News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitcoin ETFs Saw $3 Billion Weekly Inflows As US Investors Pivot to BTC2Crypto Whale Invests Over $5 million in TRUMP for Presidential Dinner Invitation3Ethereum (ETH) Whale Stability Signals Calm Before Potential Major Move

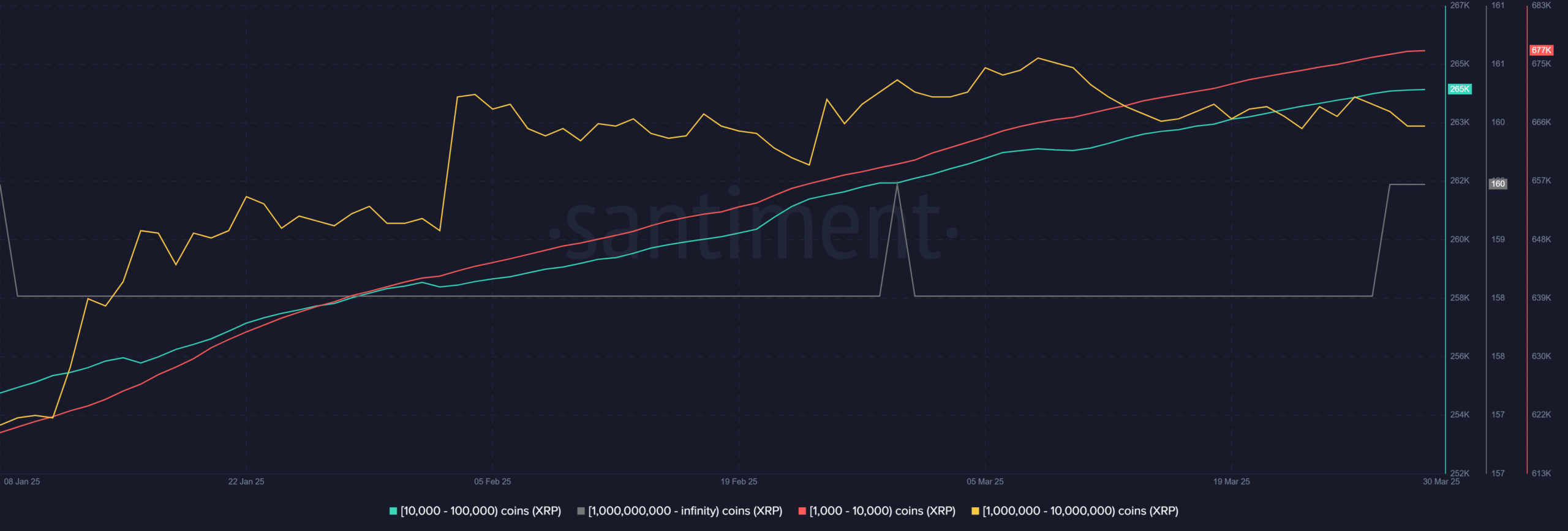

XRP’s Future: Analysts Suggest Possible Consolidation and Target of $12.50 Amid Market Uncertainty

Coinotag·2025/03/29 16:00

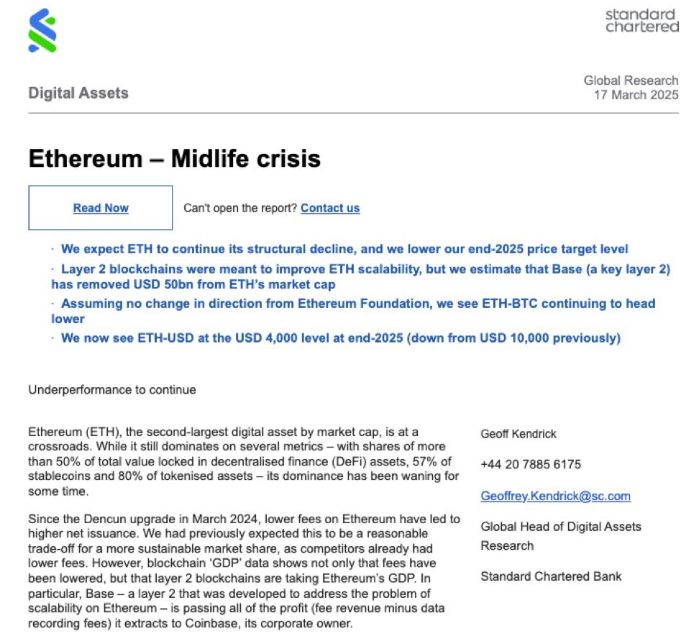

Ethereum’s Path Forward: Can the Pectra Upgrade Enhance Long-Term Utility Amid Market Challenges?

Coinotag·2025/03/29 16:00

Whale Sale Raises Questions About Solana’s Future Amid Robust Network Growth and Price Support

Coinotag·2025/03/29 16:00

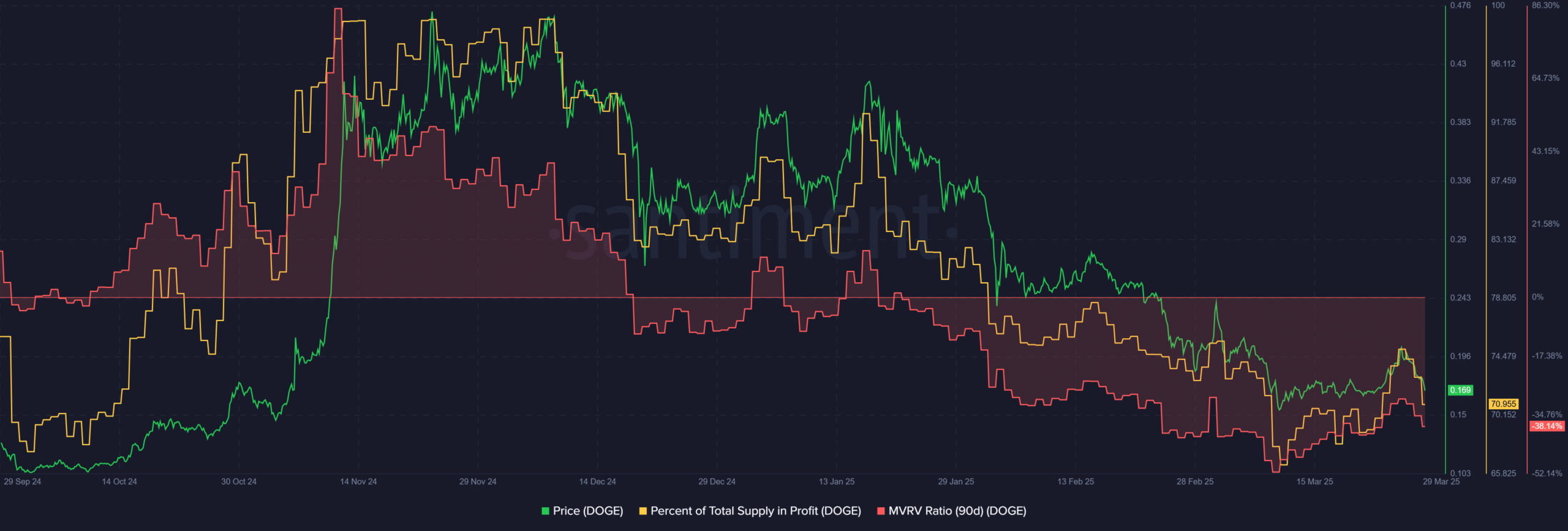

Dogecoin Bulls Eye Potential Support at $0.14 Amid Ongoing Market Weakness

Coinotag·2025/03/29 16:00

Hyperliquid (HYPE) Drops 2.06% as Whale Adds Margin to Avoid Liquidation

Newscrypto·2025/03/29 16:00

Uniswap’s app store ranking dives as user activity and trading volume decline

Quick Take Uniswap’s U.S. app store ranking surged after the pro-crypto election victory but has since collapsed from #99 to #364. The following is an excerpt from The Block’s Data and Insights newsletter.

The Block·2025/03/29 16:00

Analysis of $700k oracle manipulation exploit highlights vulnerabilities in DeFi vaults

Quick Take In February, an oracle manipulation attack affected DeFi protocols across Ethereum Layer 2 network ZKsync, including Venus Protocol, which suffered a $717,000 loss from taking on bad debt. The attacker manipulated the exchange rate of Mountain Protocol’s wUSDM wrapped yield-bearing stablecoin by using a flash loan and exploiting a donation-based vulnerability in standard ERC-4626 tokenized vaults.

The Block·2025/03/29 16:00

Pi Network Price Drops but Shows Signs of Recovery

Newscrypto·2025/03/29 16:00

Flash

- 01:19CoinList Introduces Passive Investment Opportunities with SOL and Ethena's USDePANews April 28th: According to Crowdfundinsider, digital asset platform CoinList announced the launch of two feature updates that allow users to earn passive income: SOL auto-staking and USDe interest-bearing. Users can earn up to 5.5% and 6% annual returns simply by holding SOL or USDe in their CoinList wallets. SOL staking requires no manual intervention, as the system automatically completes the delegation process; Ethena's USDe interest is paid weekly with no need for locking up funds.

- 01:19Today's Fear and Greed Index Drops to 54, Level Changes from Greedy to NeutralAccording to Jinse, today's fear and greed index has dropped to 54, changing from greedy to neutral. Note: The fear index threshold is 0-100, including indicators: volatility (25%) + market volume (25%) + social media popularity (15%) + market survey (15%) + Bitcoin's share of the total market (10%) + Google trends analysis (10%).

- 00:48Three Former SEC Legal Advisors: Paul Atkins' Focus on Enforcement Will Shift, But Not Completely DivergeJinse reported that last week, Paul Atkins was sworn in as the new chairman of the U.S. Securities and Exchange Commission (SEC). Experts suggest that the SEC's rule-making agenda may undergo significant changes, but Atkins is known for his tough stance on enforcement. Three former SEC general counsels believe that although there will be a shift in enforcement priorities under Atkins' leadership, it will not completely diverge. Melissa Hodgman, a partner at Fried, and a former senior SEC enforcement officer, predicts that under Atkins, the SEC’s enforcement will not relax, with a focus on fraud (including accounting and disclosure fraud) and insider trading. Regulatory agencies can efficiently track insider trading through social media and AI, with the enforcement team maintaining close attention. Former general counsel Robert Stebbins states that enforcement will return to the focus during Jay Clayton's tenure, concentrating on the "mass market" or retail investors, and this time, the Foreign Corrupt Practices Act will not be enforced. Megan Barbaro, who served as general counsel during the tenures of Dan Berkovitz and Gary Gensler, noted that the SEC will pay more attention to cases that actually harm investors, reduce corporate fines, limit enforcement of procedural violations, and focus on fraud. Former chairman Gary Gensler's rule-making agenda was widely criticized, and the three former chief lawyers anticipate that Atkins will tackle the challenges of cryptocurrency regulation and might simultaneously expand private market access and raise the threshold for qualified investors.