News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Despite recent market turmoil, major Bitcoin ETF issuers are acquiring large amounts of BTC, suggesting confidence in future demand and potential market stabilization.

Solana faces intense bearish pressure, plunging below support with strong downtrend signals from Ichimoku and BBTrend. A retest of February lows looms unless momentum shifts fast.

As traditional markets show clear signs of an impending recession, the crypto space is not immune from damage. Liquidations are surging as the overall crypto market cap mirrors declines in the stock market. Even though the source of these problems is localized to the US, the damage will have global implications. Traders are advised to …

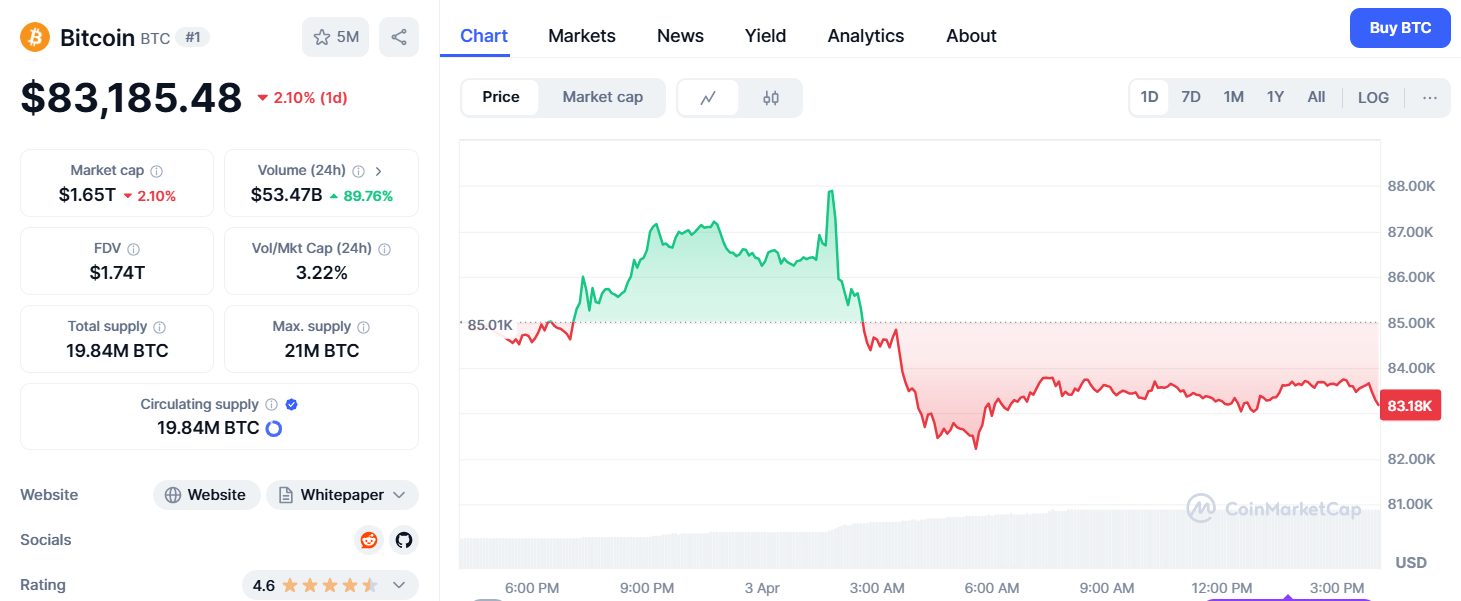

Bitcoin Futures have surged past $100 billion in open interest, showing strong activity from institutional and retail traders. Whales are increasingly taking short positions even as Bitcoin trades above $85,000, diverging from retail sentiment. Altcoin markets are seeing reduced long interest from whales with XVG and ALICE being rare exceptions showing bullish positions.

Wormhole enters April at a crossroads, with weakening momentum and a looming token unlock adding pressure. Traders eye $0.089 as the breakout pivot in an uncertain landscape.

- 16:27Trader Eugene: Negative News Has Limited Impact on BTC, Market Structure Remains SolidTrader Eugene stated in his community that despite a series of negative news affecting the market recently, including uncertainty in tariff negotiations, MicroStrategy (MSTR)'s decreased purchasing power of BTC, and escalating military tensions between India and Pakistan, BTC's price remains stable at a high of $95,000. This suggests that the structural shift in the market remains solid, and pullbacks are seen as buying opportunities. The trader emphasized that apart from mainstream cryptocurrencies, he is currently most optimistic about SOL and XRP. Overall, market sentiment is uneasy, but it is essential to go with the trend.

- 16:14Analysis: As Bitcoin Rises, "Speculative Funds" Return to the MarketOn April 29, Cointelegraph reported that as Bitcoin rises, short-term Bitcoin holders (STHs) are returning to the market, marking the entry of "speculative capital." Glassnode indicates a surge in Bitcoin "hot capital." As BTC prices hover at multi-month highs, new investors are entering the market. Glassnode noted that the amount of Bitcoin transferred in the past week has reached its highest level since early February. This metric reflects the activity of short-term holders and serves as a reference for measuring the entry of speculative capital into the market. Over the past week alone, "hot capital" has grown by more than 90%, approaching $40 billion. Since the local low at the end of March, "hot capital" has cumulatively increased by $21.5 billion, highlighting changes in market sentiment due to this "surge in capital turnover."

- 16:14Data: Solana Hot Money Soars 100% in 7 Days, Crypto Assets Rebound But Remain Below Cycle HighsAccording to Glassnode data, Solana ($SOL) hot capital reached $9.46 billion on April 28, marking a new high since March 12, with a growth of $4.72 billion (+100%) over the past 7 days. During the same period, XRP hot capital surged from $920 million to $2.17 billion, an increase of 134.9%. Despite the strong rebound, hot capital in major crypto assets remains significantly below cycle highs: BTC (-60.8%), ETH (-60.3%), SOL (-38.4%), XRP (-71.7%). Analysts believe that the inflow of funds into SOL will provide more liquidity support for stablecoins in the Solana ecosystem.