The crypto market is booming like never before, and EDOG Crypto is taking things to the next level. With the rapid release of memecoins, it is said that the market is expected to rise by about €0.0183 by the end of 2025, which could make EDOG the fastest-growing memecoin.

Previous memecoins lacked the human touch and tangible aspects, making them less significant. However, EDOG sets itself apart by offering real-world visualization, creating a strong sense of community among traders. With an engaging storyline behind every token, it establishes itself as a long-term investment, giving investors and members a more immersive experience.

Experts predict that EDOG will attract more traders than ever. Another promising crypto investment is DexBoss, a powerhouse DeFi trading platform that offers security, innovation, and significant profit potential. DexBoss Token: The Best Cryptocurrency Investment in DeFi Trading!

DeFi trading is reshaping the best crypto investment landscape, and DexBoss is a prime example of this evolution. Featuring updated AI-powered analytics, lightning-fast execution, and advanced cross-chain integration, DexBoss allows traders to seamlessly trade over 2,000 cryptocurrencies. Beyond high-leverage trading, options, and futures, DexBoss helps traders navigate the DeFi landscape for maximum profits. With the DexBoss token presale live at just $0.011, now is the perfect time to invest. Be a smart investor—buy, stake, trade, and maximize your profits while embracing the future of DeFi with DexBoss!

Note: Always DYOR, Don't invest full amount of your portfolio. #MEME

$BTC Dropped 12% from Its ATH: Time to Buy the Dip?

Bitcoin recently dropped 12% from its all-time high (ATH), sparking debates among traders and investors. While some see this as a routine correction, others are wondering whether this presents a lucrative buying opportunity. The question remains: Is this the right time to buy the dip, or should investors proceed with caution?

Understanding Bitcoin’s Correction

Bitcoin has historically been a volatile asset, experiencing sharp price swings even in bull markets. A 10–20% correction is not uncommon, especially after reaching a new ATH. Corrections occur due to profit-taking, over-leveraged positions, or macroeconomic factors influencing market sentiment.

The recent 12% drop could be attributed to several factors, including:

• Profit-taking by early investors who entered before the recent rally.

• Market liquidations from traders using excessive leverage.

• Regulatory concerns from governments or central banks.

• Macroeconomic uncertainty, including interest rate policies and inflation fears.

Despite these factors, Bitcoin’s long-term bullish trend remains intact, making this correction a potential buying opportunity.

Is This a Buying Opportunity?

For investors considering buying the dip, it’s essential to analyze the broader market conditions, historical trends, and on-chain data before making a decision.

1. Historical Patterns

Bitcoin has a history of reaching new ATHs, experiencing corrections, and then resuming its upward trend. After every major rally, short-term corrections are inevitable, but long-term holders have typically benefited from accumulating during dips.

For instance, during the 2021 bull run, Bitcoin experienced multiple 10–30% corrections before surging to new highs. If history repeats itself, this dip could be a prime buying opportunity.

2. On-Chain Data Insights

On-chain metrics such as exchange reserves, whale activity, and network growth provide valuable insights. If exchange reserves are decreasing, it suggests investors are moving Bitcoin to cold storage, indicating confidence in long-term growth.

Additionally, whale accumulation—when large investors buy Bitcoin during a dip—signals strong support at lower levels. If these trends continue, it could reinforce the idea that Bitcoin is preparing for another leg up.

3. Market Sentiment and Macroeconomic Factors

Bitcoin’s price is also influenced by global economic conditions, interest rates, and institutional adoption. If central banks maintain a dovish stance or inflation concerns persist, Bitcoin may remain an attractive hedge, fueling further demand.

Furthermore, increasing institutional adoption—such as Bitcoin ETFs and corporate treasuries adding BTC—can provide additional bullish momentum in the long term.

Risks to Consider

While buying the dip can be profitable, it’s not without risks. Bitcoin remains a volatile asset, and a deeper correction is always possible. Factors such as:

• Regulatory crackdowns in major economies.

• Macroeconomic downturns affecting investor sentiment.

• Potential market manipulations by large players.

can push Bitcoin lower. Investors should have a risk management strategy, such as dollar-cost averaging (DCA), rather than going all-in at once.

Bitcoin’s 12% drop from its ATH presents a potential buying opportunity, but investors should carefully evaluate market conditions. Historical data, on-chain trends, and macroeconomic factors suggest that Bitcoin may continue its upward trajectory in the long term. However, risks remain, and a disciplined approach—such as dollar-cost averaging and risk management—is essential for navigating Bitcoin’s volatility.

Whether this is the right time to buy depends on individual risk tolerance and investment strategy. While some may see this as a discount before the next rally, others might prefer to wait for confirmation of a market rebound. Either way, staying informed and adopting a strategic approach is key to making the most of Bitcoin’s price movements

Token unlock schedule for this week: $154M in GT to be unlocked

According to DropsTab data, the major tokens to be unlocked during the week of Feb. 24–March 2 are as follows (all times listed are in UTC):

- $WLD: 3.42 million tokens ($4.24 million), representing 0.33% of circulating supply, at 00:00 UTC on Feb. 25

- $TIA: 998,404 tokens ($3.73 million), representing 0.19% of circulating supply, at 18:00 UTC on Feb. 25

- $GT: 6.67 million tokens ($154 million), representing 7.51% of circulating supply, at 00:00 UTC on Feb. 26

- $OP: 24.16 million tokens ($28.56 million), representing 1.49% of circulating supply, at 00:00 UTC on Feb. 28

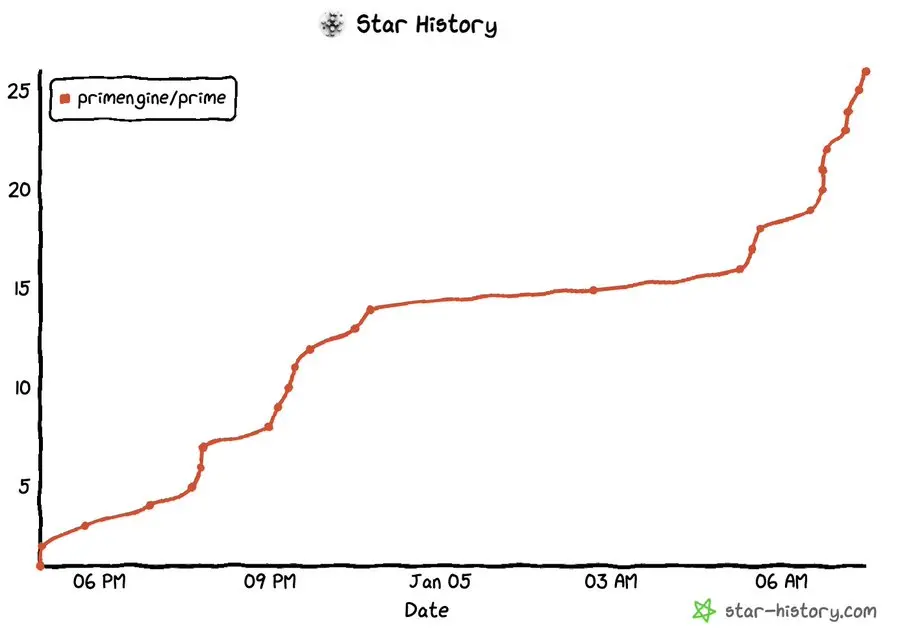

- $PRIME: 1.66 million tokens ($8.79 million), representing 3.04% of circulating supply, at 00:00 UTC on Feb. 28

- $ALT: 240.54 million tokens ($11.24 million), representing 9.43% of circulating supply, at 06:00 UTC on Feb. 28

- $ENA: 95.06 million tokens ($42.06 million), representing 3.04% of circulating supply, at 08:00 UTC on Mar. 2

Although Bitcoin (BTC) has recovered from critical downward levels, its price is still below the $10

Although Bitcoin (BTC) has recovered from critical downward levels, its price is still below the $100,000 threshold. The price of Bitcoin has been in a contraction phase since the coin’s second attempt to break above $105,000 in late January.

Considering Bitcoin’s latest recovery attempt, traders and investors are now watching out for the coin’s next big move.

According to a Glassnode report , Bitcoin shows weakening capital inflows and declining derivatives activity. This coincides with short-term holder accumulation resembling challenging market conditions.

Now trading within a relatively stable range, Bitcoin has been consolidated at around $95,000 for several weeks. At press time, the price of BTC was $97,443, demonstrating a 1.12% increase in the last 24 hours.

The report from Glassnode showed a decline in capital inflows within the perpetual futures market. This sharply dropped Bitcoin’s perpetual Open Interest (OI), reflecting a shift toward more bearish sentiment. Within the last 30 days, Bitcoin’s OI plummeted by 11.1%, indicating an unwinding of leveraged positions.

The key level to watch is the Short-Term Holder (STH) trend, which has a cost basis of around $92,500. In the past, the STH holdings level was a pivot point between local-scale bull and bear phases. At this point, buyers see unrealized losses, which could lead to more downside as panic sets in.

According to the report, the market is where price action is prime for uncoiling. This is deduced from similarities between past STH supply changes and current trends. Thus, Bitcoin could establish a new range above all-time highs if demand remains strong. On the contrary, a lack of sustained buying pressure could lead to a deeper distribution-driven correction.

Bitcoin could retest its January 30 high of $106,457 if it breaks above the upper boundary of the consolidating range of $100,000.

Moreover, technical analysis suggests a bullish outlook for Bitcoin. For example, the Relative Strength Index (RSI) on the daily chart sits at 47. It approaches its neutral level of 50 and points upwards, indicating slight strength in momentum.

QCP’s Wednesday reports highlighted that inflation fears remain a top global concern amid escalating tariff tensions. As the report emphasized, only a 10% tariff on select Chinese goods is currently in place.

As for Mexico and Canada, the proposed 25% tariffs on goods from Canada and Mexico could be dismissed after the initial suspension if a consensus is reached. The ongoing market uncertainties have contributed to fueling a negative outlook for Bitcoin.

This week’s news of FTX repayments and the memecoin LIBRA scandal also contributed to Bitcoin’s weakness. In a previous article, we discussed that FTX has started repaying creditors with an initial payout of $1.2 billion. Meanwhile, Argentina’s latest meme coin frenzy, LIBRA, also leaves thousands of investors with substantial losses, as CNF mentioned earlier.

Despite these challenges, Bitcoin remains resilient around the $97,000 level, suggesting potential upsides in the future. Cardano founder Charles Hoskinson recently forecasted that BTC could hit $250,000 in the current cycle.

最低價

最低價 最高價

最高價

![Sun [New]](https://img.bgstatic.com/multiLang/coinPriceLogo/b636aacee828671a4eada11cc3be99d51710867872121.png)

Echelon Prime 社群媒體數據

過去 24 小時,Echelon Prime 社群媒體情緒分數是 2.7,社群媒體上對 Echelon Prime 價格走勢偏向 看跌。Echelon Prime 社群媒體得分是 67,171,在所有加密貨幣中排名第 306。

根據 LunarCrush 統計,過去 24 小時,社群媒體共提及加密貨幣 1,058,120 次,其中 Echelon Prime 被提及次數佔比 0%,在所有加密貨幣中排名第 454。

過去 24 小時,共有 23 個獨立用戶談論了 Echelon Prime,總共提及 Echelon Prime 40 次,然而,與前一天相比,獨立用戶數 減少 了 39%,總提及次數減少。

Twitter 上,過去 24 小時共有 3 篇推文提及 Echelon Prime,其中 33% 看漲 Echelon Prime,67% 篇推文看跌 Echelon Prime,而 0% 則對 Echelon Prime 保持中立。

在 Reddit 上,最近 24 小時共有 0 篇貼文提到了 Echelon Prime,相比之前 24 小時總提及次數 減少 了 0%。

社群媒體資訊概況

2.7