Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

Litecoin priceLTC

Pi Network (PI) will be listed on bitget, you can quickly sell or buy PI. Check out more pi updates !

How do you feel about Litecoin today?

Price of Litecoin today

What is the highest price of LTC?

What is the lowest price of LTC?

Litecoin price prediction

When is a good time to buy LTC? Should I buy or sell LTC now?

What will the price of LTC be in 2026?

What will the price of LTC be in 2031?

Litecoin price history (USD)

Lowest price

Lowest price Highest price

Highest price

Litecoin market information

Litecoin's market cap history

Litecoin market

Litecoin holdings

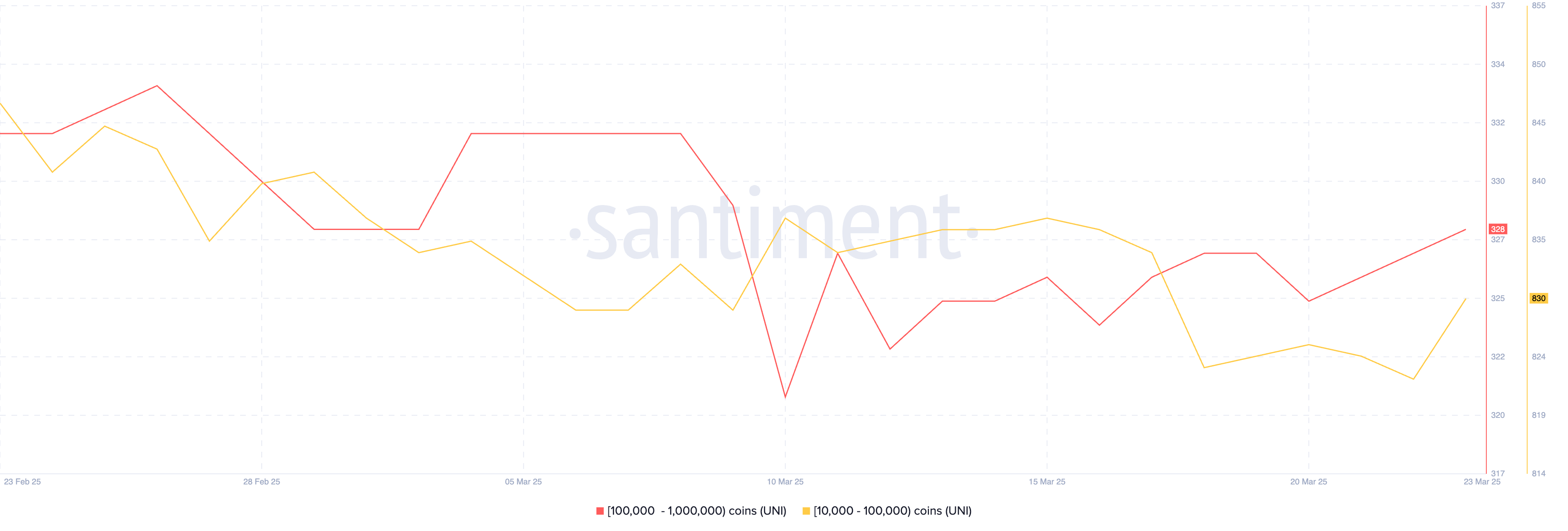

Litecoin holdings distribution matrix

Litecoin holdings by concentration

Litecoin addresses by time held

Litecoin ratings

About Litecoin (LTC)

What Is Litecoin?

Litecoin (LTC) is a decentralized open-source blockchain and is widely considered the first successful alternative coin in the market. Created in 2011 by Charlie Lee, a former Google engineer, Litecoin was designed as silver to Bitcoin's gold. While sharing similar traits, Litecoin stands out with its faster block generation times (2.5 minutes compared to Bitcoin's 10 minutes) and unique mining algorithm, Scrypt.

Litecoin was conceived as a hard fork from Bitcoin, explicitly designed to address and rectify the perceived limitations of the original cryptocurrency. Its key distinguishing characteristics include:

- A fair launch,

- A reduced block generation time,

- A increased total token supply,

- A unique hashing algorithm, and

- A distinct Graphic User Interface (GUI).

Resources

Official website: https://litecoin.org/

How Does Litecoin Work?

Blockchain and Mining

Litecoin operates using blockchain technology, which is a decentralized ledger kept up by "miners". In the context of Litecoin, mining refers to the process by which transactions are verified and added to the public blockchain ledger.

When a transaction occurs, it is grouped with others into a 'block'. Miners then verify these blocks by solving complex mathematical problems. The first miner to solve the problem gets to add the block of transactions to the existing chain of blocks, hence the term 'blockchain'. This miner is rewarded with newly created Litecoins. This mining process not only rewards miners but also serves to secure the network and verify transactions.

Scrypt Algorithm

One key difference between Litecoin and Bitcoin is the cryptographic algorithm they use to mine new coins. Litecoin uses a memory-intensive algorithm known as Scrypt, whereas Bitcoin uses a processing-intensive algorithm known as SHA-256.

Scrypt was chosen by Charlie Lee to make Litecoin mining more accessible to individuals by allowing them to use consumer-grade hardware like GPUs rather than the more expensive, specialized hardware required by Bitcoin’s SHA-256. This feature makes Litecoin more democratized and less susceptible to being monopolized by mining pools.

Faster Transaction Speeds

Litecoin's block generation time is approximately 2.5 minutes, which is four times faster than Bitcoin's 10 minutes. This shorter block generation time allows for faster transaction confirmations. It's an aspect that makes Litecoin an attractive option for merchants and customers who seek faster transaction times.

Finite Supply

Just like Bitcoin, Litecoin has a finite supply. The maximum number of Litecoins that can ever exist is 84 million, which is four times greater than the total supply of Bitcoin. As of July 2023, over 73 million Litecoins had already been mined

2023 Litecoin Halving

Litecoin halving event is rooted in the principles of scarcity and gradual reduction of block rewards. When Litecoin was first created, miners were rewarded with 50 LTC for every block they mined. Every 840,000 blocks — approximately every four years — this reward halves. In 2019, the reward decreased from 25 to 12.5 LTC, and in the upcoming 2023 halving, it will reduce further to 6.25 LTC.

This reduction process, known as "halving," is a deflationary mechanism. It effectively controls the rate at which new Litecoins enter the market, making the digital asset scarcer over time. The upcoming halving in 2023 will reduce the annual Litecoin inflation rate from around 4% to approximately 2%.

What Determines Litecoin's Price?

Understanding what determines the Litecoin price involves a multi-faceted approach that considers various market dynamics and indicators. One of the most significant factors affecting the current Litecoin price is the concept of "halving," a pre-programmed event in the Litecoin blockchain that reduces the mining rewards by half. This event, which occurs approximately every four years, impacts the Litecoin market cap and has historically led to volatile price movements in LTC to USD rates.

For example, Litecoin's price history shows that the price had dropped for months after each of its prior two halvings but also saw significant rallies leading up to these events. Halving effectively reduces the amount of new Litecoin supply, affecting its price and its conversion rate to USD.

Technical indicators also play a crucial role in Litecoin price prediction. Traders often use tools like the Relative Strength Index (RSI), Moving Averages, and the MACD to analyze the Litecoin price chart. These indicators help in identifying Litecoin's support and resistance levels and provide insights into market supply and demand. An RSI reading above 50, for instance, usually indicates bullish momentum in the Litecoin value, while readings below 50 suggest a bearish trend.

Market sentiment and external factors can also influence the Litecoin price today. Events like Litecoin's listing on new cryptocurrency exchanges or the filing of Bitcoin ETFs by major financial institutions can give Litecoin and other crypto assets a boost. Furthermore, Litecoin price live updates are closely monitored by traders who use various time frames to determine long-term, intermediate, and short-term trends.

The Litecoin price forecast is a complex interplay between internal blockchain events like halving, technical indicators, and external market factors. Keeping an eye on these elements can help you make an informed Litecoin price analysis and offer a more accurate Litecoin price prediction. By monitoring the Litecoin price history and its current price, you'll be better equipped to make sound investment decisions.

Conclusion

Litecoin, as a pioneering altcoin, offers innovations like rapid transaction times and the unique Scrypt algorithm. Its distinctive features have enhanced decentralization, accessibility, and security within the crypto space. With its upcoming halving in 2023 set to induce scarcity, Litecoin's market dynamics will be intriguing to watch. As we further embrace the digital era, Litecoin's role in facilitating efficient transactions globally remains vital. In essence, Litecoin continues to uphold its creator's vision - serving as 'the silver to Bitcoin's gold'.

Related Articles about Litecoin

Understanding the 2023 Litecoin Halving: An In-depth Analysis

LTC to local currency

- 1

- 2

- 3

- 4

- 5

How to buy Litecoin(LTC)

Create Your Free Bitget Account

Verify Your Account

Convert Litecoin to LTC

Trade LTC perpetual futures

After having successfully signed up on Bitget and purchased USDT or LTC tokens, you can start trading derivatives, including LTC futures and margin trading to increase your income.

The current price of LTC is $86.79, with a 24h price change of -6.12%. Traders can profit by either going long or short onLTC futures.

Join LTC copy trading by following elite traders.

Litecoin news

Buy more

FAQ

What is the primary purpose of the Litecoin token (LTC)?

How is Litecoin (LTC) different from Bitcoin?

What is Litecoin (LTC) halving?

Can I mine Litecoin (LTC)?

How do I store Litecoin (LTC)?

Is Litecoin's value tied to Bitcoin's value?

What is the current price of Litecoin?

What is the 24 hour trading volume of Litecoin?

What is the all-time high of Litecoin?

Can I buy Litecoin on Bitget?

Can I get a steady income from investing in Litecoin?

Where can I buy Litecoin with the lowest fee?

Where can I buy Litecoin (LTC)?

Video section — quick verification, quick trading

LTC resources

Tags:

Bitget Insights

Related assets

Litecoin Social Data

In the last 24 hours, the social media sentiment score for Litecoin was 3, and the social media sentiment towards Litecoin price trend was Bullish. The overall Litecoin social media score was 83,375, which ranks 43 among all cryptocurrencies.

According to LunarCrush, in the last 24 hours, cryptocurrencies were mentioned on social media a total of 1,058,120 times, with Litecoin being mentioned with a frequency ratio of 0.1%, ranking 12 among all cryptocurrencies.

In the last 24 hours, there were a total of 2,247 unique users discussing Litecoin, with a total of Litecoin mentions of 1,037. However, compared to the previous 24-hour period, the number of unique users increase by 7%, and the total number of mentions has decrease by 1%.

On Twitter, there were a total of 36 tweets mentioning Litecoin in the last 24 hours. Among them, 14% are bullish on Litecoin, 19% are bearish on Litecoin, and 67% are neutral on Litecoin.

On Reddit, there were 220 posts mentioning Litecoin in the last 24 hours. Compared to the previous 24-hour period, the number of mentions decrease by 6% .

All social overview

3