Bitget Daily Digest (March 11)|Strategy raises $21 billion, possible BTC buy, Tesla stock plunges

远山洞见2025/03/11 01:37

By:远山洞见

Today's preview

1. The U.S. NFIB Small Business Optimism Index for February will be released today. The previous reading was 102.8.

2. U.S. President Donald Trump is set to sign an executive order today.

3. U.S. Representative Nick Begich previously stated that he is collaborating with Senator Cynthia Lummis on a "major" Bitcoin-related initiative, with details to be announced today.

Key market highlights

1. Strategy (formerly MicroStrategy) has filed a prospectus to raise $21 billion through the issuance of 8.00% Series A Perpetual Senior Preferred Stock.

The funds may be used for general corporate purposes and potentially for Bitcoin acquisitions. Currently, the company holds 499,096 BTC at an average price of $66,357 per coin and did not make any new purchases last week. The massive fundraising initiative has sparked market interest, suggesting Strategy may continue accumulating Bitcoin.

2. MyShell has issued an official response to the CEX announcement on abnormal $SHELL market-making transactions, terminating its partnership with the involved market maker and onboarding new partners to secure stable liquidity. MyShell also stated that t

he market maker's stablecoin holdings will be entirely allocated for $SHELL buybacks within 90 days, with wallet addresses publicly available for community verification.

3.

The Movement blockchain has officially launched its public mainnet Beta, accompanied by an airdrop of its first memecoin, Gmove. Meanwhile, market volatility has intensified. A high-leverage trader on Hyperliquid executed three pinpoint trades on BTC and ETH using 50x leverage. Additionally, a well-known trader, Liangxi, started elite trades on Bitget, boasting a 97.56% win rate across 40 trades on the first day, drawing widespread discussion.

4.

Tesla's stock has plummeted 15%, reaching its lowest level since October last year, with its market cap slashed by nearly $800 billion from its peak. Market concerns are growing as Elon Musk's political role as the "Minister of DOGE" could potentially divert his focus from Tesla, SpaceX, and X. Meanwhile, X has been hit by a large-scale cyberattack, with the hacking group "Dark Storm Team" claiming responsibility on Telegram, further fueling investor uncertainty.

Market overview

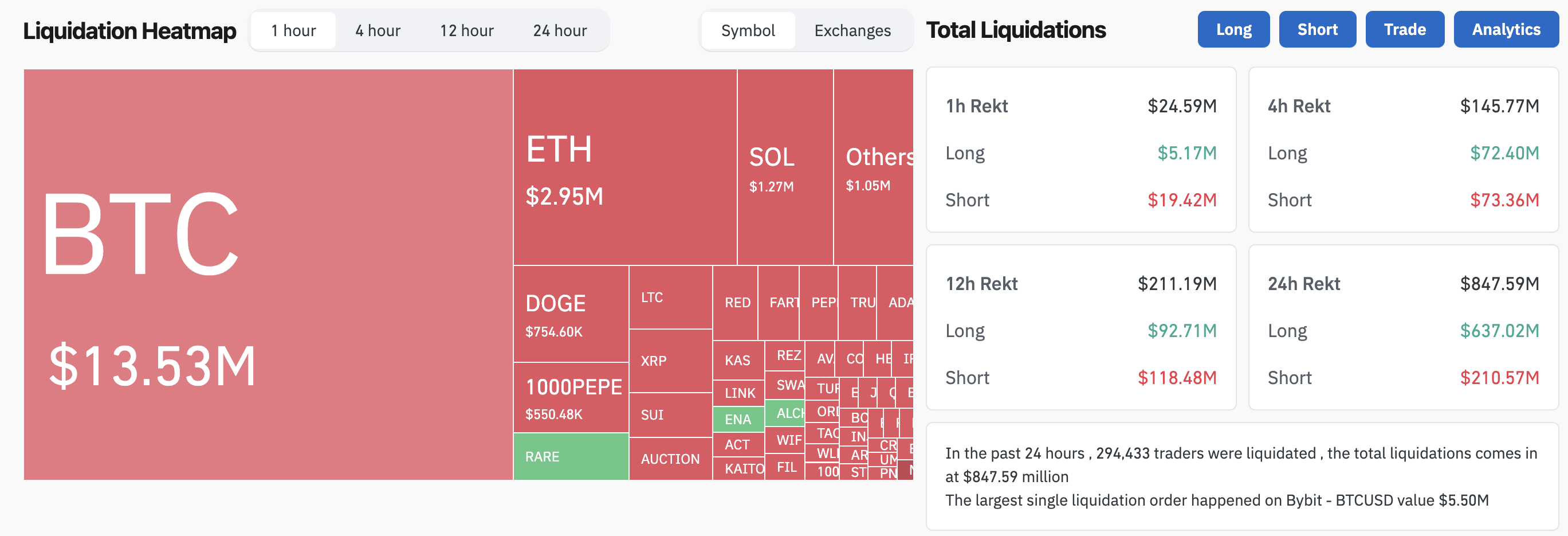

1. $BTC saw a sharp decline, briefly touching $77,000, triggering a market-wide pullback. However, the top 50 altcoins rebounded, with small-cap token $SLT surging over 100%, while newly listed $ELX remained resilient.

2. U.S. markets experienced a "Black Monday" as the Nasdaq dropped 4%, marking its largest single-day decline in two years. Meanwhile, the U.S. 2-year Treasury APR fell by over 10 basis points.

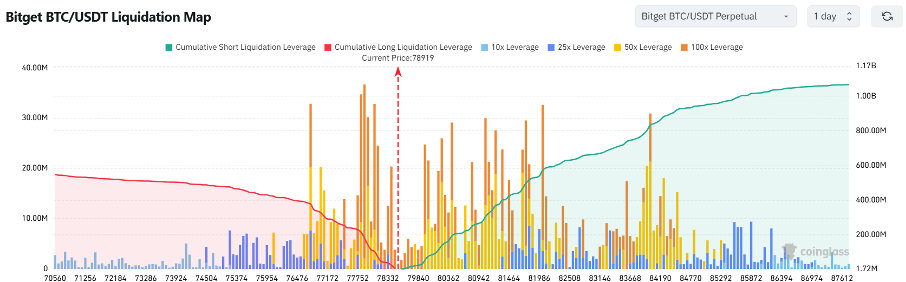

3. Currently standing at 78,919 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 77,919 USDT could trigger

over $100 million in cumulative long-position liquidations. Conversely, a rise to 79,919 USDT could lead to

more than $164 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

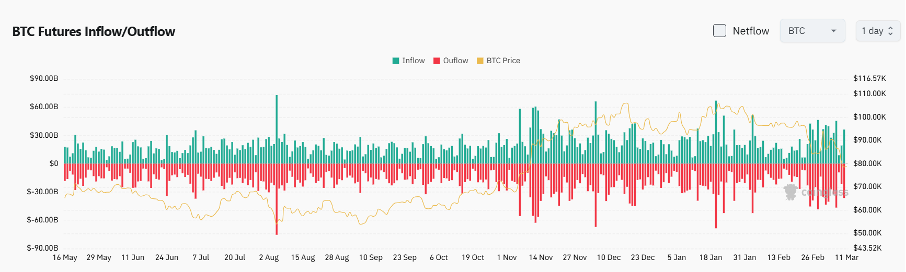

4. Over the past 24 hours, the BTC spot market recorded $36.1 billion in inflows and $36.4 billion in outflows, resulting in a

net outflow of $300 million.

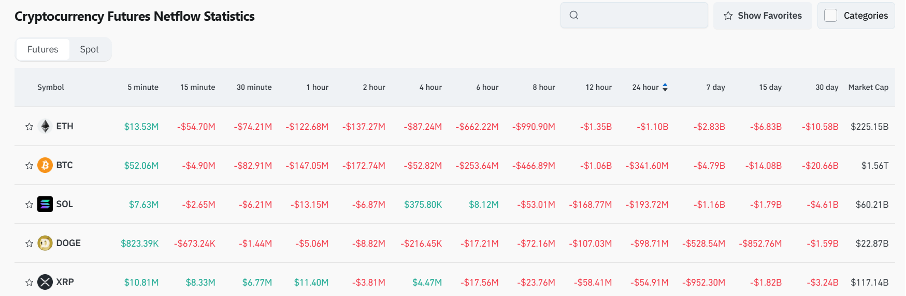

5. In the last 24 hours, $ETH, $BTC, $SOL, $DOGE, and $XRP led in

net outflows in futures trading, signaling potential trading opportunities.

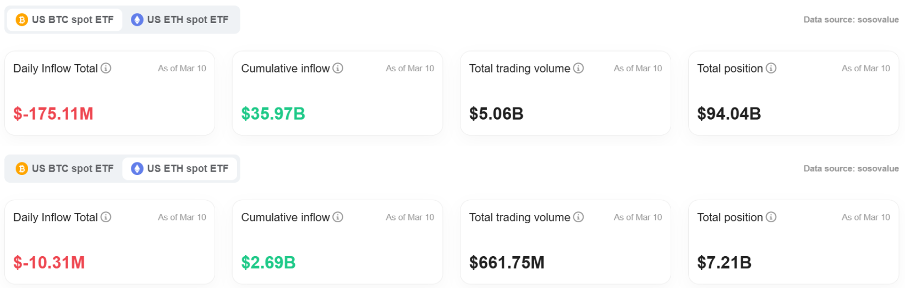

6. According to the latest data from SoSoValue, U.S. spot Bitcoin ETFs recorded a single-day outflow of $175 million, while the cumulative inflows amount to $35.97 billion, with total holdings at $94.035 billion. U.S. spot Ethereum ETFs saw a single-day outflow of $10.3161 million, with cumulative inflows of $2.689 billion and total holdings of $7.21 billion. Both saw substantial outflows compared to the previous day.

Institutional insights

Greeks.live: Market volatility remains high due to low liquidity, with traders eyeing downside targets between $74,000 and $76,000.

Read the full article here:

https://x.com/BTC__options/status/1899074338898510255

Matrixport: Funding rates remain low as the market waits for a stronger catalyst.

Read the full article here:

https://x.com/Matrixport_CN/status/1899061653666427288

News updates

1. An updated U.S. stablecoin regulatory framework is set to be released soon.

2. Trump may sign a crypto-related executive order this week, potentially lifting banking restrictions on crypto firms.

3. The Cayman Islands have updated their cryptocurrency regulatory framework. Crypto custody and trading companies must now obtain operating licenses.

4. Thailand's regulators have classified USDT and USDC as compliant cryptocurrencies.

Project updates

1. Movement public mainnet Beta is now live.

2. MyShell releases an official statement addressing the CEX announcement and outlining its $SHELL buyback plan.

3. Rex Shares and Osprey Funds have filed an N-1A form with the SEC for MOVE ETF.

4. Solana's SIMD-0228 proposal has 12.4% support and 3.4% opposition.

5. The Cocoro team has removed and burned 20% of its total token supply from LP.

6. Balancer V3 plans to expand to Avalanche following a governance vote.

7. Voting has begun for Solana's SIMD-0228, which aims to reduce SOL token inflation by 80%.

8. Pump.fun has seen no newly graduated tokens surpass $1 million in market cap in the past 24 hours.

9. Andre Cronje updates his social media bio, hinting at a new derivatives platform, flyingtulip.

10. BNB Chain launches a second round of its $4.4 million permanent liquidity support program, covering tokens across all sectors.

Highlights on X

1. @Haotian: The real cause of the bear market and the way forward

The root cause of this bear market isn't just an oversupply of assets or excessive reliance on external capital. The real issue is that the crypto market has lost its ability to discover, price, and evaluate intrinsic value while also lacking an effective mechanism for natural selection. This has led to a lack of consensus on truly valuable assets, while hype-driven, low-quality assets thrive on speculative sentiment, creating an illusion of prosperity but long-term uncertainty. The key to breaking this cycle is reviving innovation from within—prioritizing technological narratives over pure memecoin launches, focusing on differentiated product-market fit (PMF) products rather than repetitive infrastructure development, and combining DEX value creation with CEX price discovery, rather than relying solely on speculation and liquidity retracement. Looking back, major market trends — the ICO boom, DeFi/NFT explosion, Layer 2 scaling, and AI agent-driven on-chain advancements — have all created lasting value. Crypto has survived multiple cycles because of continuous internal innovation, not just fresh capital injections.

2. @Phyrex: The battle between bulls and bears — When to buy the Bitcoin dip? Where will the market

land

?

The market is currently at the intersection of emerging industry growth and speculation, resembling a short-term bearish outlook but an inevitable bull run within the next two to three years. Bitcoin is finding support around $70,000, and unless a large-scale selloff or economic recession occurs, it is unlikely to break below this level. However, if a recession does hit, panic selling could lead to a deeper correction. From a macro perspective, the Fed is still in a high-interest rate and liquidity-tight environment and has yet to shift toward true monetary easing. The market remains in a tug-of-war over liquidity expectations. For dip buyers, the key is monitoring shifts in monetary policy, economic data, and market sentiment. The $70,000–$75,000 range could be a relatively safe entry point for gradual accumulation, while maintaining proper capital management and risk control to handle potential volatility.

3. @TVBee: Has the bull market really started? Reviewing cycles and finding the inflection point

The current market environment resembles the market on March 12, 2020 ("312" event) or the period just after that crash—we are in a window between a pause in rate cuts and potential future easing. BTC's recent rally is similar to the "minor bull market" of 2019, where Bitcoin surged without triggering an altcoin season. This time, ETFs have amplified the effect, making the situation look exaggerated. Regarding the four-year cycle debate, some argue that without futures ETFs, the 2021 bull market top would have achieved in April rather than November. This suggests that market expectations can accelerate bull cycles. Consequently, this cycle's bottom-to-peak timeframe could be shorter than 14 months, making a bull market launch highly likely by late 2025 or early 2026. The crypto cycle isn't a rigid four-year pattern—it varies based on market structure and macroeconomic conditions, sometimes arriving earlier, sometimes delayed. The key is identifying when the real bull run begins.

4. @Michael_Liu93: The ultimate mindset shift for trading altcoins

The secret to trading altcoins is not technical analysis — it is understanding the mindset of the "major players". Project teams and market makers are not long-term holders; their goal is to maximize profits. They take advantage of high-liquidity exchange windows to offload tokens, create buy pressure during pumps, and crash the price ruthlessly when exiting. Once supply is tightly controlled, they consider a second wave of movement. When the market is weak, they don't protect prices — instead, they dump aggressively and buy back at lower levels. Market volatility, on the other hand, is not random but a calculated pump-and-dump. If you shift your perspective from being a trader to understanding the market from the perspective of major players, you will better grasp the game's rules and avoid becoming just another "yield crop" for the big players.

7

2

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Bitcoin’s Correction Might Be Ending Amid Weak Dollar and Stable Derivatives Markets

Coinotag•2025/03/12 07:55

Trump’s New Tariffs on Canada: Potential Impacts on Bitcoin and Market Uncertainty

Coinotag•2025/03/12 07:55

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$82,373.25

+1.04%

Ethereum

ETH

$1,888.15

-1.57%

Tether USDt

USDT

$0.9998

-0.02%

XRP

XRP

$2.2

+2.61%

BNB

BNB

$555.41

-1.30%

Solana

SOL

$124.37

+0.15%

USDC

USDC

$0.9999

-0.03%

Cardano

ADA

$0.7304

-0.56%

Dogecoin

DOGE

$0.1657

+3.02%

TRON

TRX

$0.2215

-4.06%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now