BitBNS Resumes Withdrawals After Two Years of Controversy

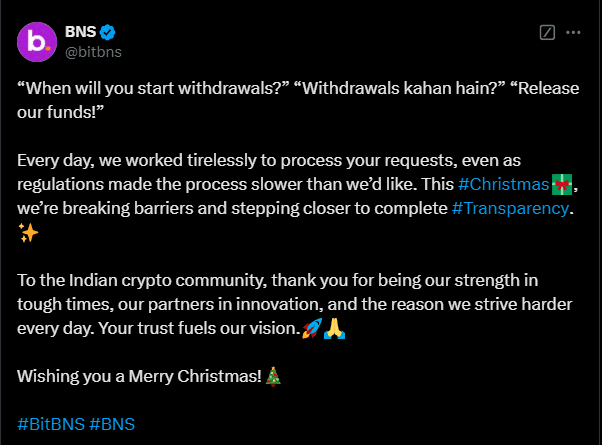

For over two years, thousands of Indian investors endured uncertainty and frustration as BitBNS, an Indian cryptocurrency exchange, froze withdrawals, leaving customers unable to access their funds. However, in a long-awaited development, the exchange has now announced the successful processing of 541 withdrawals between December 19 and December 24, 2024, signaling the first tangible progress in addressing users’ concerns.

The announcement of processed withdrawals is a glimmer of hope for the thousands of affected investors, yet it raises more questions than it answers.

source: X

source: X

With 541 withdrawals processed over six days, the exchange has yet to clarify the total number of pending withdrawal requests or provide a clear timeline for resolving the backlog. For a platform that once boasted over 4 million users, the current progress represents a mere fraction of the overall demand.

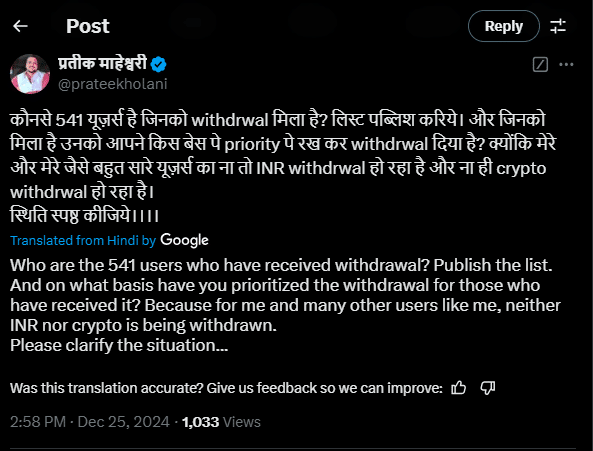

While the recent withdrawals mark a positive development, many investors remain skeptical. A Twitter user, Prateek, questioned Bitbns: on what basis have you prioritized the withdrawal for those who have received it?

source: X

source: X

Despite the ongoing crisis, Indian regulators have largely remained silent on BitBNS’s operations. The Reserve Bank of India’s general aversion to cryptocurrencies has meant that issues like these receive little to no intervention. The lack of regulatory scrutiny has only deepened investor concerns about the safety of their funds.

BitBNS’s announcement of withdrawals is a step in the right direction, but it is far from resolving the deep-seated mistrust that has developed over the past two years.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano Expected to Pump Over 10x in the Altseason, How High Can ADA Go This Bull Cycle

Ripple Rules Out 2025 IPO as Company Maintains Solid Financial Position

Google Chrome’s success ‘impossible to recreate,’ exec testifies in DOJ antitrust trial

Share link:In this post: Parisa Tabriz believes Google Chrome would decline in another company’s hands, saying it would be hard to disentangle Google from the search engine’s success. Google plans to infuse artificial intelligence into Chrome to make it more agentic. OpenAI showed interest in buying Google Chrome.

SEC Commissioner Hester Peirce calls for better crypto regulation

Share link:In this post: SEC Commissioner Hester Peirce has called for better crypto regulation in the United States. Peirce mentioned that financial firms have been approaching crypto in a way like playing “the floor is lava” children’s game. SEC commissioners want flexible regulation as SEC chairman Paul Atkins wants clear regulations for digital assets.