GRASS Price Sheds 15% Amid Rising Bearish Sentiment

GRASS price is under pressure after a 15% drop, with bearish indicators suggesting further downside. Holding $2.77 support is crucial for stabilization, while resistance at $3.08 offers hope for recovery.

GRASS price is down roughly 15% in the last 24 hours after reaching a new all-time high just two days ago, signaling a sharp shift in momentum. Despite this correction, GRASS remains among the top 20 biggest coins on Solana, with a market cap just above $700 million.

Technical indicators, including the RSI and Ichimoku Cloud, show growing bearish signals as selling pressure intensifies and key support levels come into focus. However, if GRASS can stabilize and regain bullish momentum, it has the potential to challenge nearby resistance zones and reattempt its upward trajectory.

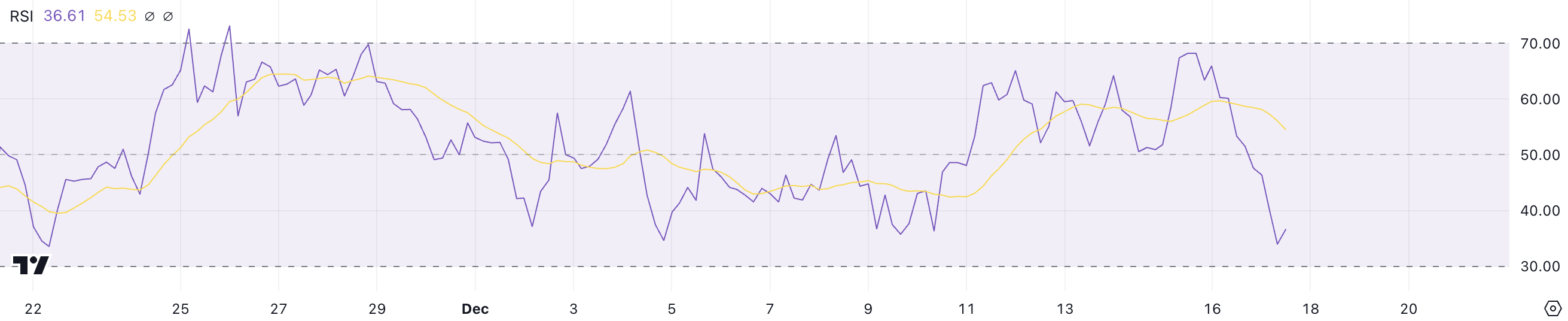

GRASS RSI Changed Quickly in Just 2 Days

GRASS RSI has dropped significantly to 36.6, down from nearly 70 just two days ago when the asset reached a new all-time high. This sharp decline reflects a notable shift in momentum, indicating that buying pressure has weakened considerably since its recent peak.

An RSI value of 36.6 places GRASS closer to oversold territory, suggesting that selling activity has been dominant. While this does not necessarily mean an immediate reversal, it highlights growing bearish sentiment and the potential for further price corrections in the short term, as investors move their pockets into other DePIN coins.

GRASS RSI. Source:

TradingView

GRASS RSI. Source:

TradingView

The Relative Strength Index (RSI) is a technical indicator used to measure the speed and magnitude of price movements, indicating whether an asset is overbought or oversold. RSI values range from 0 to 100, with readings above 70 signaling overbought conditions and increasing chances of a pullback, while values below 30 suggest oversold conditions, often preceding a recovery.

With GRASS’s RSI now at 36.6, the asset is nearing oversold levels, which could mean that selling pressure may soon ease. If buyers re-enter the market, GRASS could stabilize or experience a short-term bounce; however, failure to regain momentum could lead to continued downward movement, testing key support levels.

GRASS Ichimoku Cloud Shows an Important Bearish Signal

The Ichimoku Cloud chart for GRASS shows a bearish setup. The price has fallen sharply and is now trading below both the cloud and the key Ichimoku lines. This downward movement reflects growing selling pressure, as the blue line (Tenkan-sen, or conversion line) has crossed below the red line (Kijun-sen, or baseline), confirming a bearish crossover.

The cloud itself remains above the price with considerable thickness, indicating strong overhead resistance. For GRASS, this structure signals that the short-term trend has turned bearish, and upward recovery will face significant challenges.

GRASS Ichimoku Cloud Chart. Source:

TradingView

GRASS Ichimoku Cloud Chart. Source:

TradingView

The current Ichimoku setup suggests that GRASS could experience continued downward momentum unless it reclaims key resistance zones. For a bullish reversal, GRASS would need to first break back above the Tenkan-sen and Kijun-sen lines, which are acting as resistance, and then push through the lower boundary of the cloud.

A failure to do so could see the price test lower support levels, as bears continue to control the trend. With the cloud’s thickness representing accumulated selling pressure, any meaningful recovery will require strong buying interest to overcome these resistance zones.

GRASS Price Prediction: Is The Correction Over?

The EMA lines for GRASS reveal a critical scenario. The short-term EMAs are sharply declining and are at risk of crossing below the long-term EMAs. Such a crossover, often referred to as a death cross, is a strong bearish signal that could accelerate the ongoing correction.

This development would place significant importance on the $2.77 support level, which is acting as a key line of defense for the price. If this support fails, GRASS price could experience further downward pressure, with the next major support zone located at $2.41, potentially extending the bearish trend.

Although GRASS has a market cap around $700 million, it currently ranks on 13th among DePIN coins, below players like The Graph, Airweave, and IOTA.

GRASS Price Analysis. Source:

TradingView

GRASS Price Analysis. Source:

TradingView

On the other hand, GRASS price still has a chance to reverse this downward trajectory if it can regain bullish momentum and break through the $3.08 resistance. A successful breach of this level could restore buyer confidence, allowing the price to climb toward $3.52.

Should GRASS manage to overcome this resistance as well, the next target lies at $3.84, marking a potential continuation of the previous uptrend. This scenario would require strong buying pressure to negate the current bearish signals and re-establish upward momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US spot Bitcoin ETFs saw a net inflow of $173 million yesterday

Japanese fashion brand ANAP bought 35 bitcoins and currently holds a total of 51.6579 bitcoins

Australia’s financial regulator to crack down on inactive crypto exchanges