News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitcoin rallies above $106K but 3 key actions must happen for new all-time highs2DeepSeek panic eases as crypto and stock markets reset focus3Stablecoin expansion could drive the next cryptocurrency rally: CryptoQuant

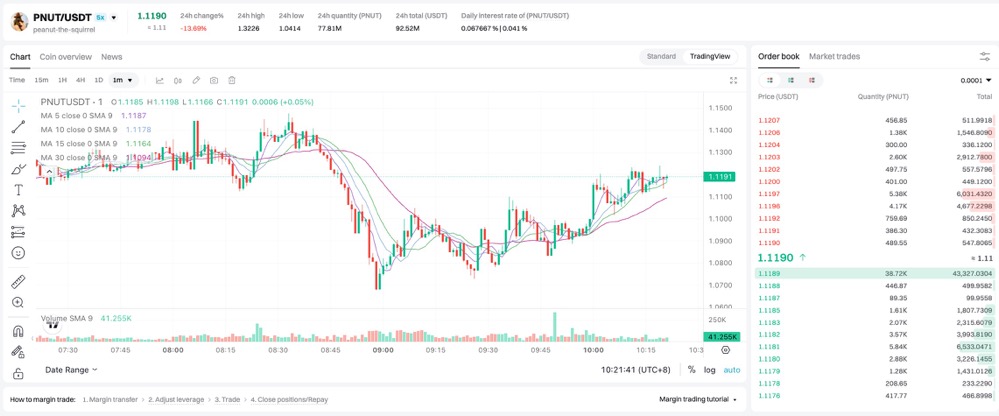

Sun and Moon Xiao Chu: Why do I continue to add positions in the pullback of $PNUT and $ACT?

Twitter Opinion Selection·2024/11/23 02:23

Trump Chooses Scott Bessent as the New US Treasury Secretary

Cryptotale·2024/11/23 01:03

A Brief History of Bitcoin's Rise: Travel Notes from $10,000 to $100,000

As the author writes this, Bitcoin has reached $99,419.99. As Bitcoin approaches $100,000, multiple factors indicate that the achievement of this milestone is based on more than mere speculation.

Chaincatcher·2024/11/23 00:44

Bitcoin Nears $100K and ETFs Sees Record $3.38B Weekly Inflows

Cryptotale·2024/11/23 00:15

Bitcoin Price Nears $100,000

Coinspaidmedia·2024/11/23 00:00

Polygon’s MGGA Hat NFTs Rank 2nd In Daily NFT Sales Volume With +$3.6M

Insidebitcoin·2024/11/22 23:11

Bitcoin Price Analysis As BTC Closes on $100K, MSTR Plunges 15%, And Crypto All-Stars Blasts Past $5 Million

Insidebitcoin·2024/11/22 23:11

If XRP Stays Above This Key Level, $2 Will Come Before Major Pullback

Timestabloid·2024/11/22 16:00

Analyst Sets Four Stellar (XLM) Prices to Watch

Timestabloid·2024/11/22 16:00

Flash

- 13:02Tether CEO: We have always supported BitcoinGolden Finance reported that Paolo Ardoino, CEO of Tether, said: “We have always supported Bitcoin. We invested in Bitcoin. We are loyal investors in Bitcoin and Bitcoin technology.”

- 13:01Dogwifhat: We have been negotiating with all parties of Sphere. If the plan fails to be implemented, the donation will be refunded.Golden Finance reported that Dogwifhat officially issued a statement today that the organizers of Wif Sphere have been negotiating with various parties to cooperate in the placement of Sphere ads. Since the Wif team is not a corporate entity, the organizers are working with well-known brands to execute this advertisement. The timetable has been agreed upon by the related parties, and in the event that the plan is not implemented, the donations will be refunded, and "the team has no intention of misleading any party." As previously reported, a spokesperson for the Las Vegas Sphere denied reaching an advertising agreement with the Solana meme coin Dogwifhat (WIF). Last year, the team led by Zion Thomas raised $650,000 to plan to project the Solana Meme coin Dogwifhat onto the Las Vegas sphere. Although the fundraising goal has been reached, the plan has not yet been realized.

- 13:00Bitwise Chief Investment Officer: Cryptocurrency's four-year cycle may have endedPANews reported on February 1 that Bitwise Chief Investment Officer Matt Hougan tweeted that Bitcoin's traditional four-year cycle may have ended. The current cycle stems from the massive deleveraging that occurred after the scandal in 2022: FTX, Three Arrows Capital, Genesis, BlockFi, Celsius, etc. With the influx of institutional investors and the maturity of market structure, Bitcoin's price volatility and cyclicality will be smoother and no longer significantly affected by the halving event. The Bitcoin market is entering a new stage dominated by macroeconomic factors and long-term investment strategies. As the crypto market develops, traditional market cycles may no longer apply, marking a shift toward broader institutional integration and sustained investor interest. At the same time, changes in Washington's attitude towards cryptocurrencies will have a greater impact, or bring in trillions of dollars in capital inflows. Compared with the past few years, any pullback will be shorter and shallower than a few years, and we are in a new mainstream era of cryptocurrencies.