News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.28)|Arizona Bitcoin Reserve Legislation Set for Vote, ProShares Trust's XRP ETF to Be Publicly Listed2Ethereum researcher proposes 100-fold 'exponential' gas limit boost to improve mainnet scaling3Pudgy Penguins (PENGU) Rockets 34%, Approaches Three-Month High of $0.019

Pi Network (PI) Introduces Two-Factor Authentication – Here’s How to Secure Your Account

CoinsProbe·2025/03/19 11:00

EOS Gains Momentum Following Key Breakout – Is RAY Gearing Up For A Similar Move?

CoinsProbe·2025/03/19 11:00

Is Dogecoin (DOGE) Gearing Up for a Reversal? Surge in Active Addresses and Key Pattern Hint at a Rally

CoinsProbe·2025/03/19 11:00

Is HYPE Ready to Soar? BNB Fractal Signals a Big Move Ahead for Hyperliquid

CoinsProbe·2025/03/19 11:00

Cardano Social Sentiments Hits Highest Bullish Level in 4 Months, Will Prices Follow?

CryptoNewsNet·2025/03/19 10:11

Research Report | Tutorial Project Analysis & TUT Market Valuation

远山洞见·2025/03/19 08:45

Bitcoin price volatility ramps up around FOMC days — Will this time be different?

Bitcoin traders tend to cut risk leading into FOMC meetings, but key price metrics are showing a divergence. Will BTC rally when the Fed minutes are released?

Cointelegraph·2025/03/19 07:30

EOS rebrands to Vaulta for $4.1B Web3 banking push

Grafa·2025/03/19 07:20

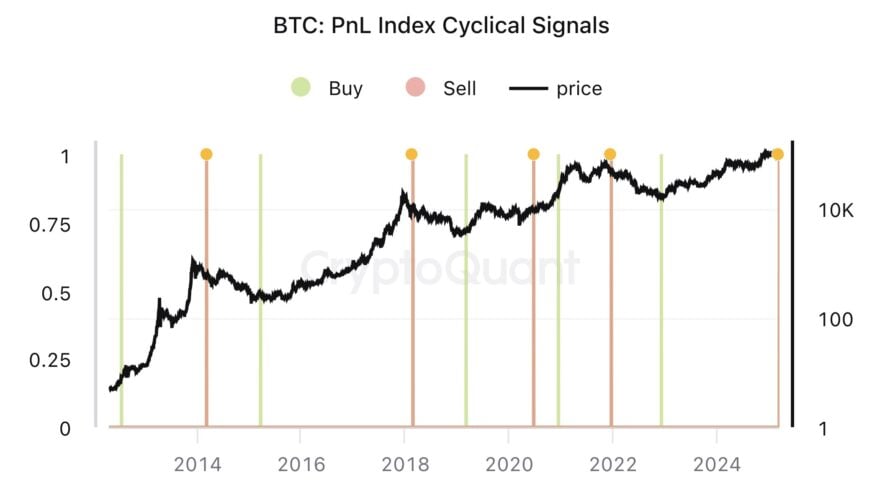

Bitcoin Bull Cycle Over? CryptoQuant CEO Warns of Possible Bearish Trend

Portalcripto·2025/03/19 05:55

Solana CME Futures Fell Short of BTC and ETH Debuts, but There's a Catch

Cointime·2025/03/19 03:45

Flash

- 20:24Bloomberg Analyst: Listing Date for ProShares XRP ETF Not Yet DeterminedBlockbeats report on April 29: Bloomberg ETF analyst James Seyffart posted on social media stating, "Many are posting/reporting that ProShares will launch an XRP ETF on April 30. We have confirmed that this is not the case. There is currently no confirmed listing date, but we believe they will indeed launch—most likely in the short term, or in the midterm."

- 20:23Analyst: Manufacturing Data Causes Dollar to Retreat to Low LevelsAccording to Blockbeats, on April 28th, an analyst from the financial website Forexlive stated that the dollar has once again fallen to low levels, with the U.S. stock market stable but the dollar weakening. The dollar's decline is accelerating, which is an ominous sign. The latest round of decline followed the Dallas Fed manufacturing index dropping to its lowest level since May 2020. This report is filled with concerns over tariffs and uncertainty in the real economy. The market is weighing whether all this poor confidence data truly signals an impending economic slowdown, with each such data point weakening the bullish rationale, especially after last week's significant rebound in U.S. stocks and the dollar. (Jinshi)

- 20:23US Stock Markets Close MixedAccording to Jinse, the three major US stock indices closed mixed, with the Dow Jones up 0.28%, the S&P 500 up 0.06%, and the Nasdaq down 0.1%. Large tech stocks were mixed, with Intel up over 2%, and slight gains for Apple, Tesla, Netflix, and Meta; Nvidia fell over 2%, while Microsoft, Google, and Amazon saw slight declines.