Research Report | Detailed Analysis of KernelDAO Project & KERNEL Market Cap Analysis

View original

远山洞见2025/04/16 02:55

By:远山洞见

1. Project Introduction

KernelDAO is a cross-chain restaking infrastructure platform dedicated to reshaping the staking value path of mainstream assets such as ETH, BTC, and BNB through shared security and liquidity design. Its ecosystem covers three core products: Kernel (BNB chain restaking protocol), Kelp (ETH liquid restaking), and Gain (airdrop reward vault), forming a cross-chain restaking network serving developers, stakers, and operators.

On the BNB chain, Kernel has launched the first restaking protocol based on the Dynamic Validation Network (DVN) architecture, allowing users to restake BNB or LST in multiple services, enhancing the overall security of the chain. Kelp, built on Ethereum's EigenLayer, issues rsETH for liquid restaking, allowing ETH stakers to maintain asset liquidity while earning basic returns. rsETH can be used in various DeFi scenarios such as lending, trading, and staking, providing users with more flexible financial strategies. Meanwhile, Gain maximizes user returns through a non-custodial Vault mechanism that automatically captures airdrops and rewards with one-click deployment.

KernelDAO completed a financing round of tens of millions of dollars in 2024, with investors including leading institutions such as Laser Digital, SCB Ventures, Bankless, GSR, HTX, and DWF. Its current valuation has reached 90 million dollars. The core team consists of seasoned professionals in DeFi, marketing, and product development, and is rapidly expanding multi-chain ecosystem collaborations, propelling KernelDAO to become a representative project of next-generation restaking infrastructure.

2. Project Highlights

1. Full-chain Restaking Infrastructure, Connecting Multi-chain Asset Revenue Paths of ETH, BNB, and BTC KernelDAO, as an infrastructure platform realizing cross-chain restaking, builds a full-stack ecosystem centered on Kernel (BNB Chain), Kelp (Ethereum), and Gain (vault automated strategy). Stakers of BNB, users of rsETH, and strategic users in pursuit of airdrops and rewards can all maximize asset value and compound growth within the KernelDAO ecosystem.

2. Introducing "Shared Security" for BNB, Reconstructing the Trust Model of On-chain Services By introducing the Dynamic Validation Networks (DVNs) mechanism, Kernel allows BNB staking assets to provide security assurances for multiple services in parallel. Stakers can flexibly choose supported services, and operators can run various validation tasks, achieving a "many-to-many" validation network. For new projects on the BNB chain, there is no need to build a security network from scratch, as they can directly leverage Kernel to access the security capabilities of the entire chain.

3. Liquid Restaking Solution Based on EigenLayer, Releasing ETH Liquidity The rsETH launched by Kelp is one of the mainstream LRT assets in the EigenLayer ecosystem. Users can obtain rsETH by staking ETH, enjoying basic staking returns and participating in EigenLayer's restaking rewards. Meanwhile, rsETH can be used in mainstream DeFi protocols (such as lending, trading, etc.) to effectively enhance asset efficiency and broaden revenue paths.

4. One-click Participation in High-Quality Airdrop Strategies, Supporting Ecologies like Pendle and Spectra Gain is a non-custodial smart vault that allows users to participate in various DeFi strategies using liquid assets like agETH/hgETH, automatically capturing airdrops and returns. Its "auto-deployment + one-click exit" design saves a considerable amount of gas fees and enhances safe, flexible, and user-friendly asset management through a transparent on-chain structure.

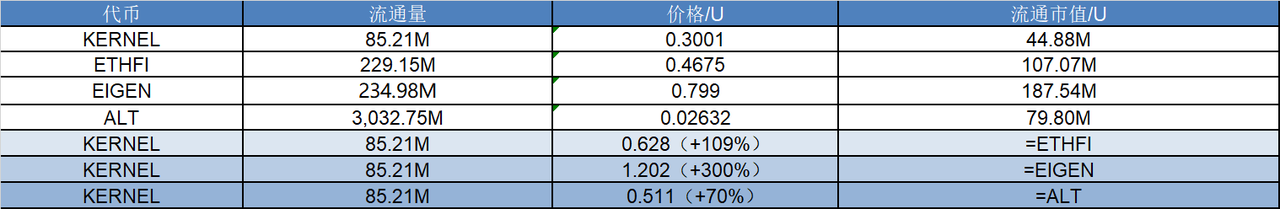

3. Market Cap Expectations

As a key infrastructure project in the restaking sector, KernelDAO covers primary chain assets like BNB, BTC, and ETH, and builds a complete restaking product matrix. Although the current market cap is still in its early stages, Kernel has significant potential for revaluation, referencing the valuation levels of similar infrastructure protocols such as EigenLayer and Ether.Fi.

4. Economic Model

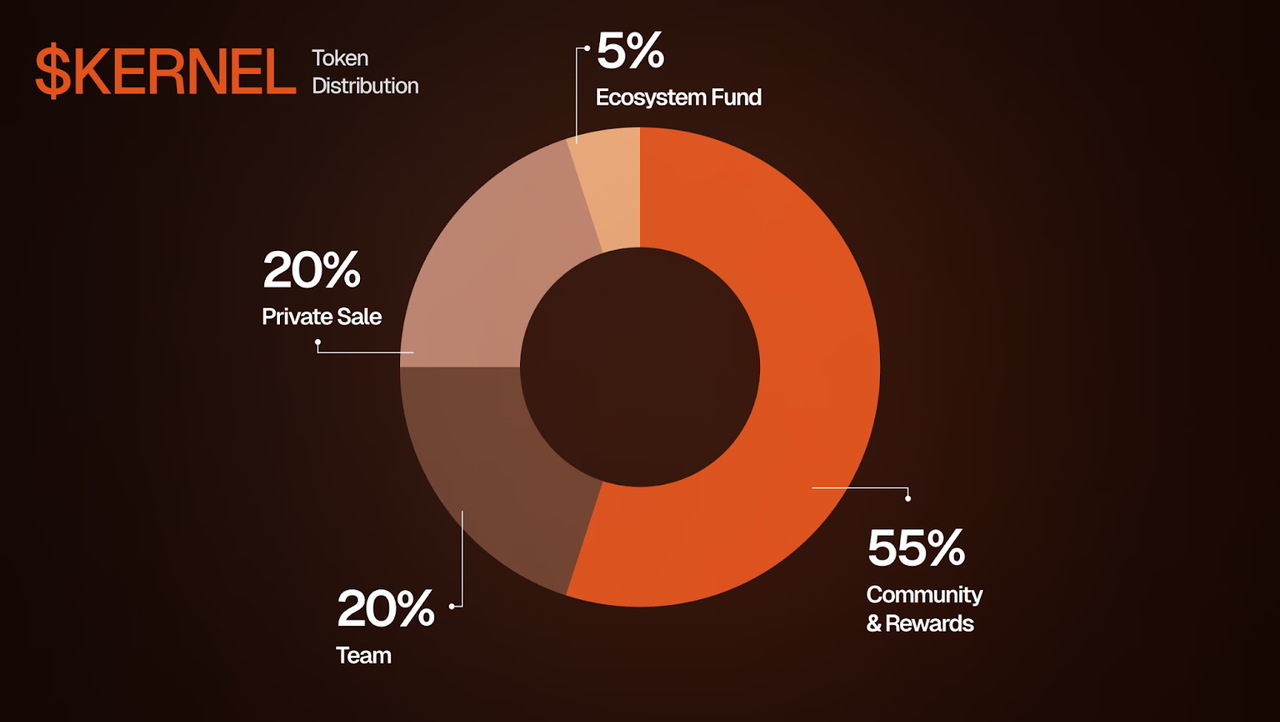

Total Supply of $KERNEL: 1,000,000,000 Tokens, Circulating

Token Distribution is as follows:

Community Rewards and Airdrops (55%)

Airdrops: 20% Follow-up Incentive Plan: 35% used to incentivize early users to participate in the ecosystem, increasing community activity and decentralization governance coverage.

Private Round (20%) used to support early investors and partners, locked for 6 months post-TGE, then linearly released over 24 months.

Core Team and Advisors (20%) incentivizing early builders and contributors, locked for 6 months post-TGE, then linearly released over 24 months.

Ecosystem and Partners (5%) includes market makers, on-chain liquidity support, and project incentives.

Token Utility:

Governance Rights and Proposal Participation enabling participation in parameter changes, product upgrades, and governance decisions within the KernelDAO ecosystem.

Restaking Security Support providing economic security assurances for the operation of middleware, LRT, Dapps, and other ecosystem services.

Liquidity Incentives earning rewards by providing liquidity through AMM and participating in official liquidity mining programs.

Ecosystem Participation and Airdrop Eligibility gaining middleware and DeFi protocol airdrop eligibility, unlocking additional restaking rewards.

Airdrop Schedule:

Season 1 (S1)

Allocation: 10%

Timing: Until December 31, 2024

Conditions: Kelp Miles / Kernel Points Users

Loyalty Reward: Re-stake by January 15, 2025, to receive a 15% boost in S2 rewards

Season 2 (S2)

Allocation: 5%

Timing: January 1 - April 30, 2025

Conditions: S1 loyal users receive a 15% reward boost

Season 3 and Beyond

Allocation: 5%

Timing: Determined by governance vote

5. Team & Financing

Team Information:

Amit (Founder & CEO): Led the design and implementation of several DeFi protocols, with rich experience in cross-chain technology.

Technical Team: Core members from top institutions like Binance Labs and Aave, specializing in smart contract development and security auditing.

Financing:

Private Round: 9 million USD, valuation at 90 million USD (May 2024)

Investors include over 30 institutions and angel investors like Frax Founder Sam Kazemian, such as Laser Digital (Nomura), SCB Ventures, GSR, HTX, DWF, ViaBTC Capital, and Bankless.

Seed Round: 1 million USD (November 2024)

Investor: YZi Labs

6. Potential Risk Warnings

1. The cross-chain restaking model and DVN dynamic validation architecture introduced by KernelDAO are still in early large-scale operation and may face validator coordination failures, unstable on-chain incentives, and other issues that could impact protocol security and user returns.

2. KernelDAO's phased release of airdrop plans might attract malicious arbitrage by "sybil" accounts, diluting real user interests and increasing the operational burden of the community in the later stages.

3. The private round and team tokens are set to be released linearly over 24 months, both unlocking 6 months post-TGE. Inadequate market liquidity or unmet expectations may exert pressure on token prices during phased unlocking.

7. Official Links

Website:

https://kerneldao.com/

Twitter:

https://x.com/kernel_dao

Telegram:

https://t.me/KelpDAOxyz

2

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Bitcoin’s Recent Surge Towards $90,000 Faces Possible Pullback Amid Tariff Uncertainty

Coinotag•2025/04/16 10:00

Solana’s Recent 20% Surge Suggests Potential to Test Key Resistance Levels Amid Rising DEX Activity

Coinotag•2025/04/16 10:00

Bitcoin trader sees gold 'blow-off top' as XAU nears new $3.3K record

Bitcoin is in no mood to copy gold's bull run yet, but on the horizon is a "terminal" end to the record XAU/USD winning streak, a trader predicts.

Cointelegraph•2025/04/16 09:44

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$84,203.75

-1.51%

Ethereum

ETH

$1,587.05

-2.73%

Tether USDt

USDT

$1.0000

+0.01%

XRP

XRP

$2.09

-3.01%

BNB

BNB

$583.03

-0.83%

Solana

SOL

$126.42

-4.08%

USDC

USDC

$1

+0.01%

TRON

TRX

$0.2544

+2.58%

Dogecoin

DOGE

$0.1540

-2.77%

Cardano

ADA

$0.6088

-4.36%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now