Solana Whale Initiates 32,000 SOL Purchase, Will It Trigger Price Breakout?

Solana whale accumulation is growing at a fast pace. The price fluctuation is fueling the ambition of long-term SOL whales. Other visible ecosystem updates is pushing the prospect of the price to a new high.

Price fluctuations largely characterize the digital asset market, especially for coins like Bitcoin, Ethereum, and Solana.

Investors generally monitor price actions and dump some assets during periods of uncertainty to prevent huge losses.

A Solana whale does not follow that rule, as revealed by a notable development that could trigger a price rally.

Solana Whale Shows Long-Term Conviction Despite Heavy Losses

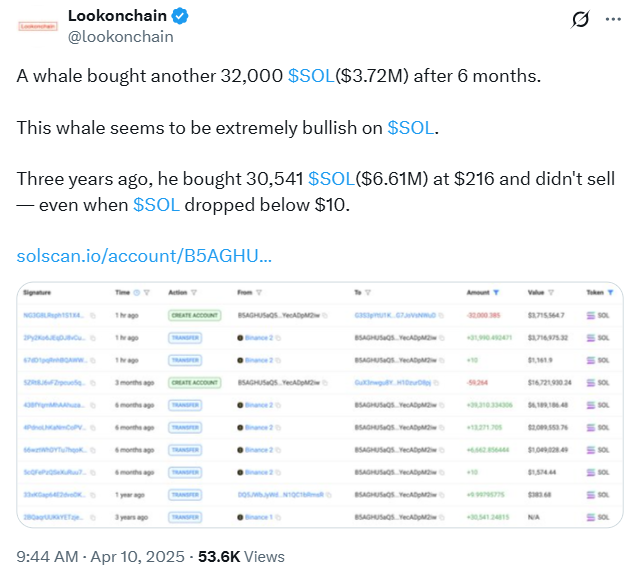

As per a new Lookonchain update, this Solana whale has purchased 32,000 SOL valued at $3.72 million.

The purchase is not the first with this whale whose accumulation traits have sparked discussion within the Solana ecosystem.

Notably, the SOL whale acquired 30,541 SOL for $6.61 million about three years ago. At the time, Solana’s price was changing hands in the crypto market at $216 per coin.

Image Source: Lookonchain on X

Image Source: Lookonchain on X

This large holder did not offload his assets even when Solana’s crashed to below $10 per SOL.

This development shows how bullish this Solana whale has become about SOL’s long-term outlook.

Despite witnessing a staggering unrealized loss following the brutal drop in price, the whale has held its position over the years.

Another intriguing development about this Solana investor, as tracked by Lookonchain, is that over the three-year period, the whale made other purchases.

The largest accumulation occurred six months ago when he bought 10,000 SOL at $1.16 million.

A user, NEO AI, noted that while others looked to exit, this whale held the line.

“The question is no longer why they’re buying… it’s what they know that you don’t,” he wrote.

The whale’s behavior suggests that he believes Solana’s price will recover and surge past the $216 at which he made the most purchase.

This explains its continued accumulation moves despite the volatility over the years.

Solana Price and Technical Indicators

Meanwhile, Solana’s technical indicators suggest that the asset might soon experience a bullish breakout.

Notably, Ted, an investor and analyst, noted that Solana is “approaching its trendline resistance again.”

According to Ted, if SOL’s price breaks through this level, it could spark a bullish rally.

Although SOL has dropped massively from its all-time high (ATH) by a staggering 60%, the analyst believes that the worst might have passed for Solana.

Image Source: Ted Pillows on X

Image Source: Ted Pillows on X

Ted highlighted many upcoming events that could serve as catalysts to drive Solana’s price to higher levels.

The Solana “Firedancer upgrade” is one major performance update that the ecosystem looks forward to.

The upgrade improves Solana’s speed and throughput and should make the network more scalable.

Additionally, Ted believes that the various applications filed for the Solana exchange-traded fund (ETF) hold promise.

He suggests that once the Securities and Exchange Commission (SEC) gives the regulatory green light, it may open the door to institutional investment, which could also fuel a Solana price breakout.

Furthermore, including Solana in the U.S. Digital Asset Stockpile is another bullish catalyst for SOL.

SOL: Between Resistance and Long-Term Targets

As of this writing, SOL price has rebounded strongly from the $100 support level and was trading at $117.49, a 2.63% increase in the last 24 hours.

SOL’s trading volume saw a significant drawdown of 37% to $4.07 billion. Investors expect SOL to break above $120 to reignite hope among market participants.

However, failure to breach this resistance could result in short-term consolidation and a decline to between $107 and $112.

Some ecosystem optimists have boldly predicted a surge to levels as high as $1,000 before the end of 2025.

Their prediction relies on the approval of SOL ETF, the Firedancer upgrade, and the 140% increase in stablecoin supply on Solana.

The rise in decentralized exchange trading volume signals the growing usage of Solana’s DeFi ecosystem.

These factors might support the optimistic outlook that the Solana price has bottomed out , setting the stage for a possible rally.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Michael Saylor Labels Bitcoin as Chaos-Driven Asset

BlackRock’s Larry Fink Warns of U.S. Recession Impacts

Trump, Bukele to Discuss Bitcoin, Trade, and Security

Tether Mints Additional $1B USDT on Tron Network, Boosting Cumulative Total to $9B in 2025: A Look at Market Implications