 兌換 CLP$64.211 ONE 兌換 HNLL1.751 ONE 兌換 UGXSh249.931 ONE 兌換 ZARR1.251 ONE 兌換 TNDد.ت0.221 ONE 兌換 IQDع.د89.091 ONE 兌換 TWDNT$2.231 ONE 兌換 RSDдин.7.611 ONE 兌換 DOP$4.241 ONE 兌換 MYRRM0.31 ONE 兌換 GEL₾0.191 ONE 兌換 UYU$2.921 ONE 兌換 MADد.م.0.681 ONE 兌換 AZN₼0.121 ONE 兌換 OMRر.ع.0.031 ONE 兌換 KESSh8.811 ONE 兌換 SEKkr0.721 ONE 兌換 UAH₴2.84

- 1

- 2

- 3

- 4

- 5

最近更新時間 2025-02-24 17:59:19(UTC+0)

如何購買 OneFinity(ONE)

建立您的免費 Bitget 帳戶

使用您的電子郵件地址/手機號碼在 Bitget 註冊,並建立強大的密碼以確保您的帳戶安全

認證您的帳戶

輸入您的個人資訊並上傳有效的身份照片進行身份認證

購買 OneFinity (ONE)

我們將為您示範使用多種支付方式在 Bitget 上購買 OneFinity

OneFinity 動態

以太坊做空倉位一週激增40%,空頭回補還是回天乏術?

Abmedia•2025-02-10 01:15

Velar 向聯合 Stacks 社區推出“.BTC 名稱授予計劃”

簡單來說 Velar 推出了“.BTC 名稱授予計劃”,以促進 Stacks 上數位身分的標準化,並推動“.btc”數位身分標準在比特幣生態系統中更廣泛的採用。

Mpost•2025-01-31 11:33

有雷慎入!《魷魚遊戲》第二季這個玩家竟是知名炒幣 Youtuber?導演想表達什麼社會現象?

Abmedia•2024-12-26 23:15

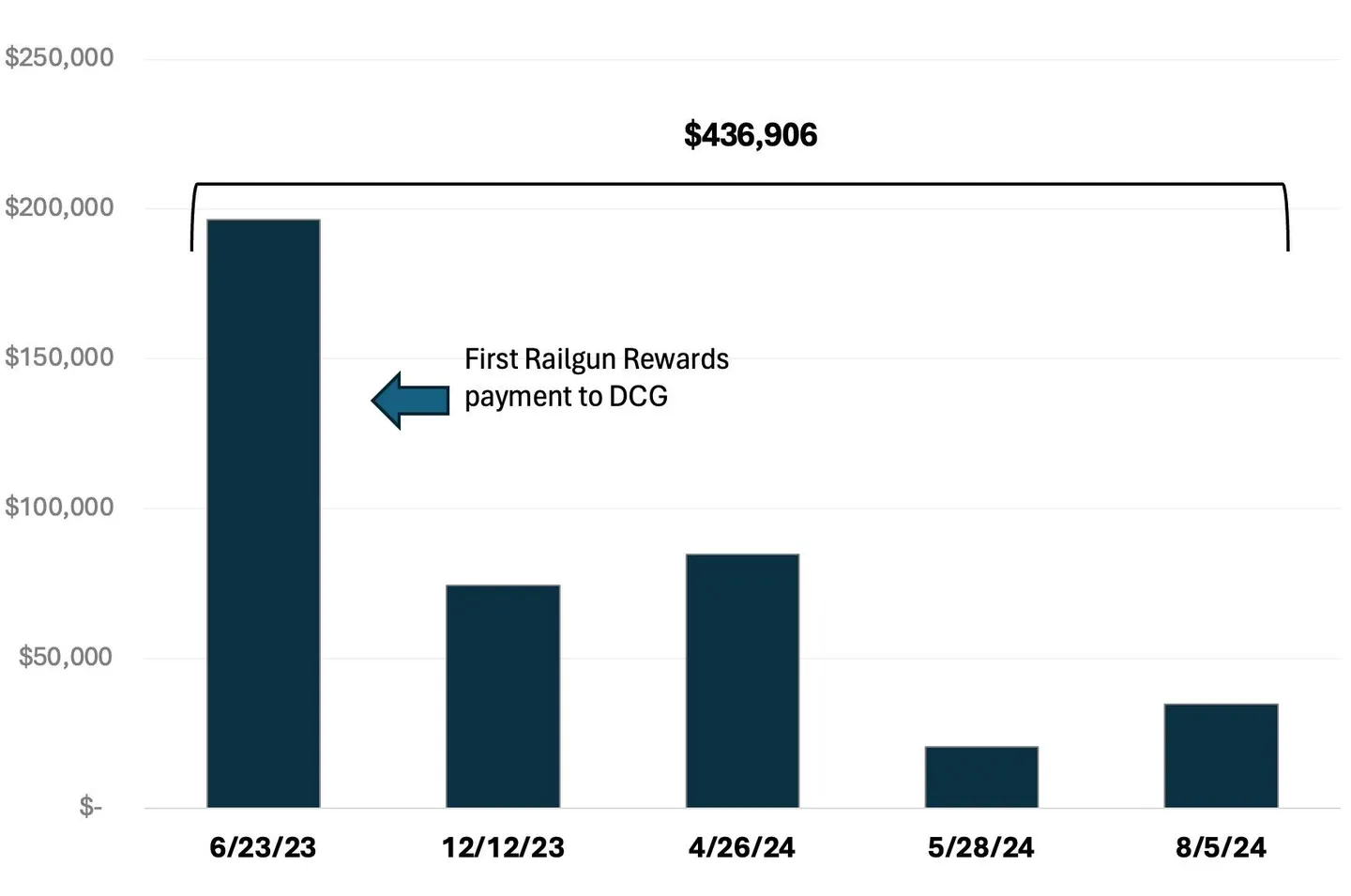

福布斯:DCG 是否從朝鮮黑客洗錢活動中獲利?

DCG 去年 6 月至今從混幣器 Railgun 獲得了約 43 萬美元資金。有調查顯示,Railgun 可能涉嫌朝鮮黑客集團 Lazarus Group 的非法洗錢活動。

Chaincatcher•2024-11-02 00:33

購買其他幣種

用戶還在查詢 OneFinity 的價格。

OneFinity 的目前價格是多少?

OneFinity 的即時價格為 $0.07(ONE/USD),目前市值為 $297,311.71 USD。由於加密貨幣市場全天候不間斷交易,OneFinity 的價格經常波動。您可以在 Bitget 上查看 OneFinity 的市場價格及其歷史數據。

OneFinity 的 24 小時交易量是多少?

在最近 24 小時內,OneFinity 的交易量為 $12,134.82。

OneFinity 的歷史最高價是多少?

OneFinity 的歷史最高價是 $0.8604。這個歷史最高價是 OneFinity 自推出以來的最高價。

我可以在 Bitget 上購買 OneFinity 嗎?

可以,OneFinity 目前在 Bitget 的中心化交易平台上可用。如需更詳細的說明,請查看我們很有幫助的 如何購買 指南。

我可以透過投資 OneFinity 獲得穩定的收入嗎?

當然,Bitget 推出了一個 策略交易平台,其提供智能交易策略,可以自動執行您的交易,幫您賺取收益。

我在哪裡能以最低的費用購買 OneFinity?

Bitget提供行業領先的交易費用和市場深度,以確保交易者能够從投資中獲利。 您可通過 Bitget 交易所交易。

您可以在哪裡購買 OneFinity(ONE)?

影片部分 - 快速認證、快速交易

如何在 Bitget 完成身分認證以防範詐騙

1. 登入您的 Bitget 帳戶。

2. 如果您是 Bitget 的新用戶,請觀看我們的教學,以了解如何建立帳戶。

3. 將滑鼠移到您的個人頭像上,點擊「未認證」,然後點擊「認證」。

4. 選擇您簽發的國家或地區和證件類型,然後根據指示進行操作。

5. 根據您的偏好,選擇「手機認證」或「電腦認證」。

6. 填寫您的詳細資訊,提交身分證影本,並拍攝一張自拍照。

7. 提交申請後,身分認證就完成了!

加密貨幣投資(包括透過 Bitget 線上購買 OneFinity)具有市場風險。Bitget 為您提供購買 OneFinity 的簡便方式,並且盡最大努力讓用戶充分了解我們在交易所提供的每種加密貨幣。但是,我們不對您購買 OneFinity 可能產生的結果負責。此頁面和其包含的任何資訊均不代表對任何特定加密貨幣的背書認可,任何價格數據均採集自公開互聯網,不被視為來自Bitget的買賣要約。

Bitget 觀點

CoinLive

7小時前

Singaporean Woman Slapped with 10 Years Jail Time for Defrauding Bybit of $4.2 Million

Bybit Scammer Gets 10 Years Jail Sentence

Ho Kai Xin, a 32-year-old from Singapore, has been sentenced to nearly 10 years in prison for defrauding the crypto exchange Bybit out of $4.2 million (S$5.7 million) in cryptocurrency.

While working for Wechain Fintech, which processed payroll for Bybit, Ho manipulated Excel spreadsheets to falsely show USDT payments due to digital wallets under her control.

🚨 JUST IN: A Singaporean woman has been sentenced to nearly 10 years in jail for defrauding @Bybit_Official of over $4 million in crypto. Ho Kai Xin, 32 years old, exploited her role at Wechain Fintech, which processed payroll for Bybit, by manipulating Excel spreadsheets to… pic.twitter.com/1fBRpPEMyY

— The Crypto Fool (@the_cryptofool) February 20, 2025

Over three months in 2022, millions were illicitly transferred, which she spent on luxury goods, including Louis Vuitton handbags, sunglasses, and a Mercedes-Benz.

She also placed a $560,000 deposit on a multimillion-dollar penthouse.

Prosecutors revealed that Ho became bolder after her initial embezzlement went unnoticed, even linking her crypto addresses to other employees’ names.

Her fraudulent activities were uncovered in September 2022 when an executive noticed discrepancies in the payroll spreadsheet.

Despite a court order to freeze her assets, Ho continued to lavishly spend the stolen funds, further compounding her crimes.

Ho Awaiting Commencement of New Sentence When Current One Expires

In January, Ho was sentenced to six weeks in jail for contempt of court after violating a civil court order prohibiting her from using funds she had embezzled.

Despite the court's directive issued in October 2022, Ho spent nearly $840,000 between November and December of that year on a freehold penthouse and luxury Louis Vuitton items.

The contempt charge stemmed from Bybit Fintech’s civil lawsuit to recover the stolen cryptocurrency.

Ex-Bybit Payroll Employee Sentenced for $5.7M Crypto Theft A former employee of Wechain Fintech, Bybit’s payroll provider, has been sentenced to nearly 10 years in prison for embezzling $5.7 million, mostly in USDT. Between May and August 2022, she falsified payroll records,… pic.twitter.com/FbujPy9Yfl

— Cryptol (@newscryptol) February 20, 2025

On 27 January, Ho was handed the short sentence, but this is just one part of her legal troubles.

She now faces an additional nine years and 11 months in prison after pleading guilty to over a dozen charges.

This sentence will begin after her current term expires.

Upon her arrest, Ho falsely claimed a fictitious cousin, "Jason Teo," was responsible for the illegal transfers, a story that took police over 140 hours to debunk.

Her defense attorney, James Gomez, requested a lighter sentence of eight years and eight months, citing her role as the mother of two young children.

He said during the trial:

"Her actions were a lapse in judgment, and she has since reflected deeply on the consequences they have had on her family, the victim and the justice system."

ORDER+0.06%

SIX-1.47%

Crypto Raven

7小時前

One of the finest tokens in crypto world right now is $BNB. Their performance over the years has been nothing but astonishing and this article is the proof. Let's talk about $BNB's recent growth.

BNB’s market cap exceeded $101 billion in Q4 2024, marking a 114% YoY rise and a 22% increase from the previous quarter, according to a report by crypto research firm Messari.

Messari noted that amid a booming crypto market driven by U.S. President Donald Trump's election, BNB hit a record high of $789 on Dec. 4, 2024.

That indicates they grew more than twice in a span of one year.

And for some recent time growth, according to Defillama, on chain activities of BSC chain has went up significantly.

$BNB is still going strong and this is just the start. #BNBChainMeme #BNB_Market_Update

UP-2.44%

BNB-3.23%

TopCryptoNews

7小時前

🟡 Altcoin Collapse Likely Coming in Q3 of This Year, According to Analyst Benjamin Cowen – Here’s Why

Widely followed crypto analyst Benjamin Cowen says that altcoins are likely to collapse in the third quarter of 2025.

In a new strategy session, Cowen tells his 874,000 YouTube subscribers that judging by previous cycles, altcoins likely have another leg to move down sometime during Q3 of movement as their movements are largely coupled with the price action of Bitcoin (BTC).

He says that around November is when altcoins can mount their recovery.

“I think at some point this year, [altcoins are] probably going to break down… And maybe [they’ll] do that this summer and then we’ll see them sort of bounce back up later on this year, something like where they come down here and then maybe go up. Remember, [the] big move by alt / Bitcoin pairs in 2017 didn’t actually occur until November so you have to remember that.”

Cowen’s chart, which examines TOTAL3 – an index that tracks the total value of all digital assets excluding Bitcoin, Ethereum ( ETH ) and stablecoins – appears to suggest that it will fall below the 0.27 line when paired against BTC. TOTAL3/BTC is currently sitting at 0.47.

In previous cycles when TOTAL3/ BTC touched the 0.27 area, the altcoin market collapsed.

Cowen goes on to say that the health of the altcoin market is largely dependent on BTC, and potentially the yields in 10-year Treasuries which often reflect investors’ general risk appetite.

“If Bitcoin breaks up to a new cycle high, then I think Bitcoin would lead that move , so the altcoin markets’ fate in March is just dependent on Bitcoin. If Bitcoin goes up, they’ll go up too…

If Bitcoin breaks down, I think it would probably correspond to maybe a surge in the long end of the yield curve , and that is something we’ve been tracking. If you actually look at the 10-year yield, one of the things that actually caused Bitcoin to sort of consolidate [previously] and then eventually break down was a surge of the 10-year yield.”

#Altcoin #Altcoins

BTC-1.63%

ETH-5.42%

Blockchain Reporter

7小時前

Bitcoin Sell-Side Risk Ratio Hits Low Levels

The Bitcoin (BTC) Sell-Side Risk Ratio has plummeted to historically low values, signaling a potential local bottom and an accumulation phase in the market. This key metric, which measures the incentive for long-term holders to sell, suggests a low sell-side risk environment, potentially paving the way for future price appreciation.

#Bitcoin $BTC Sell-Side Risk Ratio has dropped to low values, often indicating local bottoms, accumulation phases, and a low sell-side risk environment! pic.twitter.com/0QxIh4RQYe

— Ali (@ali_charts) February 23, 2025

According to Crypto Analyst Ali Martinez, The Sell-Side Risk Ratio is a valuable on-chain metric used to gauge market sentiment by analyzing the behavior of long-term Bitcoin holders. It measures the relative profitability of selling BTC against the historical average. When the ratio is low, it indicates reduced selling pressure, as holders have less incentive to realize profits. Conversely, high values suggest increased selling pressure due to attractive profit-taking opportunities.

According to the latest data from Glassnode, the Sell-Side Risk Ratio has dropped to one of its lowest points in recent history, as depicted in the accompanying chart. Historically, such low values have correlated with local bottoms and accumulation phases, where long-term investors are less likely to sell. This pattern has often preceded significant upward price movements.

Historical Context, Low Risk, Accumulation Outlook

The chart illustrates three previous instances where the Sell-Side Risk Ratio reached similarly low levels, marked by black arrows: November 2023: The ratio touched the red line, signaling a local bottom. This was followed by a strong rally as accumulation increased.September 2024: A similar dip occurred, leading to another price surge as long-term holders refrained from selling.February 2025: The current drop mirrors these historical patterns, suggesting a potential bottoming out and a favorable accumulation period.

The current low Sell-Side Risk Ratio reflects a low sell-side risk environment, indicating that long-term holders are not under pressure to sell at current prices. This trend aligns with the notion of an accumulation phase, where investors accumulate BTC at lower prices, potentially setting the stage for a future bullish cycle.

If historical patterns hold, Bitcoin could be entering a prolonged accumulation phase, with reduced selling pressure leading to price stability and eventual appreciation. This phase typically precedes a bull run as market confidence and buying momentum increase.

The Bitcoin Sell-Side Risk Ratio’s current low values provide a critical insight into market sentiment and potential future price movements. By indicating reduced selling pressure and increased accumulation, this metric suggests that Bitcoin may be nearing a local bottom, making it a key indicator to watch in the coming weeks.

BTC-1.63%

S-1.38%

BGUSER-PS43XJFR

8小時前

Bitget’s One-Click Copy Trade User Agreement | Bitget Support Center https://www.bitgetapp.com/support/articles/9104577718297?appVersion=2.50.9&time=1740390821001&androidSdk=31&language=en_US&appTheme=standard

S-1.38%

ONE-9.58%

相關資產

相近市值

在所有 Bitget 資產中,這8種資產的市值最接近 OneFinity。