Bitcoin all-time high due in '2-3 weeks' as traders see BTC copying gold

Bitcoin may be flagging on short timeframes, but there is plenty of belief in BTC price discovery returning as gold surges.

Bitcoin ( BTC ) abandoned its latest gains into the Feb. 11 Wall Street open as gold consolidated after a fresh all-time high.

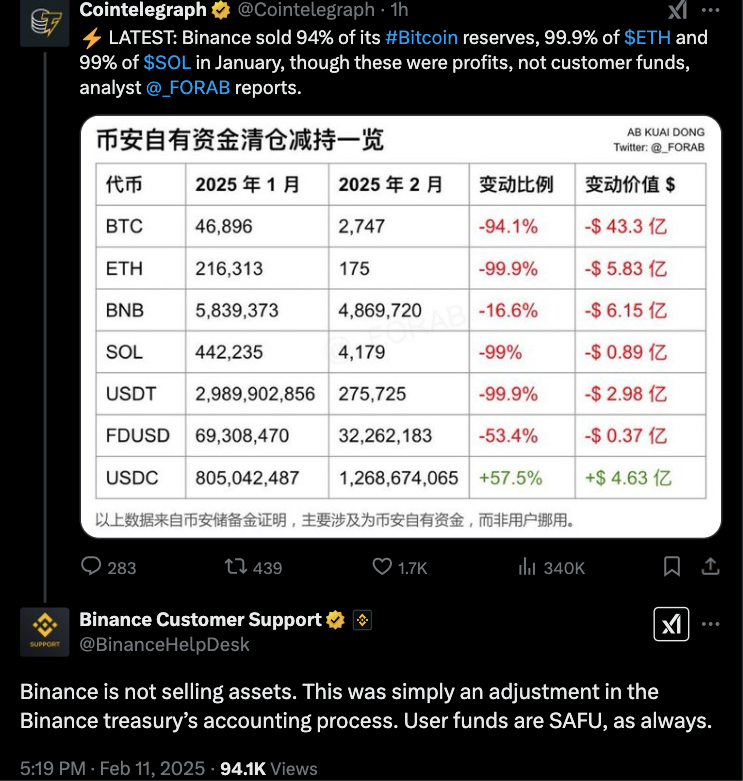

Binance confusion spoils BTC price upside

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dropping $1,500 in a single hourly candle.

Reports that major global crypto exchange Binance had sold almost all of its Bitcoin, Ether ( ETH ), Solana ( SOL ) and others, appeared to exacerbate downside volatility.

While not new, the drawdown in Binance’s crypto reserves, rumored to be a result of profits on its holdings, became a hot topic across social media on the day, with Binance subsequently denying the claims.

BTC price action thus struggled as Wall Street began trading, while gold cooled its rampant ascent into price discovery.

This had produced fresh record highs of $2,942 per ounce after the daily open.

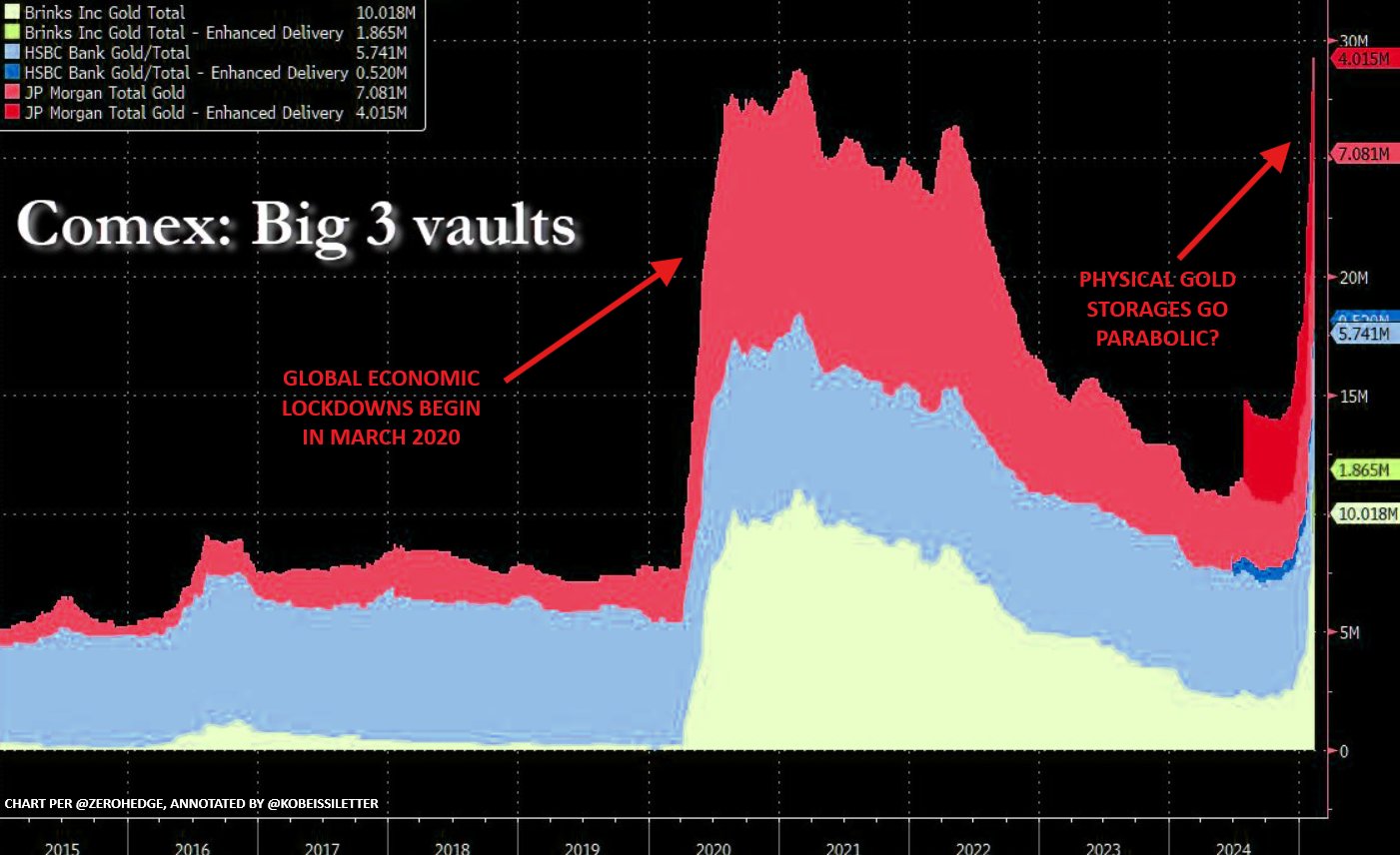

“Physical gold BUYING has gone apocalyptic: Gold inventories in the 3 largest COMEX gold vaults just surged by 15 MILLION ounces in 2 months,” trading resource The Kobeissi Letter responded on X.

“That's a +115% increase, putting physical gold holdings ABOVE 2020 pandemic levels.”

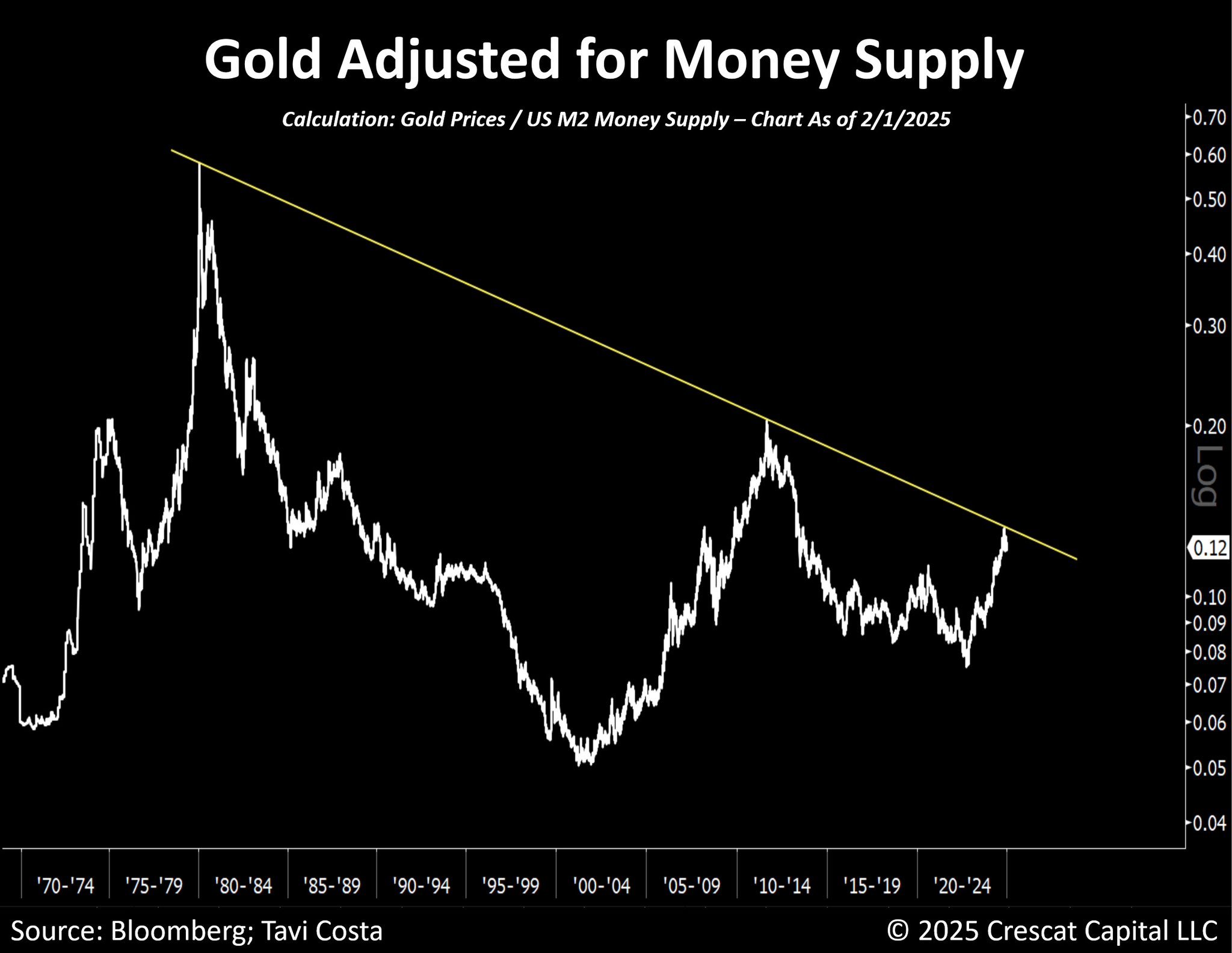

Kobeissi attributed the phenomenon to US liquidity injections, along with uncertainty over inflation trends.

“And this is particularly the case as US Deficit spending is out of control. The US has borrowed $838 BILLION in the first 4 months of FY 2025,” it continued.

“This is crushing bond prices as treasury yields are driven higher. Gold's position as the global hedge has only grown as a result.”

Counting down to Bitcoin’s gold copycat move

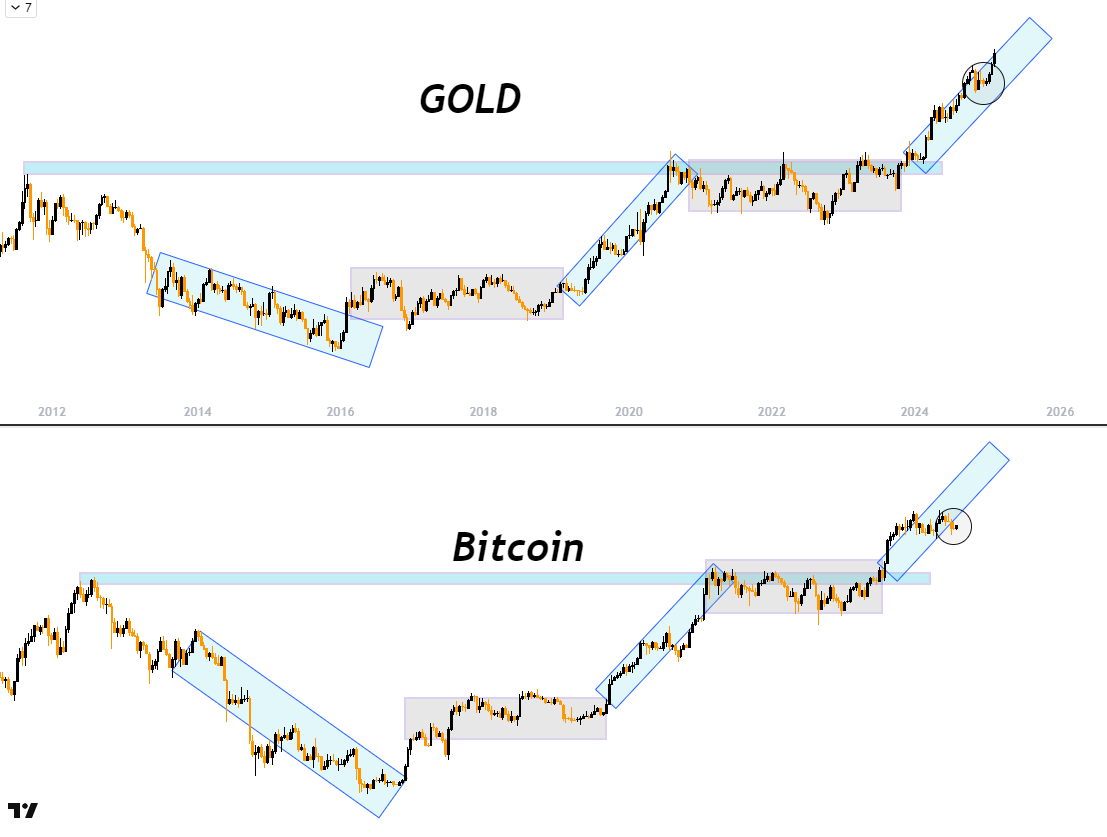

Others were optimistic that Bitcoin would still follow in gold’s footsteps — albeit after a traditional three-month delay .

Among them was crypto trader, analyst and entrepreneur Michaël van de Poppe.

“Bitcoin is likely to print new all-time highs,” he told X followers on the day.

“Gold has been printing strong all-time highs and I think we'll see the same for Bitcoin in the coming 2-3 weeks.”

An accompanying chart described an “ideal zone for entries” on BTC/USD being around $90,000.

Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, likened the situation to Summer 2024.

“As long as Gold keeps trending, Bitcoin almost always sees a comparable (bigger) breakout within 3-6 months. Hoping it's on the short end of that horizon this time around,” part of an X post on the topic read.

“Tariffs = uncertainty + possible inflation. Central banks + Asia are bidding Gold hard as an inflation hedge. Rotation into the hardest asset on earth inevitable.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Easing inflation could ignite another BTC rally: 10x Research

10x Research’s Markus Thielen sees a “real possibility” of a lower CPI print in the US on Feb. 12, which could defy consensus expectations and trigger a Bitcoin rally.