Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.79%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$83131.12 (-0.74%)Fear at Greed Index34(Fear)

Total spot Bitcoin ETF netflow +$114.2M (1D); -$1.13B (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.79%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$83131.12 (-0.74%)Fear at Greed Index34(Fear)

Total spot Bitcoin ETF netflow +$114.2M (1D); -$1.13B (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.79%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$83131.12 (-0.74%)Fear at Greed Index34(Fear)

Total spot Bitcoin ETF netflow +$114.2M (1D); -$1.13B (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

May kaugnayan sa coin

Price calculator

Kasaysayan ng presyo

Paghula ng presyo

Teknikal na pagsusuri

Gabay sa pagbili ng coin

kategorya ng Crypto

Profit calculator

Achain presyoACT

Hindi naka-list

Quote pera:

PHP

Kinukuha ang data mula sa mga third-party na provider. Ang pahinang ito at ang impormasyong ibinigay ay hindi nag-eendorso ng anumang partikular na cryptocurrency. Gustong i-trade ang mga nakalistang barya? Click here

₱0.09244+7.85%1D

Price chart

Last updated as of 2025-03-18 04:18:33(UTC+0)

Market cap:--

Ganap na diluted market cap:--

Volume (24h):₱0.09

24h volume / market cap:0.00%

24h high:₱0.09257

24h low:₱0.08569

All-time high:₱79.62

All-time low:₱0.01329

Umiikot na Supply:-- ACT

Total supply:

1,000,000,000ACT

Rate ng sirkulasyon:0.00%

Max supply:

1,000,000,000ACT

Price in BTC:0.{7}1941 BTC

Price in ETH:0.{6}8478 ETH

Price at BTC market cap:

--

Price at ETH market cap:

--

Mga kontrata:--

Ano ang nararamdaman mo tungkol sa Achain ngayon?

Tandaan: Ang impormasyong ito ay para sa sanggunian lamang.

Presyo ng Achain ngayon

Ang live na presyo ng Achain ay ₱0.09244 bawat (ACT / PHP) ngayon na may kasalukuyang market cap na ₱0.00 PHP. Ang 24 na oras na dami ng trading ay ₱0.09244 PHP. Ang presyong ACT hanggang PHP ay ina-update sa real time. Ang Achain ay 7.85% sa nakalipas na 24 na oras. Mayroon itong umiikot na supply ng 0 .

Ano ang pinakamataas na presyo ng ACT?

Ang ACT ay may all-time high (ATH) na ₱79.62, na naitala noong 2018-01-10.

Ano ang pinakamababang presyo ng ACT?

Ang ACT ay may all-time low (ATL) na ₱0.01329, na naitala noong 2024-07-28.

Bitcoin price prediction

Kailan magandang oras para bumili ng ACT? Dapat ba akong bumili o magbenta ng ACT ngayon?

Kapag nagpapasya kung buy o mag sell ng ACT, kailangan mo munang isaalang-alang ang iyong sariling diskarte sa pag-trading. Magiiba din ang aktibidad ng pangangalakal ng mga long-term traders at short-term traders. Ang Bitget ACT teknikal na pagsusuri ay maaaring magbigay sa iyo ng sanggunian para sa trading.

Ayon sa ACT 4 na teknikal na pagsusuri, ang signal ng kalakalan ay Malakas bumili.

Ayon sa ACT 1d teknikal na pagsusuri, ang signal ng kalakalan ay Buy.

Ayon sa ACT 1w teknikal na pagsusuri, ang signal ng kalakalan ay Sell.

Ano ang magiging presyo ng ACT sa 2026?

Batay sa makasaysayang modelo ng hula sa pagganap ng presyo ni ACT, ang presyo ng ACT ay inaasahang aabot sa ₱0.09047 sa 2026.

Ano ang magiging presyo ng ACT sa 2031?

Sa 2031, ang presyo ng ACT ay inaasahang tataas ng +39.00%. Sa pagtatapos ng 2031, ang presyo ng ACT ay inaasahang aabot sa ₱0.2711, na may pinagsama-samang ROI na +215.76%.

Achain price history (PHP)

The price of Achain is -4.87% over the last year. The highest price of in PHP in the last year was ₱0.2715 and the lowest price of in PHP in the last year was ₱0.01329.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h+7.85%₱0.08569₱0.09257

7d-6.02%₱0.05899₱0.09843

30d-0.07%₱0.05899₱0.09925

90d-37.69%₱0.05863₱0.1485

1y-4.87%₱0.01329₱0.2715

All-time-99.32%₱0.01329(2024-07-28, 233 araw ang nakalipas )₱79.62(2018-01-10, 7 taon na ang nakalipas )

Achain impormasyon sa merkado

Achain's market cap history

Achain holdings by concentration

Whales

Investors

Retail

Achain addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

Achain na mga rating

Mga average na rating mula sa komunidad

4.6

Ang nilalamang ito ay para sa mga layuning pang-impormasyon lamang.

ACT sa lokal na pera

1 ACT To MXN$0.031 ACT To GTQQ0.011 ACT To CLP$1.491 ACT To HNLL0.041 ACT To UGXSh5.911 ACT To ZARR0.031 ACT To TNDد.ت01 ACT To IQDع.د2.111 ACT To TWDNT$0.051 ACT To RSDдин.0.171 ACT To DOP$0.11 ACT To MYRRM0.011 ACT To GEL₾01 ACT To UYU$0.071 ACT To MADد.م.0.021 ACT To OMRر.ع.01 ACT To AZN₼01 ACT To KESSh0.211 ACT To SEKkr0.021 ACT To UAH₴0.07

- 1

- 2

- 3

- 4

- 5

Last updated as of 2025-03-18 04:18:33(UTC+0)

Achain balita

Meta Gorgonite: Bakit ang potensyal ng $ACT ay malayo pa sa katapusan

推特观点精选•2024-11-23 02:50

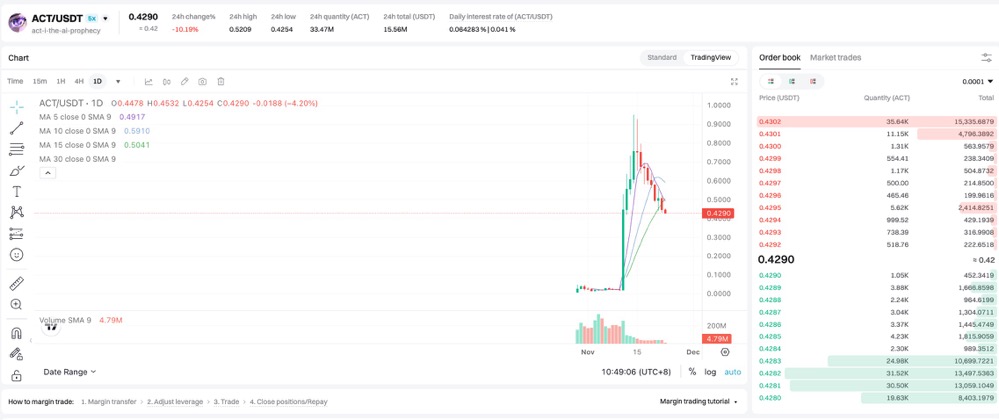

Sun at Moon Xiao Chu: Bakit patuloy akong nagdadagdag ng posisyon sa pag-pullback ng $PNUT at $ACT?

Twitter Opinion Selection•2024-11-23 02:24

![Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 22]](https://img.bgstatic.com/multiLang/web/8e1199d7822fef00d2ec95133764186d.png)

Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 22]

Renata•2024-11-22 09:22

![Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 18]](https://img.bgstatic.com/multiLang/web/8e1199d7822fef00d2ec95133764186d.png)

Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 18]

Renata•2024-11-18 07:48

Buy more

Ang mga tao ay nagtatanong din tungkol sa presyo ng Achain.

Ano ang kasalukuyang presyo ng Achain?

The live price of Achain is ₱0.09 per (ACT/PHP) with a current market cap of ₱0 PHP. Achain's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. Achain's current price in real-time and its historical data is available on Bitget.

Ano ang 24 na oras na dami ng trading ng Achain?

Sa nakalipas na 24 na oras, ang dami ng trading ng Achain ay ₱0.09244.

Ano ang all-time high ng Achain?

Ang all-time high ng Achain ay ₱79.62. Ang pinakamataas na presyong ito sa lahat ng oras ay ang pinakamataas na presyo para sa Achain mula noong inilunsad ito.

Maaari ba akong bumili ng Achain sa Bitget?

Oo, ang Achain ay kasalukuyang magagamit sa sentralisadong palitan ng Bitget. Para sa mas detalyadong mga tagubilin, tingnan ang aming kapaki-pakinabang na gabay na Paano bumili ng .

Maaari ba akong makakuha ng matatag na kita mula sa investing sa Achain?

Siyempre, nagbibigay ang Bitget ng estratehikong platform ng trading, na may mga matatalinong bot sa pangangalakal upang i-automate ang iyong mga pangangalakal at kumita ng kita.

Saan ako makakabili ng Achain na may pinakamababang bayad?

Ikinalulugod naming ipahayag na ang estratehikong platform ng trading ay magagamit na ngayon sa Bitget exchange. Nag-ooffer ang Bitget ng nangunguna sa industriya ng mga trading fee at depth upang matiyak ang kumikitang pamumuhunan para sa mga trader.

Saan ako makakabili ng crypto?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Ang mga investment sa Cryptocurrency, kabilang ang pagbili ng Achain online sa pamamagitan ng Bitget, ay napapailalim sa market risk. Nagbibigay ang Bitget ng madali at convenient paraan para makabili ka ng Achain, at sinusubukan namin ang aming makakaya upang ganap na ipaalam sa aming mga user ang tungkol sa bawat cryptocurrency na i-eooffer namin sa exchange. Gayunpaman, hindi kami mananagot para sa mga resulta na maaaring lumabas mula sa iyong pagbili ng Achain. Ang page na ito at anumang impormasyong kasama ay hindi isang pag-endorso ng anumang partikular na cryptocurrency.

Bitget Insights

khurram264

8h

Investment Strategies for Bubblemaps (BMT) Token

Investment Strategies for Bubblemaps (BMT) Token

If you're considering investing in Bubblemaps ($BMT ), it's crucial to have a clear strategy based on your risk tolerance, market conditions, and investment goals. Below are some strategies that could help maximize potential returns while managing risks.

---

1. Long-Term Holding ("HODL" Strategy)

Best for: Investors who believe in the long-term potential of Bubblemaps and are willing to hold through market volatility.

✔️ Why?

The project has secured funding and is building a strong analytics platform.

If adoption grows, demand for the token may increase.

Long-term crypto investments tend to benefit from overall market growth cycles.

✔️ Strategy:

Buy BMT at lower price levels and accumulate more over time (dollar-cost averaging).

Stake or hold $BMT in a secure wallet to benefit from potential future token utilities.

Plan to hold for at least 1-3 years unless market conditions drastically change.

---

2. Short-Term Trading (Swing Trading or Day Trading)

Best for: Experienced traders who can capitalize on BMT’s price volatility.

✔️ Why?

BMT’s price fluctuations create opportunities for short-term gains.

Technical analysis can help identify buying and selling opportunities.

✔️ Strategy:

Identify key support and resistance levels using price charts.

Buy when BMT is oversold and sell when it hits a resistance level.

Use stop-loss orders to protect against sudden price drops.

Stay updated on news, partnerships, and exchange listings that may affect price movements.

---

3. Staking and Passive Income

Best for: Investors who want to earn passive income while holding BMT.

✔️ Why?

Some projects offer staking rewards or incentives for long-term holders.

This strategy helps mitigate risks by generating returns even in bearish markets.

✔️ Strategy:

Check if BMT offers staking rewards through its platform or partnerships.

Stake tokens on a reputable exchange or DeFi platform for passive earnings.

Monitor staking conditions, such as lock-up periods and APY rates.

---

4. Diversification Strategy

Best for: Investors who want to spread risk across multiple crypto assets.

✔️ Why?

The crypto market is unpredictable, so investing in multiple assets reduces risk.

Even if BMT underperforms, other investments may compensate.

✔️ Strategy:

Allocate only a portion of your portfolio to BMT (e.g., 5-10%).

Invest in established cryptocurrencies (like Bitcoin and Ethereum) alongside BMT.

Consider adding other emerging altcoins in the analytics and blockchain sectors.

---

5. Watch for Exchange Listings and News

Best for: Investors looking for quick gains from major market events.

✔️ Why?

Listings on major exchanges (Binance, Coinbase, etc.) often drive up token prices.

Partnerships, product launches, and institutional investments can act as catalysts.

✔️ Strategy:

Follow official BMT announcements and crypto news sources.

Enter early before major events (if you believe a listing or partnership is imminent).

BITCOIN-1.68%

MAJOR-4.61%

Berserker_09

10h

Long-term Ethereum accumulation could unwind if ETH price falls below $1.9K

Ethereum’s native token, Ether ( $ETH ), continues to consolidate under $2,000, which some traders view as a psychological level. Ether price slipped below this range on March 10, and the altcoin continues to trade at its lowest value since October 2023.

Ether price has also lost market value with respect to other major altcoins, with XRP price reaching its highest level against ETH in five years on March 15.

The real question among investors is whether ETH is capable of recapturing a portion of its recent losses or whether traders will capitulate if the price falls below $1,900.

Ethereum traders could jump ship if price falls below $1,900

According to data from a data analytics platform, Ethereum holders accumulated 3.56 million ETH between $1,900 and $1,843, with an average price of $1,871. Therefore, the current accumulation value currently stands at $6.65 billion. This indicates that ETH’s price has a strong support level between $1,900 and $1,843, which can potentially act as the bullish reversal zone.

However, if Ether drops below $1,843, data points to the possibility of rising capitulation fears. Capitulation is a market sentiment where investors tend to panic, selling their positions at a loss during a sharp market correction. If ETH consolidates for a prolonged period under $1,843, the likelihood of a deeper correction increases exponentially.

Below $1,843, the size and volume of ETH accumulation are significantly lower, which further illustrates the importance of the $1,900 to $1,843 support range.

Similarly, the percentage of Ethereum addresses under profit dropped to its lowest level since the start of the decade. It is the lowest value since December 2022 at just under 46%.

A low percentage of profitable addresses has historically indicated a price bottom for Ethereum. Given the high ETH accumulation and fewer profitable addresses, these factors may act as bullish signals. As a result, the likelihood of Ethereum consolidating below $1,843 in the long term is decreasing.

Ethereum long/short ratio indicates a neutral market

Ether’s current market sentiment based on the long/short ratio, a metric to evaluate the proportion of futures traders betting for price increases (long) versus decreases (shorts).

According to the chart above, the largest investors are more inclined toward taking long positions, whereas smaller investors are in the process of deleveraging. Deleveraging means unwinding risky, borrowed positions, which lowers market volatility and interest in leveraged trading.

With the current ratio at 1.3, the long/short ratio indicates a balanced but cautious market.

ETH-0.98%

MAJOR-4.61%

QasimGill

11h

Crypto News Today, March

Crypto News Today, March

Altcoin Rally Gains Momentum Amid SEC Reversal and Trump Support

The SEC appears to be softening its stance on altcoins, coinciding with Trump’s enthusiastic crypto posts and his family’s large purchases of altcoins and Ethereum. Bullish sentiment is growing as Grayscale increases its ADA allocation and altcoin ETFs are on the horizon. Despite the inherent volatility, many believe these price swings are temporary, anticipating a strong bull run when interest rates fall and liquidity increases. I have been bullish on altcoins for years and remain committed to this long-term macro thesis, accepting the ups and downs of the market.

Senate Advances Bipartisan GENIUS and FIRM Acts to Strengthen Stablecoin Regulation

In its first legislative mark of the 119th Congress, the Senate Banking Committee advanced the GENIUS Act, which establishes a clear framework for stablecoins for payments. Chairman Tim Scott stressed that this bipartisan move protects consumers, national security, and promotes domestic innovation. The committee also approved the FIRM Act, which seeks to end debanking by eliminating reputational risk as a regulatory measure. This historic meeting reflects a strong commitment to transparent financial regulation and reinforces the United States’ leadership in digital asset innovation.

Don’t miss out on what’s happening in the world of crypto!

Stay up to date on the latest trends in Bitcoin, Altcoins, DeFi, NFTs, and more with breaking news, expert analysis, and live updates

Treasury Considers Third-Party Custody of Strategic Bitcoin Reserves

The U.S. Treasury Department met with cryptocurrency custodians, including Anchorage Digital, to discuss how to protect strategic bitcoin reserves. Industry leaders suggested third-party custody as an interim solution, while self-custody remains a long-term goal. The meeting highlights the government’s focus on protecting its bitcoin assets amid growing institutional interest in the crypto space.

US Court Approves Three Arrows Capital to Expand $1.53 Billion Claim Against FTX

A U.S. court has approved Three Arrows Capital’s proposal to increase its claim against FTX to $1.53 billion. According to the filing, as of June 12, 2022, 3AC held $1.53 billion in FTX assets, which were liquidated over the next two days to repay a $1.3 billion debt owed to FTX. 3AC initially filed a $120 million claim in FTX's bankruptcy case in June 2023, later expanding it to reflect the full amount.

20% Ethereum Price Drop Could Trigger $336 Million in DeFi Liquidations

Ethereum has plunged 15% over the past week and is currently trading below its 200-day EMA, raising concerns about cascading liquidations in the DeFi space. Analysts warn that the drop could trigger up to $336 million in liquidations as key support levels are breached. The drop highlights the increased risk in the decentralized finance market, where leveraged positions could be forced to close, exacerbating market volatility and affecting overall investor sentiment.

Pi Network News Today

Pi Network announced a final extension of the grace period until March 14, 2025 at 8:00 AM UTC — marking the project’s 6th anniversary. This final extension is designed to maximize inclusion, giving all Pioneers one last chance to verify their balances and complete KYC and Mainnet migration. Early Pioneers and inactive users are urged to submit their applications via the Mainnet listing on the app before the deadline, as failure to do so will result in the forfeiture of most of the moved balance, including bonuses associated with referral team contributions.

$BTC

BTC-0.99%

MOVE-0.76%

DevMak

12h

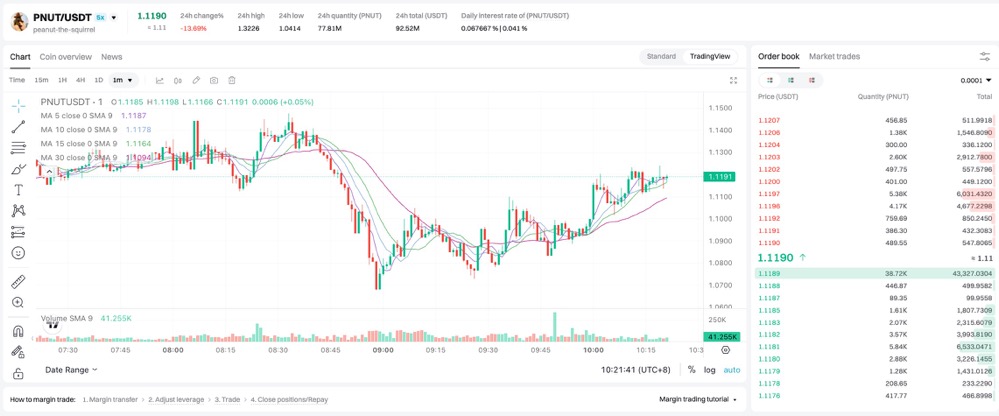

pi/usdt price chart

Disclaimer: This analysis is based solely on the chart and should not be taken as financial advice. Cryptocurrency trading is highly volatile and risky.

Overview:

Current Price: $1.3291

24 Hour Change: -5.15% (indicating a recent downtrend)

Timeframe: The main chart shows a 1-day (1D) view, with options for shorter timeframes (1m, 15m, 1h, 4h

Technical Indicators:

BOLL (Bollinger Bands):

BOLL: 1.7833 (Middle Band - likely the 20-period moving average)

UB: 2.5476 (Upper Band)

This suggests volatility, with the price currently below the middle band, indicating potential bearish pressure.

SAR (Parabolic SAR):

SAR(0.02, 0.2): 0.9546

The SAR is below the price, which is a bullish signal. However, given the recent price drop, this might be lagging or about to flip.

Moving Averages (MA):

MA(5): 75.84M

MA(10): 89.45M

The 5-day MA is below the 10-day MA, further confirming the short-term downtrend.

MACD (Moving Average Convergence Divergence):

MACD: 0.1486

DIF: 0.0187

DEA: 0.0930

The MACD line is above the signal line (DIF > DEA), which is a bullish signal. However, the values are quite low, and the recent price action needs to be considered.

KDJ (Stochastic RSI):

K: 30.2225

D: 34.9339

J: 20.7998

The KDJ values are relatively low, suggesting the asset is not overbought. The J line being the lowest suggests some bearish momentum.

RSI (Relative Strength Index):

RSI(14): 44.8864

The RSI is below 50, indicating bearish momentum.

Stoch RSI (Stochastic Relative Strength Index):

K: 0.0000

D: 0.0000

Both values being zero indicates that the market might be extremely oversold or that there is a lack of volatility in the RSI.

Trend Analysis:

Short Term (Based on 1D Chart and Recent Price Action):

Bearish. The price has dropped significantly in the last 24 hours, and the MAs confirm a short-term downtrend.

The price is below the Bollinger Band middle line.

Mid Term (Based on 1D Chart and Indicators):

Potentially turning bearish. While the MACD is still technically bullish, the price action and other indicators suggest a potential trend reversal.

The location of the candles trending downward under the middle Bollinger band, and heading toward the lower band, indicates a bearish trend.

Long Term (Limited Information):

Difficult to determine without a longer timeframe chart. However, the current indicators suggest caution.

Support and Resistance Levels (Based on Visual Analysis and Chart Data):

Resistance Levels:

$1.8253 (Previous price level)

$2.8399 (Previous price level)

$3.7456 (previous price level)

The upper Bollinger band at $2.5476 will act as a dynamic resistance.

Support Levels:

$1.3135 (24 hour low)

$0.8106 (Previous price level)

$0.0001 (Previous price level)

The lower Bollinger band (calculated using the middle band and the standard deviation) will act as a dynamic support.

Additional Observations:

The volume (VOL) is fluctuating, but it's essential to analyze volume in relation to price action. Increased volume during a price drop can indicate strong selling pressure.

The yellow lines drawn on the picture are trend lines, and show a strong down trend.

The dates on the bottom of the graph show that the graph spans from approximately 2025-02-20 through 2025-03-16.

Recommendations (General, Not Financial Advice):

Exercise caution due to the recent price drop and bearish indicators.

Monitor the volume and price action closely for any signs of reversal.

Consider using shorter timeframes (1h, 4h) for more granular analysis.

Set stop-loss orders to manage risk.

ACT-1.83%

S-4.45%

yasiralitrader

19h

💐🪴*Congress Repeals IRS Broker Rule: What's Next for DeFi Regulation?*👏

*Congress Repeals IRS Broker Rule: What's Next for DeFi Regulation?*

In a significant victory for the decentralized finance (DeFi) industry, Congress has repealed the IRS broker rule, which required DeFi protocols to report gross proceeds from crypto sales and taxpayer information to the Internal Revenue Service (IRS) ¹. However, this raises questions about how lawmakers will regulate DeFi while balancing user privacy demands.

*The Repealed Rule and Its Implications*

The repealed rule, issued by the IRS in December 2024, was set to take effect in 2027. Industry lobby groups deemed it burdensome and beyond the agency's authority. The White House has signaled its support for the bill, with President Donald Trump ready to sign it into law.

*Privacy Concerns and Regulatory Challenges*

The crypto industry has welcomed the repeal, citing concerns over user privacy. Marta Belcher, president of the Filecoin Foundation, emphasized the importance of protecting users' ability to transact anonymously, similar to cash transactions ¹. However, regulators face challenges in balancing user privacy with Anti-Money Laundering (AML) and Know Your Customer (KYC) concerns.

*Possible Solutions and Future Directions*

One possible solution is the integration of zero-knowledge proofs, which allow users to confirm certain data without revealing it. Etherealize CEO Vivek Raman suggests that clear frameworks for blockchain-based privacy, while maintaining AML and KYC requirements, are necessary for the industry to move forward ¹. The Senate Banking Committee has approved the GENIUS Act, a stablecoin bill, and the crypto framework bill, FIT 21, is being revised for potential passage.

*Key Takeaways*

- *Repeal of IRS Broker Rule*: Congress has repealed the IRS broker rule, relieving DeFi protocols from reporting obligations.

- *Regulatory Challenges*: Lawmakers face challenges in balancing user privacy with AML and KYC concerns.

- *Possible Solutions*: Zero-knowledge proofs and clear frameworks for blockchain-based privacy may help address regulatory concerns.

- *Future Directions*: The GENIUS Act and FIT 21 bills aim to provide a clearer regulatory framework for the DeFi industry.$BTC

BTC-0.99%

MOVE-0.76%

Mga kaugnay na asset

Mga sikat na cryptocurrencies

Isang seleksyon ng nangungunang 8 cryptocurrencies ayon sa market cap.

Kamakailang idinagdag

Ang pinakahuling idinagdag na cryptocurrency.

Maihahambing na market cap

Sa lahat ng asset ng Bitget, ang 8 na ito ang pinakamalapit sa Achain sa market cap.

Achain Social Data

Sa nakalipas na 24 na oras, ang marka ng sentimento ng social media para sa Achain ay 3, at ang trend ng presyo ng social media patungo sa Achain ay Bullish. Ang overall na marka ng social media ng Achain ay 0, na nagra-rank ng 846 sa lahat ng cryptocurrencies.

Ayon sa LunarCrush, sa nakalipas na 24 na oras, binanggit ang mga cryptocurrencies sa social media nang 1,058,120 (na) beses, na binanggit ang Achain na may frequency ratio na 0%, na nagra-rank ng 1081 sa lahat ng cryptocurrencies.

Sa nakalipas na 24 na oras, mayroong total 13 na natatanging user na tumatalakay sa Achain, na may kabuuang Achain na pagbanggit ng 1. Gayunpaman, kumpara sa nakaraang 24 na oras, ang bilang ng mga natatanging user bumaba ng 0%, at ang kabuuang bilang ng mga pagbanggit ay bumaba ng 0%.

Sa Twitter, mayroong kabuuang 0 na tweet na nagbabanggit ng Achain sa nakalipas na 24 na oras. Kabilang sa mga ito, ang 0% ay bullish sa Achain, 0% ay bearish sa Achain, at ang 100% ay neutral sa Achain.

Sa Reddit, mayroong 0 na mga post na nagbabanggit ng Achain sa nakalipas na 24 na oras. Kung ikukumpara sa nakaraang 24 na oras, ang bilang ng mga pagbanggit bumaba ng 0% . Bukod pa rito, mayroong 0 na komento na nagbabanggit ng Achain. Kung ikukumpara sa nakaraang 24 na oras, ang bilang ng mga pagbanggit ay bumaba ng 0%.

Lahat ng panlipunang pangkalahatang-ideya

3