Bitcoin ETFs hit new record with over $3.1B in weekly inflows

United States-based spot Bitcoin exchange-traded funds (ETFs) have reached a record high in weekly inflows, signaling continued investor enthusiasm amid Bitcoin’s parabolic rally.

Spot Bitcoin ( BTC ) ETFs saw net inflows of $3.38 billion for the week of Nov. 18–22, according to crypto tracking platform SoSoValue, marking a 102% increase from the previous week’s $1.67 billion inflow.

The figure represents the largest recorded weekly inflows for spot Bitcoin ETFs. It also marks the seventh consecutive week of positive flows, according to SoSoValue.

BlackRock’s iShares Bitcoin Trust (IBIT) still leads the pack with $48.95 billion in net assets as of Nov. 22 and cumulative inflows of $31.33 billion. Meanwhile, the Grayscale Bitcoin Trust ETF, despite holding $21.61 billion in net assets, has seen outflows exceeding $20 billion since its launch.

Digital asset products record $37 billion year-to-date

According to data from the crypto investment firm CoinShares, digital asset investment products have already brought in $37 billion in inflows year-to-date.

The ETF inflows were driven primarily by the Bitcoin ETFs and had already outpaced the debut of gold ETFs, which only attracted $309 million in the first year of trading.

CoinShares reported that the inflows into the US were offset by outflows from other countries like Germany, Sweden and Switzerland. According to CoinShares, the recent BTC price high was seen as a chance to take profits rather than double down on positions.

CoinShares data estimates total Bitcoin ETF inflows at $3.12 billion for the week.

Short-Bitcoin products also recorded $10 million in inflows, indicating some investors are hedging against potential downside risk. Meanwhile, markets in Australia, Canada and Hong Kong collectively showed optimism, contributing approximately $70 million in inflows.

Bitcoin hits a new all-time high of $99,655

The increase in weekly inflows comes as BTC recorded a new all-time high before experiencing a slight correction. Cointelegraph Markets Pro data shows that on Nov. 22, BTC hit a new price record of $99,655.50.

Despite this, the crypto asset could not break through to $100,000, a much-anticipated milestone for the crypto community. The asset currently trades at $98,459.95.

Magazine: Bitcoin’s $100K push wakes taxman, Vitalik visits real Moo Deng: Asia Express

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

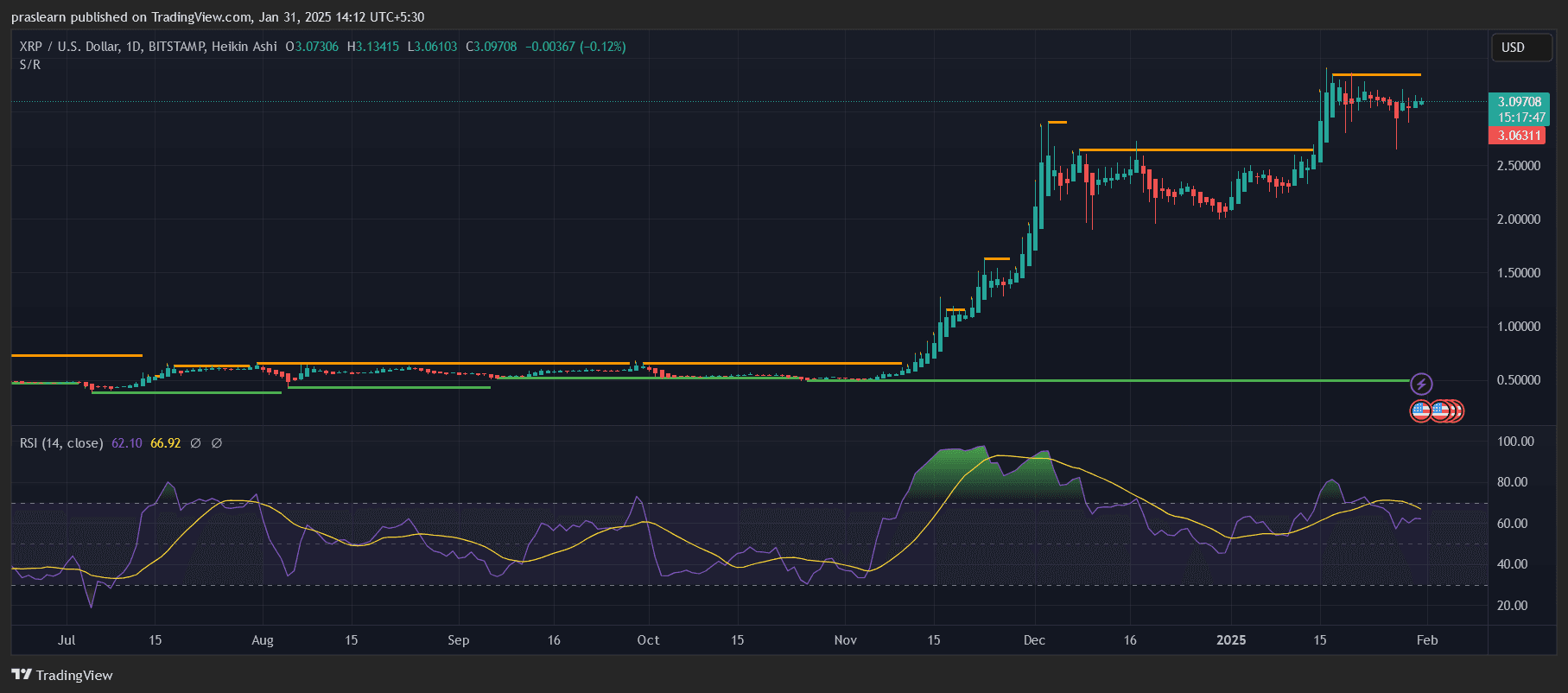

Ethereum (ETH) and XRP (XRP) Price Action Signals Key Breakouts: Is a Rally Incoming?

Dogecoin (DOGE) Supporter Elon Musk's Father Takes Action Before Him! He Will Earn $200 Million Using Musk's Name!

Errol Musk, father of Tesla CEO Elon Musk, said he plans to raise between $150 million and $200 million through a token project called Musk LT.

50-Year Analyst Peter Brandt Says He's Bullish on XRP, Reveals Price Targets!

Peter Brandt shared that he expects a rise in the Ripple (XRP) price.

Will XRP Price Reach $5 in February 2025?