News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (April 30) | Trump Media&Technology Group Plans to Launch Truth Social Utility Token, US SEC Delays Approval of Several Cryptocurrency ETFs2BlackRock’s $1 Billion Bitcoin Investment Boosts Market Outlook3Week 16 On-Chain Data: Intensifying Structural Supply-Demand Imbalance, Data Reveals Solid Blueprint for Next Bull Run?

Bitcoin surges to $58,000 amid renewed ETF inflows

Cryptobriefing·2024/08/08 15:27

Putin Officially Legalized Cryptocurrency Mining in Russia

Cryptodnes·2024/08/08 14:57

Bitcoin Report from JPMorgan Analysts: 'Institutional Investors Support Bitcoin!'

JPMorgan analysts led by Nikolaos Panigirtzoglou attributed Bitcoin's recovery to support from institutional investors.

Bitcoinsistemi·2024/08/08 14:30

Brazil’s SEC Approves The Country’s First Solana ETF

Insidebitcoin·2024/08/08 13:53

CATDOG (CATDOG): The Meme Coin That Ends the War Between Cats and Dogs

Bitget Academy·2024/08/08 12:28

How to earn Telegram ⭐ Stars with MAJOR app

Medium·2024/08/08 08:53

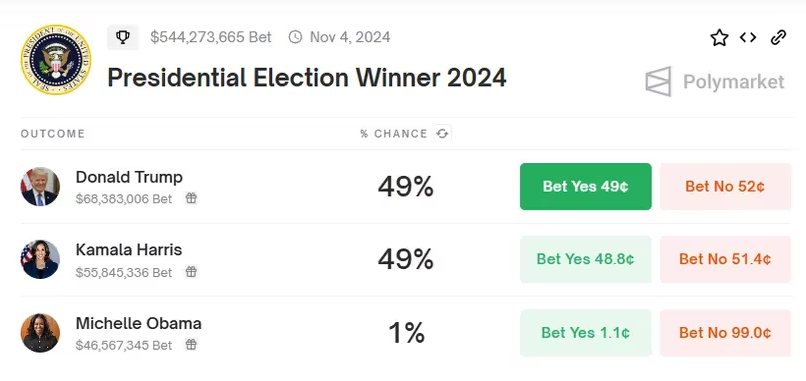

Kamala Harris Makes a Big Cryptocurrency Move, Catches Donald Trump!

Polymarket users currently predict that former US President Donald Trump and incumbent Vice President Kamala Harris have a 49% chance of winning the upcoming November presidential election.

Bitcoinsistemi·2024/08/08 08:45

The Stakes Are High!!! Critical Dates for Bitcoin Traders

Institutional Crypto Research Written by Experts

10xResearch·2024/08/08 03:57

Flash

- 21:56Trump says proposed spending bill will mean "the largest tax cut in American history"On May 1st, U.S. President Trump stated that the "big beautiful bill" currently in the works might be "bigger than tariffs." Trump praised Senate Majority Leader Thune for his work on legislation and added that Democrats are "trying to block it at every turn," warning that "if they succeed, it will mean a 58% tax increase." Trump reiterated that the proposed spending bill would mean "the largest tax cut in American history."

- 21:56Fed's Mouthpiece: Dallas Fed's "Trimmed Mean" PCE Indicator Falls Below 2.5% Year-on-Year for the First Time Since September 2021According to MetaEra news, on May 1 (UTC+8), "Fed's mouthpiece" Nick Timiraos commented that the Dallas Fed's "trimmed mean" PCE indicator fell below 2.5% year-on-year for the first time since September 2021.

- 21:55Ripple's Acquisition of USDC Issuer Circle RejectedAccording to a report by Jinse Finance, Ripple offered $4 billion to $5 billion in an attempt to acquire stablecoin issuer Circle, but the offer was rejected due to being too low. Ripple has not yet decided whether to make another acquisition offer.