Bitget Daily Digest (March 31) | Trump's reciprocal tariff countdown looms, April 2 May Become a Global Asset Watershed

远山洞见2025/03/31 10:29

By:远山洞见

Today's preview

1. The U.S. Chicago Purchasing Managers' Index (PMI) for March will be released today, with the previous value at 45.5.

2. Four.Meme will update its liquidity pool by transitioning to PancakeSwap V2 and burning the new token LP.

3. ZKsync concludes Season 1 of its 'Ignite' incentive program today.

4. Terraform Labs opens its claims portal for crypto asset losses on March 31, with a filing deadline of April 30.

Key market highlights

1.

Trump's reciprocal tariffs will soon take effect, and April 2 may become a turning point for global asset prices. Markets are closely watching the tariff details to be announced this Wednesday, covering sensitive industries such as automobiles, pharmaceuticals, and semiconductors. Although Trump has expressed willingness to negotiate tariff agreements with certain countries, he emphasized that negotiation could only happen after the announcement, increasing the uncertainty of policy impact. With no tax rates or exemption list available yet, risk-averse sentiment grows. Analysts generally regard the first week of April as a sensitive window for global trade landscape and asset pricing.

2. Michael Saylor, founder of Strategy (formerly MicroStrategy), posted the Bitcoin portfolio tracker on X again, saying: "Needs even more Orange." As previously observed,

Strategy often discloses new BTC purchases the day after such posts.

3. Nate Geraci, president of The ETF Store, posted on X that with Nasdaq submitting a 19b-4 application to the U.S. Securities and Exchange Commission for listing and trading Grayscale Avalanche ETF, there are now ETF filings including 11 altcoins:

XRP, SOL, DOGE, ADA, AVAX, SUI, HBAR, DOT, LTC, APT, and AXL. It is reported that VanEck has also filed for an Avalanche ETF. Currently, AVAX is approximately the 15th largest digital asset by market cap.

4. Ethereum's market cap has fallen to $218.7 billion, down nearly 10% over 7 days, now ranking 68th among global assets, overtaken by McDonald's. Meanwhile, a video of Vitalik Buterin playfully 'meowing' at a robot dog has ignited debate on social media. Several industry insiders, including Cork Protocol's co-founder, have questioned his focus on Ethereum's development. Vitalik has yet to respond.

Market overview

1. $BTC fell in the short term, briefly touching $81,500, with the broader market declining. $FIRE, $REZ, and $X are the top gainers. New coins show a wide divergence in performance, with the popular $GHIBLI continuing its downtrend.

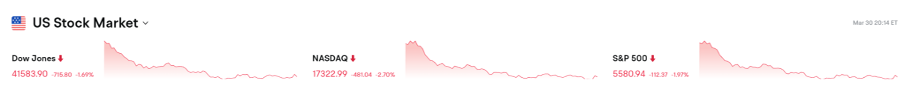

2. US stocks dropped sharply last Friday, with Nasdaq falling 2.7%. CoreWeave's debut has been a rollercoaster, and Wolfspeed plunged 50%. Chinese concept stocks declined. Crude oil futures dropped, and gold hit a new high.

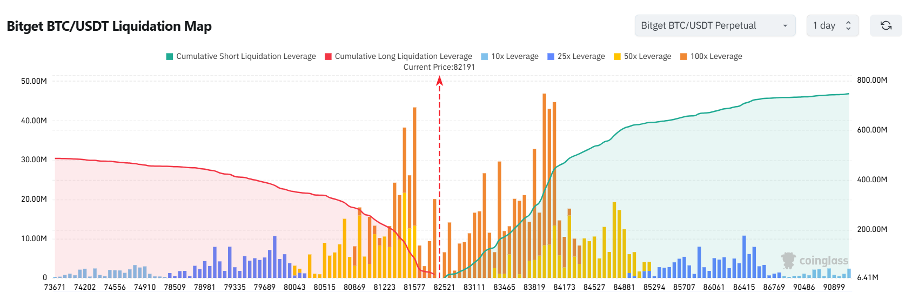

3. Currently standing at 82,191 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 81,191 USDT could trigger

over $218 million in cumulative long-position liquidations. Conversely, a rise to 83,191 USDT could lead to

more than $124 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

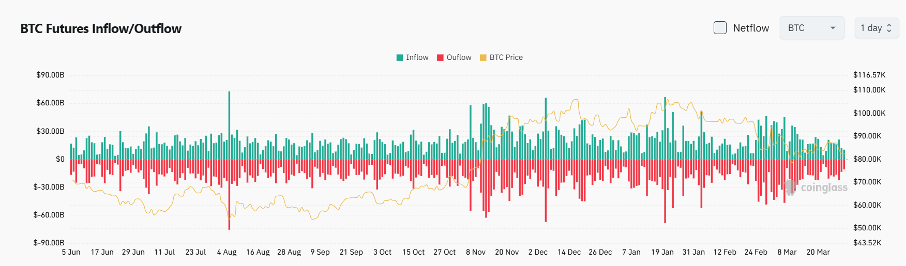

4. Over the past 24 hours, the BTC spot market recorded $10.3 billion in inflows and $10.6 billion in outflows, resulting in a

net outflow of $300 million.

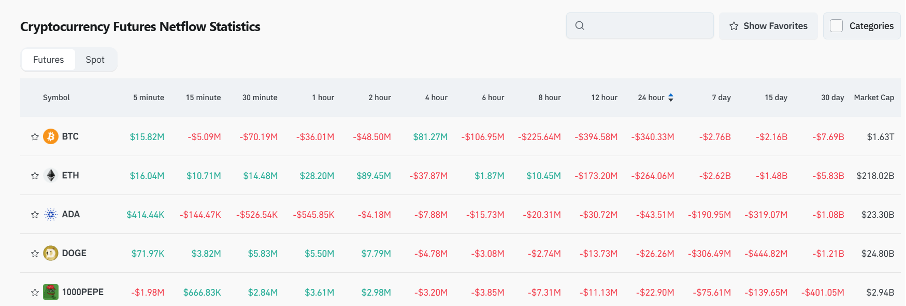

5. Over the last 24 hours, $BTC, $ETH, $ADA, $DOGE, and $PEPE lead in futures trading

net outflows, signaling potential trading opportunities.

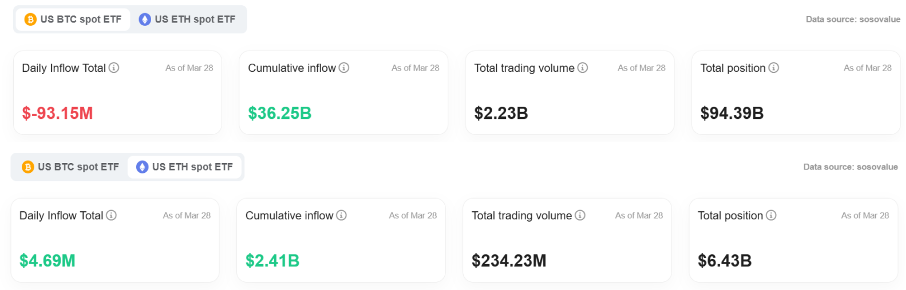

6. According to the latest data from SoSoValue, U.S. spot Bitcoin ETFs recorded a single-day outflow of $93.1572 million, while the cumulative inflows amount to $36.247 billion, with total holdings at $94.388 billion. U.S. spot Ethereum ETFs saw a single-day outflow of $4.6817 million, with cumulative inflows of $2.409 billion and total holdings of $6.425 billion.

Institutional insights

Goldman Sachs: Hedge funds sold the second-largest amount of global technology stocks in 5 years this week

CryptoQuant: 8000 Bitcoins which have been dormant for five to seven years have been moved recently

21Shares: Long-term positive catalysts forming for Bitcoin

Article:

https://www.benzinga.com

News updates

1. Trump says he's not joking about serving third term as president, suggesting a method of running as vice president in a Vance campaign and having power handed to him.

2. Trump's team is considering expanding tariffs, possibly raising them across the board to 20%.

3. Japan's Financial Services Agency (FSA) plans to classify cryptocurrencies as financial products and impose insider trading regulations.

4. California legislature advances the "Bitcoin Rights Bill".

5. HKMA: A regulatory framework for stablecoin issuance is in development and may be finalized in the coming months.

Project updates

1. PumpSwap exceeded 700,000 total users in 10 days since launch, with nearly $2.5 billion in total volume

2. Michael Saylor hints at increasing Bitcoin holdings again, sharing another investment tracking chart.

3. PancakeSwap generated $24.08 million in revenue over the past 7 days, ranking third in crypto ecosystem income.

4. Jupiter co-founder: Jupiter Mobile V2 is about to launch.

5. LayerZero CEO: The second round of airdrops will be entirely different from the first, focusing on actual use.

6. ZOTH posted an update on the hacking incident: No significant fund movement so far. Tracking and investigation are still ongoing.

7. Sonic Labs canceled its USD-pegged algorithmic stablecoin plan, aiming to develop an alternative denominated in UAE dirham.

8. Trading volume of the top 10 stablecoins has dropped to one-fourth of last December's bull market level

9. Hyperliquid added a fully on-chain validator voting feature to vote on asset delisting.

10. Terraform Labs to open crypto creditor claims portal on March 31.

Highlights on X

1. Aylo: ETH faces short-term pressure but retains long-term potential

More crypto-native users believe ETH is overvalued at present. As the second-largest crypto asset, its $500 billion valuation is hard to justify with only $1.1 billion in revenue over the past year. Even if the market cap is revised down to $220 billion, it may still not appeal to traditional finance. Overestimating Ethereum's short-term adoption speed is pushing ETH into a bear cycle, though this doesn’t discount its long-term potential—it just means the value needs time and real adoption to be realized.

2. @thecryptoskanda: The "casino logic" of memecoins—different approaches on BSC vs Solana

The on-chain market-making logic of memecoins is essentially a casino ecosystem. Pump on Solana is more like an "entertainment city" — offering real estate and rules. Genuine gambling takes place in various new tokens with surging market cap. Developers act as the dealers, while trading platforms serve as the gambling halls. As long as on-chain market makers have exit strategies, new gaming tables will keep popping up. On BSC, the inability to exit on-chain makes it more expensive and less attractive for dealers. The ecosystem relies heavily on Binance's intervention, through Alpha listings, KOL hype, vote-to-list, and liquidity subsidies—essentially creating certainty to lure dealers in. Essentially, Solana relies on mechanisms while BSC relies on people—two completely different "casino" models.

3. Crypto_Painter: BTC breaks key support, rebound rally may be over

BTC has broken below the middle band and the lower edge of the ascending channel, suggesting the rebound might be finished. Spot premium index is falling, combined with ETF net outflows, indicating this dip is institution-led. Weekend price action exhibited shrinking volume and consolidation, potentially signaling the end of institutions reducing their positions. In the short term, watch the $78,000–$79,000 supporting zone, and beware of potential false breakdowns on Monday.

4. @thankUcrypto: Beware of "path dependency" in trading

The biggest enemy in trading isn't the market—it's your own path dependency and stubborn disbelief. ETH drops, you call the bottom and go all in, but it sinks further. TUT bounces, you short in disbelief—then get wrecked as it spikes. In hype-driven, emotional markets, logic loses; trend-riders win. If sell orders keep getting absorbed, big players might be pushing you out.

5

2

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Compound (COMP) Soars Following Upbit Listing Announcement – Are More Gains Ahead?

CoinsProbe•2025/04/02 00:01

ICP and INJ Gain Momentum After Key Breakout Retest – Is a Recovery Ahead?

CoinsProbe•2025/04/02 00:01

ACT Token Tanks 50% After Binance’s Leverage Update, Whale Liquidation, and Market Maker Sell-Off

CoinsProbe•2025/04/02 00:01

WLD and CRV Near Key Resistance – Are Major Breakouts on the Horizon?

CoinsProbe•2025/04/02 00:01

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$85,109.87

+2.92%

Ethereum

ETH

$1,891.91

+3.58%

Tether USDt

USDT

$1

+0.02%

XRP

XRP

$2.11

+1.38%

BNB

BNB

$606.91

+0.22%

Solana

SOL

$125.6

+0.84%

USDC

USDC

$1

+0.01%

Dogecoin

DOGE

$0.1721

+3.32%

Cardano

ADA

$0.6724

+1.74%

TRON

TRX

$0.2385

+0.82%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now