Raised 35,000 SOL in Half a Day, What Is the AI-Pool Presale by a16zdao Member?

ICO Presale, but this time with a new twist of AI Narrative.

Original Title: "A Tweet to Receive 35,000 SOL, What Is the AI-Pool Pre-sale Participated by a16zdao Member?"

Original Source: DeepTech TechFlow

Trends are cyclical, and this is equally true in crypto. Having grown tired of the PumpFun PvP, the market has once again embraced the old-school tactic from the beginning of the year — the pre-sale, but this time with a new twist involving AI-driven narratives.

Early this morning, Twitter user Skely (@123skely) tweeted to announce the start of the AI token issuance project AI-Pool (@aipool_tee)'s pre-sale. Perhaps Skely's affiliation with @a16zdao lent some credibility as the pre-sale raised over 10,000 $SOL in less than two hours, and over 35,000 $SOL by midday.

The pre-sale funding strategy was hot earlier this year, with many projects raising thousands of $SOL; however, few achieved significant success in the end. In theory, the market has become disillusioned with this strategy, so what makes this pre-sale different?

An AI-Managed Pre-sale Pump.fun?

In simple terms, the project AI-Pool, part of this pre-sale, is a "money-printing Fi" managed by AI agents.

In the tweet, Skely mentioned that in early pre-sale funding models (such as slerf, bome, etc.), if a large sum of funds was successfully raised, the launch would naturally bring joy to all. However, fundamentally, this money-printing model, from raising funds to personal wallets, was a massive test of human nature. Even if developers had no ill intent at the beginning, the temptation of increasing funds proved too much, a lesson learned from GM.AI.

The current pump-fun model has indeed avoided some centralized malfeasance. However, it has now been plagued by bots at every turn: fake comments, sniper attacks at opening, trend tracking, etc. Even with a fair launch in mechanism, for retail investors, the opportunity for truly fair participation in trading is diminishing. Not only do they have to PvP with humans, but they also have to PvP with bots that are online 24/7.

In short, these participation methods are by no means fair to retail investors. Since humans cannot outsmart bots in pumping, and humans often violate promises in pre-sale models, why not let AI manage the pre-sale process.

How Does AI-Pool Work?

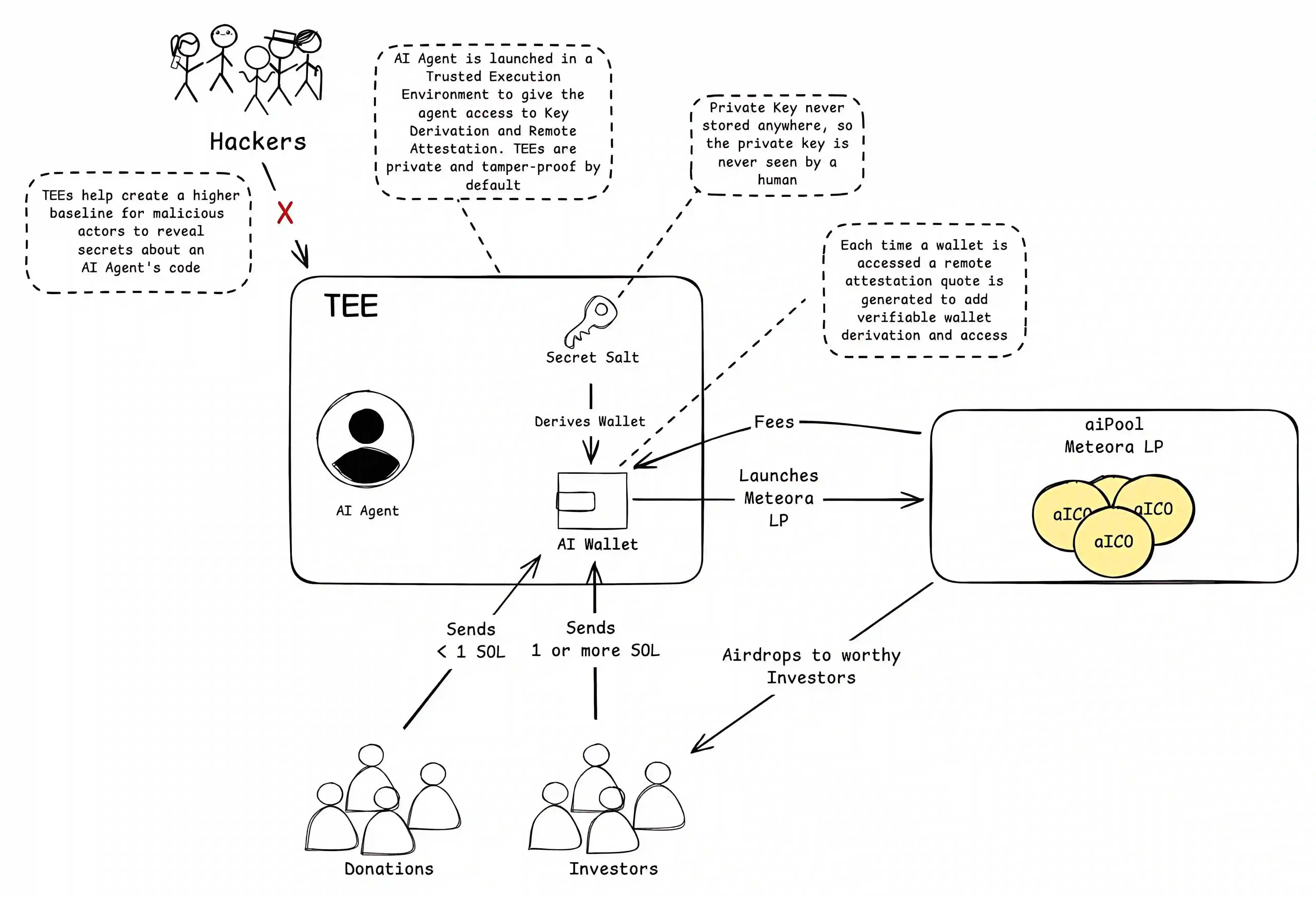

This is an intelligent token issuance system built on Trust Execution Environment (TEE). At its core is an AI agent running in TEE, ensuring its operating environment is protected from hacking or tampering through a special security mechanism. The system utilizes a carefully designed private key management scheme that ensures private keys are never exposed to humans, thereby fundamentally safeguarding the system's security.

In its daily operation, the system accepts two forms of fund injection: small donations (less than 1 SOL) and larger investments (1 SOL or more). These funds flow into the intelligent wallet managed by the AI agent. The AI agent utilizes these funds to launch new token projects on the Meteora liquidity pool and airdrops them back to eligible investors.

Throughout the process, every wallet operation generates a remote attestation credential, which is not only used to validate the legitimacy of the operation but also ensures that the wallet's derivation process and access rights are traceable and secure.

Skely also specifically emphasized that this series of developments was carried out through ai16z's ELIZA framework.

Key Project Mechanisms:

1. Fund Reception: Users directly send 1 SOL minimum and up to 10 SOL to the AI agent's wallet address (opRyDjuRetWnsP78FNFTPEnAJX7AkjuD6GTP7tsqHXd):

· Amounts below the minimum will be considered donations

2. Security Measures: Utilizing @PhalaNetwork's TEE (Trust Execution Environment) technology:

· Private keys are generated and stored in TEE

· Developers cannot access the private key

· All operations can be verified in the terminal logs

3. Liquidity Management:

· AI will create a liquidity pool through Metoria (not PumpFun)

· Transaction fees flow directly back to the AI wallet

· Eligible participants will receive token distributions

Skely also mentioned in the tweet that this presale is not entirely risk-free:

The current project is still in V1 version, and 10% of the total token supply will be sent to a custodial wallet (publicly visible). These funds will be used for potential future exchange listings, integrations (such as cross-chain LP pools), or burning. Technically, developers can push code changes to adjust the rules, but this requires an execution period of around 24 hours. Once the token is listed and locked, changes cannot be made.

It is also mentioned that in V2 and future versions, the team aims to have the AI agents in the project operate fully autonomously, possibly in the form of a DAO. This way, everyone can benefit from fees flowing to the AI agent's wallet, while also implementing some whitelist technology and attempting to blacklist individuals trying to exploit or manipulate the system.

Market FOMO Drives Investment, But Distribution Mechanism Criticized

From the speed of market investment perspective, this presale has indeed been a success. The presale address received over 35,000 $SOL in just half a day, amounting to nearly $7 million. Although the presale specified a limit of 10 $SOL per address, there were still individuals who sent over 500 $SOL in a single transaction to the presale address.

Presale Address:

opRyDjuRetWnsP78FNFTPEnAJX7AkjuD6GTP7tsqHXd

Skely himself did not expect such a high level of FOMO during this presale. When the account neared 30,000 $SOL, he halted the presale, stating that any further investments would only be accepted for LP pool participation (though the specifics of the hard cap and how the oversubscribed $SOL would be allocated remain unclear).

Although the intended investments were made, there were some serious issues with this presale that left users dissatisfied:

1. While encouraging investments, Skely did not initially set a clear hard cap for this presale, causing the amount of SOL in the presale address to increase continuously. Early investors' shares may be diluted, leading to growing concerns and dissatisfaction among participants. Some Twitter users even bluntly stated: Isn't this just a presale rug pull disguised with an AI shell? The real deal is being able to withdraw the funds.

2. The allocation mechanism is unclear; Skely mentioned in a tweet that the tokens would be distributed to "deserving individuals," but this standard is highly subjective, and Skely did not further elaborate on this statement.

3. Some people have also pointed out that the Twitter account for this project, @aipool_tee, has changed its name multiple times, and its previous name (cable) was not very nice... However, Skely himself later tweeted acknowledging that the project account indeed underwent multiple name changes, but stated that it was only to come up with a more suitable name.

Summary

Possibly due to having raised a large sum of money but with the mechanism still unclear, Skely has already sparked discontent among some community members. At the time of writing, Skely's Twitter account has been suspended.

However, before the account suspension, Skely tweeted announcing that the token would be launched on December 24th, World Standard Time, and to prevent sniper attacks, the specific token release time would not be disclosed.

Whether this presale is indeed an attempt by the team to create a substantive application or another scam leveraging AI, hopefully, this time, the ones hurt will no longer be the retail investors who voluntarily contribute their funds...

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto, AI growth could strain North American energy grids: NERC

The Abstract plugin has been officially merged into Eliza by ai16z

Christmas Bitcoin price comparison: Reaching $98,200 in 2024, 392,800 times that of 2010