Bitcoin Faces Indecision Amid Fading Whale Activity and Key Support Levels

-

Bitcoin markets show indecision as prices fluctuate between $83,000 and $86,000, raising questions about the future momentum of the leading cryptocurrency.

-

Recent observations indicate a decline in whale wallets, hinting at potential caution from major holders amidst a backdrop of market uncertainty.

-

Experts suggest that failure to hold key support at $83,583 could trigger more significant declines, while breaking resistance at $86,092 might bolster upward targets.

Bitcoin exhibits market indecision with key price levels in play; whale activity signals caution while investors eye critical support and resistance points.

Bitcoin Whales Pull Back: Early Signs of Fading Confidence?

The number of Bitcoin whales—wallets holding between 1,000 and 10,000 BTC—has declined slightly in recent days, dropping from 2,015 on April 14 to 2,010 by April 16. This pullback comes just after the metric hit its highest level since May 2024, suggesting a potential shift in sentiment among large holders.

While the drop may seem small, movements in whale behavior often precede broader market trends, making even slight changes worth watching.

Bitcoin Whales. Source: Santiment.

Whale activity is a key on-chain signal because these large holders can significantly influence market liquidity and price direction. An increase in whale wallets often reflects accumulation and long-term confidence, while a decline may suggest strategic profit-taking or risk-off behavior.

The recent dip from the local peak could indicate that some whales are trimming exposure as market uncertainty rises. If the number continues to fall, it may signal weakening institutional conviction, potentially putting short-term pressure on Bitcoin’s price.

Bitcoin Stalls Near Ichimoku Pivot as Momentum Fades

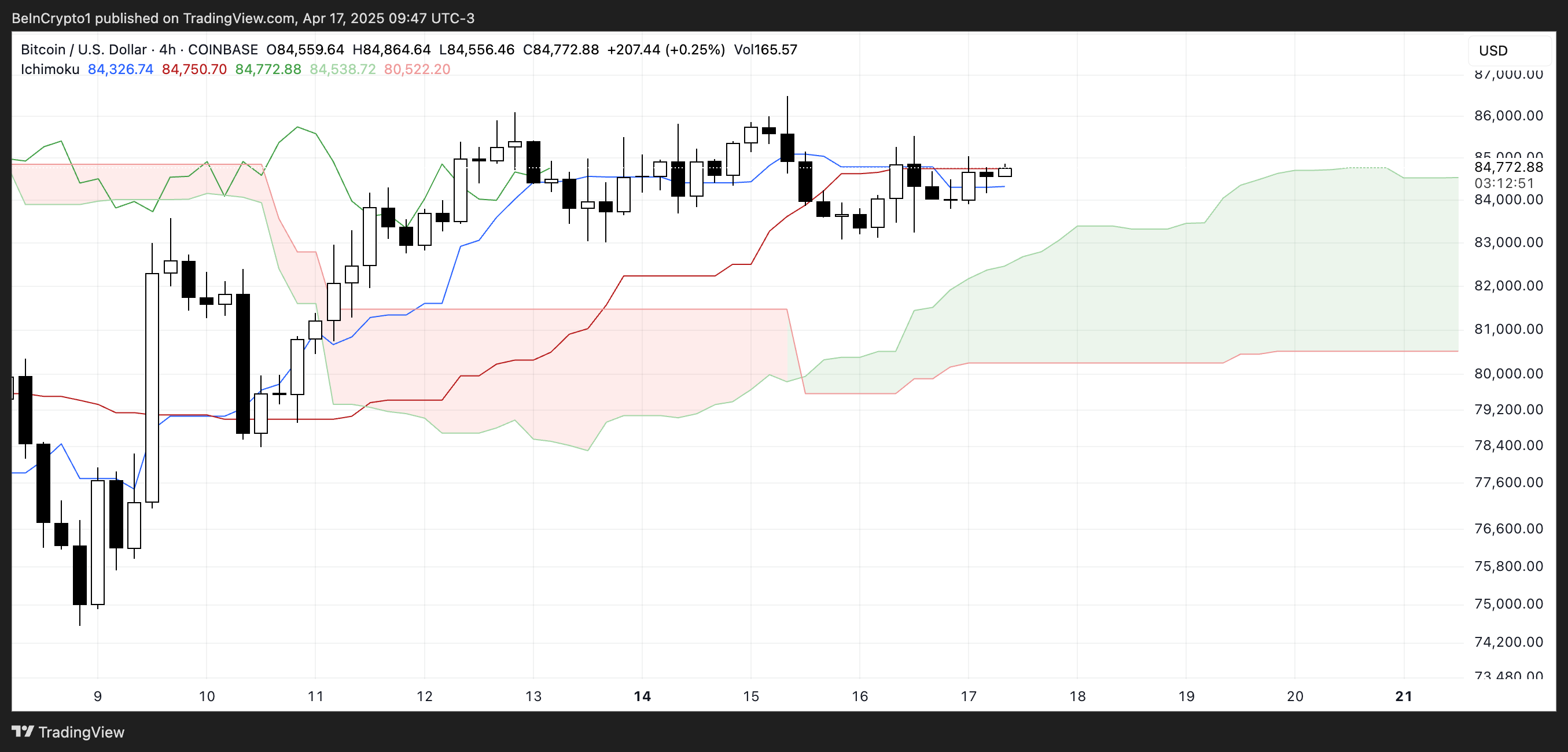

The Ichimoku Cloud chart for Bitcoin shows a period of consolidation, with the price currently trading near the flat Tenkan-sen (blue line) and Kijun-sen (red line). This alignment suggests a lack of short-term momentum, as both lines are moving sideways, indicating equilibrium between buyers and sellers.

The Kumo (cloud) ahead is bullish, with the Senkou Span A (green cloud boundary) above the Senkou Span B (red cloud boundary), but the distance between them is relatively narrow.

BTC Ichimoku Cloud. Source: TradingView.

This hints at weak bullish momentum for now. The price is sitting just above the cloud, which is a positive sign, but without a clear breakout above the Tenkan-sen and recent highs, the trend remains indecisive.

Chikou Span (lagging line) is overlapping with recent candles, reinforcing the sideways movement. Overall, Bitcoin is hovering in a neutral-to-slightly-bullish zone, but it needs a stronger push to confirm a clear trend direction.

Bitcoin Struggles for Direction as Key Levels Loom

Bitcoin’s EMA lines are currently flat, indicating a weak and uncertain trend. The price action shows hesitation, with bulls and bears lacking conviction.

If the support level at $83,583 is tested and fails to hold, the market could enter a sharper correction, targeting the next support at $81,177.

BTC Price Analysis. Source: TradingView.

However, if bulls manage to regain control, Bitcoin could shift toward recovery. The first key resistance lies at $86,092—breaking this level would suggest renewed upward momentum.

From there, the next upside targets would be $88,804 and, if the trend strengthens further, $92,817. Reaching this level would mean breaking above the $90,000 mark for the first time since March 7, potentially sparking renewed interest from both retail and institutional investors.

Conclusion

In conclusion, Bitcoin navigates critical support and resistance levels, reflecting a broader uncertainty in the markets. The recent decline in whale wallets serves as a barometer for institutional sentiment. Investors are advised to monitor these movements closely as Bitcoin seeks direction amidst fluctuating momentum and market sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Temu, Shein respond to tariffs by raising prices for American buyers

Share link:In this post: Shein and Temu have sharply raised prices for U.S. shoppers in response to the new Trump-era tariffs on Chinese goods. Some products on Shein have surged by up to 377%, while Temu has doubled prices on select items to offset potential tariff costs. Reports suggest this is just the first wave, with other major retailers expected to follow suit as the tariff regime fully kicks in.

EURC gains popularity in April, tracking the Euro rally

Share link:In this post: The Euro rally sparked speculation for EURC, Circle’s alternative currency stablecoin. EURC volumes increased in April, as the supply expanded to over 211M tokens. EURC is expanding its volumes on DEX, with new liquidity pools added to Solana markets Orca and Meteora.

Bitcoin's Bull Run Reloads: Analyst Expects BTC to Break All-Time Highs

XRP price rises 10% in a week as long-term holders reduce selling