Bitget Daily Digest | Buzz around $RSR continues, Sotheby's VP launches new coin (December 5)

Market highlights

1. Donald Trump announced on Truth Social that Paul Atkins has been confirmed as the new Chairman of the U.S. SEC. Notably, Atkins once served as an advisor to the Reserve Rights Foundation. Amidst clashing reports, $RSR and $DTF have become the center of speculation and trading frenzy.

2. On-chain activity highlights that $BAN token developers and Sotheby's Vice President Michael Bouhanna are launching a new token named $VOID. Early buyers secured 15% of the total supply during the internal trading phase, pushing its market cap to nearly $20 million.

3. Coinbase has recently been listing Solana-based memecoins, with $GIGA and $TURBO following $MOODENG. This trend may inject fresh capital into niche markets like Solana-based memecoins and AI projects, further fueling market attention and speculative interest.

4. Bitget has strategically expanded its presence in the Vietnamese market while maintaining steady compliance progress across multiple regions. BGB fundamentals continue to strengthen, lifting its price to a record high of $1.80.

Market overview

1. BTC rally: Bitcoin surged strongly, nearing the $100,000 mark, though performance across other sectors was mixed. The market's focus is moving away from well-established tokens to memecoins.

2. The NASDAQ 100 index rose by 1.29%, while the chip stock MyerTech gained over 23%. In contrast, the Halter USX China Index fell by over 1%.

3. Currently priced at 98,274 USDT, Bitcoin faces significant liquidation risks. A 1000-point drop to around 97,274 USDT could result in over $550 million in cumulative long position liquidations. Conversely, a rise to 99,274 USDT could lead to more than $672 million in cumulative short position liquidations. Both long and short positions should exercise caution and manage leverage prudently to avoid large-scale liquidations.

4. Over the past 24 hours, Bitcoin saw $5.15 billion in inflows and $5.1 billion in outflows, resulting in a net inflow of $50 million.

5. In the last 24 hours, $BTC, $AAVE, $GTC, $AGI, and $A8 led in futures trading net inflows, signaling potential trading opportunities.

Highlights on X

1. @timotimoqi's strategies for positioning and taking profits with Solana second-wave memecoins

This article outlines the author's practical strategies for positioning and securing profits with Solana second-wave memecoins. It focuses on analyzing market narratives, identifying manipulated markets, and evaluating PnL ratios for optimal outcomes. Using Cupsey as a study case, it explains how to identify whale-dominated memecoins, establish strategic positions, implement effective profit-taking techniques, and manage portfolio allocation. The goal is to assist retail investors in attaining high win rates and returns in second-wave memecoin trading.

X post: https://x.com/timotimoqi/status/1864215905749881195

2. @qinbafrank's profitable strategies in major crypto market trends: Fine-tuning Beta, Alpha, and Super Alpha approaches

The author breaks down strategies for profiting in major crypto market trends:

1. Beta strategy: Fully investing in large-cap tokens to ride large-scale market trends

2. Alpha strategy: Focus on fundamentals and market patterns to identify and invest in leading tokens.

3. Super Alpha strategy: Fine-tune portfolio allocation with sector rotations and short-term technical analysis. The article also highlights the significant potential of on-chain returns while addressing the risks tied to futures trades. It highlights the importance of win rates, risk-reward ratios, portfolio management, and timing cycles in implementing these strategies.

X post: https://x.com/qinbafrank/status/1863161267462324533

3. @lanhubiji: From "toys" to opportunities – evaluating investment potential in emerging sectors

@lanhubiji argues that if something new looks attractive initially, the opportunity may already be gone. In contrast, things initially dismissed as "toys" could hold significant investment potential—much like DeFi in its early days and the current phase of AI agents. While these technologies are undervalued today, they hold immense potential for the future.

X post: https://x.com/lanhubiji/status/1864211360789438864

4. @wangfeng_0128 analyzes the return and future potential of CRV

Curve Finance (CRV), a leading DeFi platform, is experiencing a strong resurgence, with the potential for up to a 10x increase in value. Backed by BlackRock funds and institutional partnerships, CRV has solidified its dominance in stablecoins and decentralized finance. Its low slippage, high liquidity, and collaborations with various DeFi protocols make it a core platform for liquidity provision and yield farming. Additionally, CRV's tokenomics and multi-chain expansion present vast market potential. Its recent rise above $1.20 signals the fading of bearish sentiment, positioning CRV to capture a larger share of the DeFi market in the future.

X post: https://x.com/wangfeng_0128/status/1864156058736054734

Institutional insights

1.CryptoQuant: The 30-day demand from retail investors for BTC has reached its highest level since 2020.

X post: https://x.com/cryptoquant_com/status/1864346040633008510

2.QCP Capital: The market's rapid rebound highlights strong buying momentum. While short-term macro risks persist, the overall outlook remains bullish.

Article: https://t.me/QCPbroadcast/1374

3.SlowMist: The DEXX attacker is consolidating funds and transferring them cross-chain to Ethereum via Wormhole.

X post: https://x.com/evilcos/status/1864452169698824371

News updates

1. South Korea's ruling party opposes the impeachment of president Yoon Suk-yeol.

2. Indian government alleges tax evasion by Binance, WazirX, and other crypto companies.

3. Jerome Powell: Bitcoin's competitor is gold, not the U.S. dollar.

4. The United Kingdom has uncovered a large-scale crypto money-laundering scheme involving drug traffickers and Russian spies.

5. Vladimir Putin indicates that no one can ban Bitcoin, and everyone is striving to reduce costs and improve reliability.

Project updates

1. Magic Eden airdrop qualification and allocation query tools are now live.

2. Ripple is staying aligned with NYDFS on final approval for RLUSD; original launch date gets postponed.

3. L1 blockchain Gravity to launch Devnet phase 1 and unveil development roadmap.

4. UXLINK Mini App achieves over 500,000 users within 35 days of its launch on LINE.

5. TRON's daily protocol revenue hits $21.66 million, setting new record.

6. Vana mainnet to launch in next week; VANA token release imminent.

7. GMT's STEPN gaming token sees a monthly increase of over 160%. Unblocking of IPs in mainland China draws attention.

8. XION releases whitepaper and tokenomics; 15.19% of tokens allocated to community and launch activities.

9. In November, Aptos DEX sees a 28x increase in daily trading volume and a 19x increase in TVL.

10. Nansen launches a new portfolio tracker, free for all users.

Token unlocks

Taiko (TAIKO): Unlocking 9.29 million tokens, valued at $20.9 million, accounting for 11.38% of circulating supply.

Delysium (AGI): Unlocking 8.57 million tokens, valued at $2.1 million, accounting for 0.67% of circulating supply.

Everclear (NEXT): Unlocking 20.11 million tokens, valued at $2.6 million, accounting for 18.82% of circulating supply.

Recommended reads

How to find potential projects in the Virtuals ecosystem? Analyzing internal market mechanics and value investment strategies

Virtuals adopts pump.fun's issuance model and meme-like AI agent token marketing, but maintains its original project intent. For investors looking for potential projects, shifting strategies and mindset and investing time in analyzing AI agent products and fundamentals could be the correct approach to value investing. Meanwhile, for the Base ecosystem, which currently has much less liquidity than Solana, replicating the meme ecosystem alone attracts only short-term traffic and opportunists, while relying on differentiated products and unique ecosystems is the core approach to retain users.

Read the full article here: https://www.bitgetapp.com/zh-CN/news/detail/12560604395015

Solana Foundation: Three strategic directions for AI-crypto integration

The Solana Foundation outlines three key development directions: Building an intelligent agent-driven economy, enhancing LLM capabilities for Solana code development, and supporting open and decentralized AI technology stacks.

Read the full article here: https://www.bitgetapp.com/zh-CN/news/detail/12560604395013

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report | In-depth Analysis of PumpBTC & PUMP Market Valuation

Pump Fun Introduces PumpFi for Memecoins and NFTs Funding

Bitcoin Price Weakness: Exploring Factors Beyond the US Tariff War and Market Sentiment

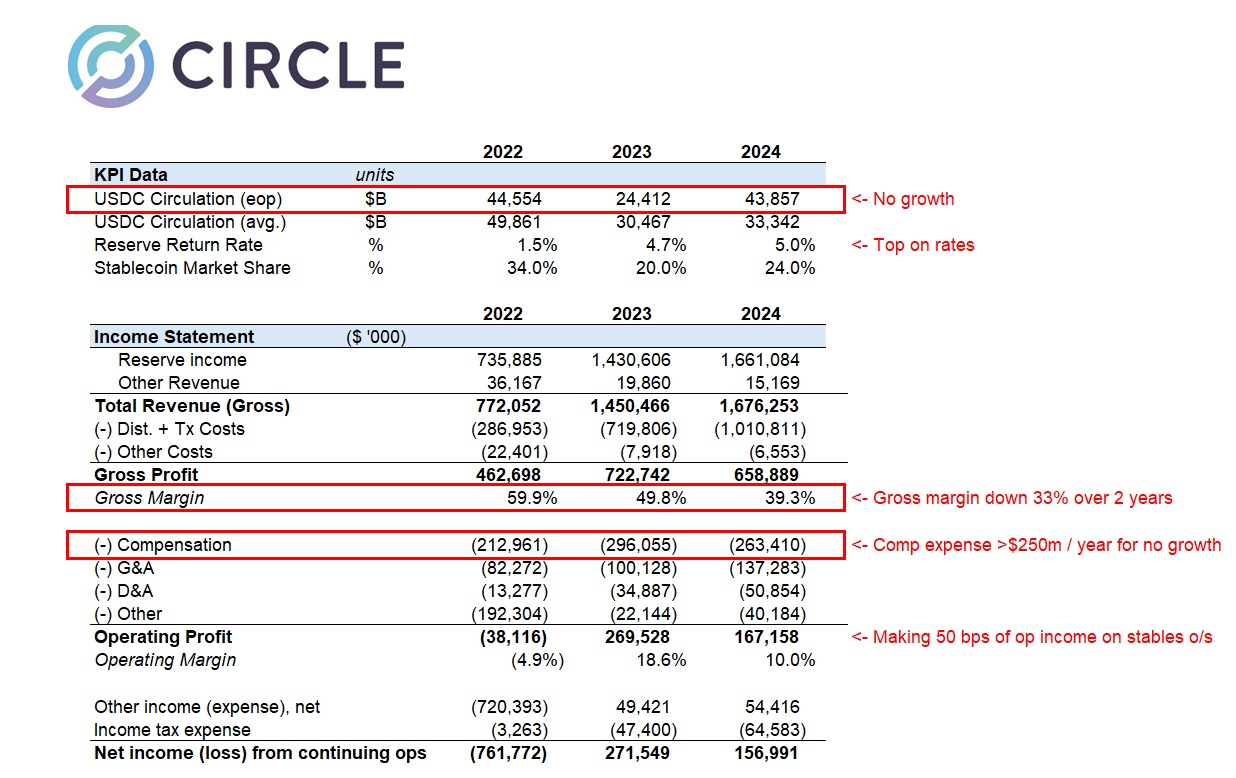

Concerns Arise Over Circle’s IPO Amid Revenue Growth and Profitability Challenges