Bitget Daily Digest (March 6) | Mt. Gox transfers 12,000 BTC, Trump-linked crypto project adds $WBTC, $ETH and $MOVE

远山洞见2025/03/06 09:45

By:远山洞见

Market highlights

1.U.S. Commerce Secretary Howard Lutnick has

confirmed that the Trump administration will unveil plans for a strategic Bitcoin reserve at the upcoming White House Crypto Summit. WLFI, a crypto project backed by the Trump family, is ramping up its investments, adding $10 million in $ETH, $10 million in $WBTC, and $1.5 million in $MOVE.

The combined signal of favorable policy and real capital inflows has triggered a short-term surge in $MOVE.

2.The White House Crypto Summit is set to take place from 1:30 PM to 5:30 PM (local time) on March 7, featuring key executives from Chainlink, Exodus, MicroStrategy, and other major crypto firms. Market participants expect favorable policy signals, which could lead to short-term speculative interest in related tokens

such as $SOL, $ADA, $ONDO, $AVAX, and $NEAR.

3.

The defunct Mt. Gox exchange has transferred 12,000 BTC, worth approximately $1.09 billion. Argentine prosecutors are seeking to freeze $100 million in $LIBRA tokens and have requested the recovery of a deleted X post by President Javier Milei, which promoted the token. Milei previously faced legal action for endorsing CoinX.

Market overview

1.BTC briefly crossed the $$90,000 mark, triggering a broad market rebound with all top 50 tokens seeing gains. Small-cap tokens like $ZOO and $CEC posted strong performances, while AI-driven tokens such as $ALCH and $FARTCOIN ranked among the top gainers. Storage and Cosmos ecosystem tokens led sector-wise rallies.

2.U.S. stocks rose by over 1%, with automobile and Chinese concept stocks leading the gains. Alibaba surged nearly 9%. German stocks jumped more than 3%, with bond yields soaring. The Euro rallied sharply, while the U.S. dollar fell over 1%.

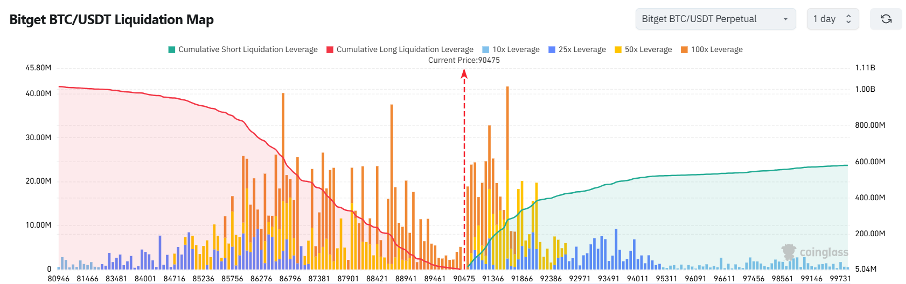

3.Currently standing at 90,475 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 89,475 USDT could trigger

over $30 million in cumulative long-position liquidations. Conversely, a rise to 91,475 USDT could lead to

more than $220 million in cumulative short-position liquidations. With short liquidation volumes far surpassing long positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

4.In the past 24 hours, BTC saw $3.8 billion in spot inflows and $3.65 billion in outflows, resulting in

a net inflow of $150 million.

5.In the last 24 hours, $BTC, $SOL, $ADA, $XRP, and $TRUMP led in

net outflows in futures trading, signaling potential trading opportunities.

6.According to the latest data from SoSoValue, U.S. spot Bitcoin ETFs recorded a single-day outflow of $6.8675 million, while the cumulative inflows amount to $36.72 billion, with total holdings at $100.418 billion. U.S. spot Ethereum ETFs saw a single-day outflow of $63.3202 million, with cumulative inflows of $2.758 billion and total holdings of $7.951 billion. Compared to the previous day, BTC outflows decreased, while ETH outflows significantly increased.

Highlights on X

DannyAtlas: How Solana's SIMD 228 proposal could reshape the ecosystem and market trends

The SIMD-228 proposal aims to dynamically adjust SOL's token issuance rate to maintain a 50% staking rate while gradually reducing SOL's inflation over the long term. Currently, Solana's inflation rate stands at 4.8%, with a target reduction of 1.5%–2%. If implemented, the proposal would initially result in lower staking rewards but lead to greater long-term stability by curbing inflation. However, this shift may trigger short-term sell pressure on SOL, as staking becomes less attractive, potentially increasing on-chain liquidity. Voting on the proposal begins on March 6, 2025, with venture capital firms and the Solana Foundation taking opposing positions. VCs generally support reducing inflation as it benefits large SOL holders, while the Foundation is concerned that such changes could hinder decentralization and institutional adoption. The vote's outcome could have far-reaching implications for SOL's price dynamics and the broader ecosystem.

@CycleStudies: Learning from History — Will Bitcoin mirror SUI's price pattern?

Bitcoin's recent price movements have been compared to SUI's price pattern in February, with both assets experiencing an initial sharp drop, a bounce back to their 21-day exponential moving average (EMA), and a subsequent retest of the 200-day EMA as support. After reaching this level, SUI spent 21 days consolidating, forming a lower-high, lower-low pattern before its next significant move. If Bitcoin follows the same trajectory, it may continue fluctuating around these key EMAs rather than showing an immediate breakout or breakdown. Key signals to watch include large bullish or bearish candlesticks, often indicative of profit-taking. A break above the 20-day EMA or a drop below the 200-day EMA would disrupt this consolidation phase and suggest a shift in the market, warranting caution.

Phyrex: Market battle between bulls and bears intensifies, with attention on White House crypto summit.

Bitcoin's price action is currently influenced by two competing forces: Trump's crypto policies and the Federal Reserve's macroeconomic stance. While the upcoming March 8 White House crypto summit could reveal further details about a U.S. Bitcoin strategic reserve, its broader market impact could be limited. Instead, the real drivers of liquidity are likely be adjustments to U.S. tariffs, potential rare earth mining agreements following the Russia-Ukraine war, and the Federal Reserve's March 20 dot plot update. If no clear data signals emerge, the market may remain highly volatile and directionless, as bulls and bears struggle for control. Given these uncertainties, traders should be wary of short-term political hype and instead focus on Ukraine's rare earth agreement, North American tariff policies, and the Fed's interest rate trajectory. Until clearer signals emerge, adopting a wait-and-see approach may be the best strategy to avoid unnecessary risk.

@DtDt666: What to expect from the White House crypto summit—BTC reserve strategy and key tokens to watch

At the upcoming White House crypto summit, Trump is expected to reveal details about a Bitcoin strategic reserve—though this initiative is more about halting BTC sell-offs than government purchases.

Certain tokens could benefit from this narrative, including $TRUMP, which is linked to Trump's political brand, and $BTC, which remains central to the strategic reserve discussion. Other potential beneficiaries include:

$SOL, which benefits from a compliance-friendly narrative.

XRP and ADA, both tied to lobbying efforts on crypto regulation.

$ONDO, a leading token in the RWA sector.

AVAX and NEAR, both U.S.-based Layer 1 blockchains.

While the actual financial impact of this policy move may be limited, market speculation on U.S. government backing could still drive short-term volatility in these assets.

Institutional insights

VanEck: The combined effect of SIMD 096 and SIMD 0228 is expected to reduce SOL's selling pressure by $677 million to $1.1 billion annually.

1Confirmation to continue to double down on ETH investments

Franklin Templeton: Solana DeFi tokens are undervalued and exhibit 'valuation asymmetry' compared to their Ethereum counterparts.

News updates

1.South Korea moves closer to Bitcoin ETF decision, looks to Japan as example.

2.SEC's cryptocurrency task force meets with representatives from Circle and WisdomTree to discuss crypto regulation matters.

3.Argentine prosecutor moves to freeze $100M in crypto raised by LIBRA sale.

4.The Russian Ministry of Finance considers allowing "super qualified investors" to trade cryptocurrencies.

Project updates

1.Solayer launches native SOL staking.

2.Trump's crypto project WLFI adds $10 million in ETH, $10 million in WBTC, and $1.5 million in MOVE.

3.Canary submits S-1 application documents for its AXL ETF.

4.Pump.fun: Only three graduated tokens have exceeded $1 million in market cap in the past 24 hours.

5.98.2% of new shares of Trump's cryptocurrency project WLFI have been sold.

6.Aave founder plans to create a low-risk savings product called sGHO.

7.Berachain co-founder regrets selling too many BERA tokens to venture capital firms and is currently working to buy back its supply.

8.Ethereum's Sepolia testnet faces issues with Pectra upgrade, prompting developers to initiate investigation.

9.The Uniswap community expands its Delegate Reward Initiative to incentivize active governance with UNI tokens.

10.Kaspa releases its testnet upgrade, boosting block generation speed to 10 blocks per second

2

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

ONDO Hits New All-Time High In TVL – Is a Breakout Around the Corner?

CoinsProbe•2025/03/06 10:55

Movement (MOVE) Gains Momentum as Trump’s World Liberty Accumulates – Is a Breakout on the Horizon?

CoinsProbe•2025/03/06 10:55

IMX and SAND Retest Key Breakouts – Is a Bounce Back Ahead?

CoinsProbe•2025/03/06 10:55

Bitcoin Jumps Above $92K as Trump Delays Tariffs on Canada and Mexico

Analysts see the tariff delay as a sign of economic stability, boosting investor confidence in risk assets like cryptocurrencies.

CryptoNews•2025/03/06 08:55

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$90,323.21

+0.58%

Ethereum

ETH

$2,261.89

+2.32%

XRP

XRP

$2.61

+5.44%

Tether USDt

USDT

$0.9999

-0.03%

BNB

BNB

$600.47

+0.70%

Solana

SOL

$148.44

+2.83%

USDC

USDC

$1

+0.02%

Cardano

ADA

$0.9387

-4.17%

Dogecoin

DOGE

$0.2072

+2.60%

TRON

TRX

$0.2416

-0.58%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now