News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.25) | Trump Considers Tiered Tariff Plan for China, Federal Reserve Eases Crypto Regulation2ARK Invest Sees Bitcoin Hitting $1.5M By 2030 On Rising Institutional Demand3US spot bitcoin ETFs log $442 million in net inflows as BTC price shows resilience

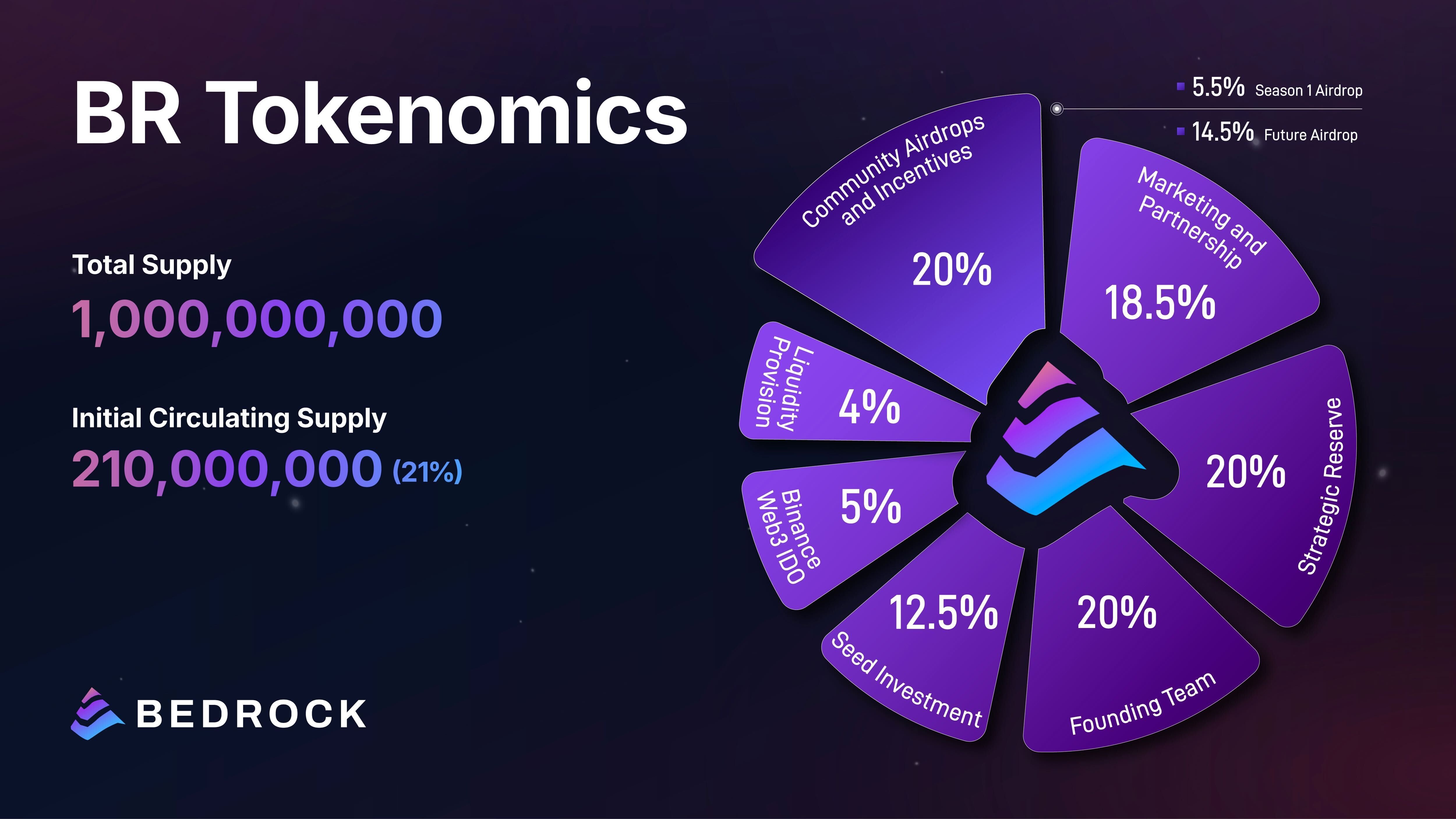

Bedrock’s $BR Token is Live: How It Fuels Bitcoin Staking with PoSL

Bedrock·2025/03/20 12:35

US lawmakers target stablecoin legislation by August

Grafa·2025/03/20 10:30

First Solana futures ETFs launch March 20

Grafa·2025/03/20 10:30

EU crypto payments shift to retail and food

Grafa·2025/03/20 10:30

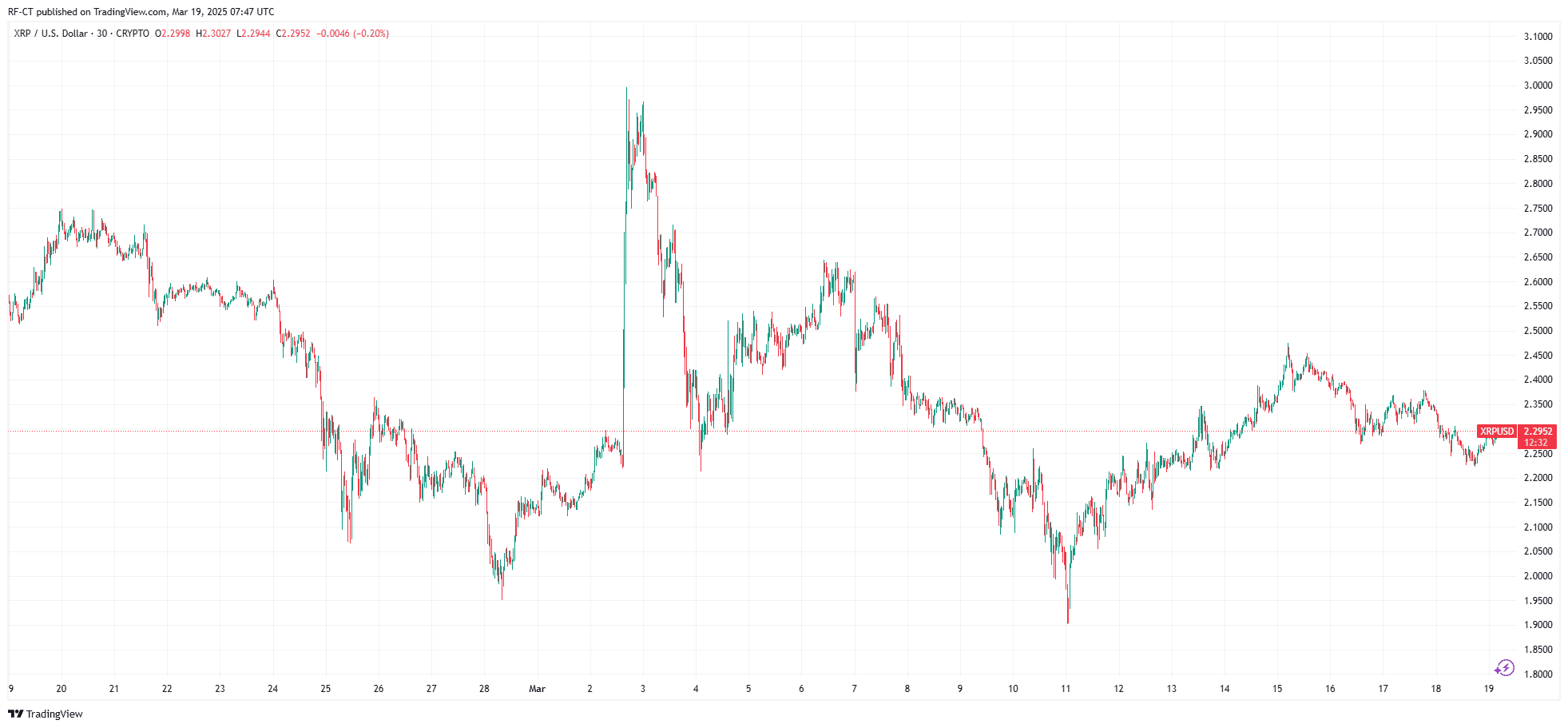

XRP Price Prediction: Can XRP Price Reach $10 after FOMC Meeting?

Cryptoticker·2025/03/20 04:11

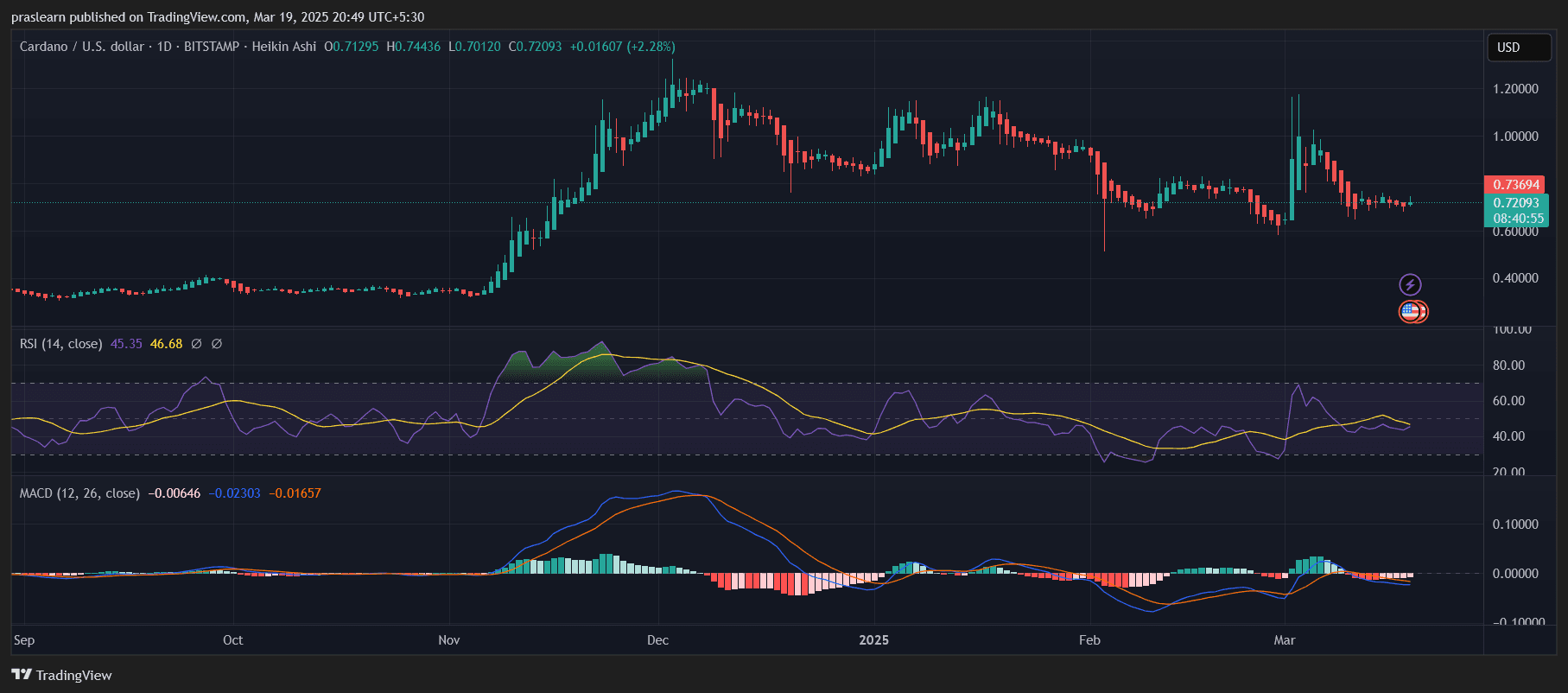

Can Cardano Price Reach $100?

Cryptoticker·2025/03/20 04:11

Kadena (KDA) Holds Key Support – Can the Double Bottom Pattern Spark a Recovery?

CoinsProbe·2025/03/20 03:22

XRP Pumps as SEC Drops Ripple Lawsuit – Key MA Resistance Holds the Key to Uptrend

CoinsProbe·2025/03/20 03:22

INJ and JASMY Approaches Falling Wedge Resistance – Could Breakout Spark a Recovery?

CoinsProbe·2025/03/20 03:22

Flash

- 06:2688% of Tokenized Treasury Issuances are Held by Six Entities including BlackRockAccording to ChainCatcher and reported by Cointelegraph, data from RWA.xyz shows that six entities hold 88% of tokenized U.S. Treasuries. The largest issuer of tokenized wealth remains BlackRock. The company's tokenized U.S. Treasuries fund, BUIDL, has a market cap of $2.5 billion, 360% higher than its nearest competitor. The top six funds also include: Franklin Templeton's BENJI, with a market cap of $707 million; Superstate's USTB, with a market cap of $661 million; Ondo's USDY, with a market cap of $586 million; Circle's USYC, with a market cap of $487 million; Ondo's OUSG fund, with a market cap of $424 million. Together, these six funds account for 88% of all tokenized treasury issuances.

- 04:27Important Dynamics Overview for April 26th, Midday7:00-12:00 Keywords: USDC, XRP Spot ETF, xAI, Solscan 1.Solana's circulating USDC surpasses 10 billion units; 2. SEC Commissioner Uyeda calls for expanded crypto asset custody options; 3. The world's first XRP spot ETF is listed and traded on the Brazilian exchange; 4. Musk's xAI plans to raise $20 billion, potentially becoming the second-largest startup financing in history; 5. Google's first search result for "Solscan" is a phishing ad link, users need to be cautious; 6. U.S. Senator: Trump's dinner for TRUMP holders could be grounds for impeachment; 7. Chainalysis: The TRUMP dinner generated $900,000 in transaction fees for Trump and his allies within two days.

- 03:11BlackRock IBIT Continues 9 Days of Inflows, Increases BTC Holdings by $1.6 BillionAccording to Jinse, The ETF Store President Nate Geraci revealed data on platform X showing that BlackRock IBIT has experienced 9 consecutive days of inflows, increasing its BTC holdings by $1.6 billion. Official data shows that IBIT's current total Bitcoin holdings have reached 586,164.3086 BTC, with a market value hitting $54,659,645,928.78.