Mining 1 Bitcoin Costs $80k? Sorry, This Math Isn’t Mathing

- Critics argue Bitcoin mining‘s environmental impact outweighs its benefits.

- Data showed BTC mining is currently unsustainable.

- There are doubts about the accuracy of this data.

Bitcoin mining is an energy-intensive process in which specialized hardware competes to solve cryptographic puzzles. It requires trillions of guesses per second to match a target hash, and while this computation secures the network, it comes at a significant energy cost.

Sponsored

Critics argue that Bitcoin mining is wasteful, with some even calling for a ban over environmental concerns . Recent data now claims it costs more to mine a single Bitcoin than its market price, casting doubt on mining’s long-term sustainability. However, questions linger over the accuracy of these figures.

Is Bitcoin Mining Unsustainable?

According to data from research platform MacroMicro, the average cost to mine one Bitcoin now exceeds its market value, suggesting that mining may be financially unsustainable under current conditions.

Average Bitcoin mining cost per MacroMicro

Average Bitcoin mining cost per MacroMicro

MacroMicro’s data indicates that it currently costs $80,670 to mine one Bitcoin, while the spot price is $68,700.

This disparity gives a 1.15 ratio of average mining costs to Bitcoin’s price, measured as a 30-day moving average. The ratio has climbed sharply since April, when it was at 0.65.

A ratio above one signals unprofitable mining conditions, which would push miners to exit the network. Conversely, a ratio below 1 creates incentives for more miners to join.

Electricity Costs Make All the Difference

With MacroMicro’s Average Mining Costs/Bitcoin Price Ratio above 1, inefficient miners would power down their rigs and exit the network. The network’s hash rate can offer insights although no direct data is available on the exact number of active miners.

Bitcoin’s hash rate hit a record high of 838 EH/s on October 21 and remains on an upward trend, according to CoinWarz. This sustained growth suggests that miners are not leaving the network, raising questions about the accuracy of MacroMicro’s data.

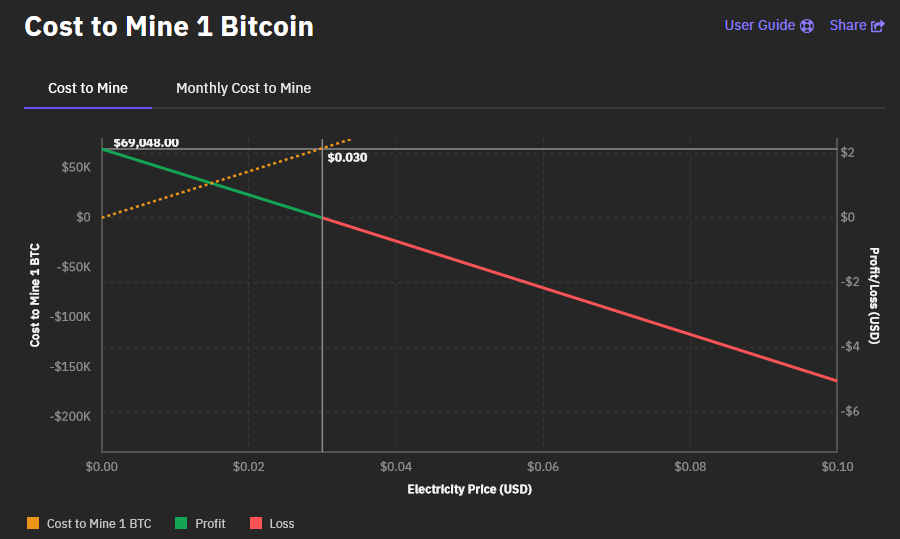

A potential issue with MacroMicro’s data is its assumed electricity cost, which may not reflect regional price variations. Research from Braiins showed that a small difference in electricity costs, $0.02 per kWh versus $0.03 per kWh, can mean the difference between a $22,480 profit and a $803 loss, highlighting how a small difference in electricity cost can impact mining profitability.

Bitcoin mining costs and impact on profitability, per Braiins

Bitcoin mining costs and impact on profitability, per Braiins

On the Flipside

- Miners often leverage unique advantages like stranded energy resources, energy arbitrage opportunities, or cooling solutions that can lower operational costs below “average” calculations.

- With block rewards halving every four years, more reliance will be placed on fees.

- Some miners maintain operations even during unprofitable periods because they believe in future price appreciation.

Why This Matters

While critics trumpet MacroMicro’s data as proof of Bitcoin’s mining crisis, the network’s soaring hash rate tells a different story.

Michael Saylor likens MicroStrategy to Bitcoin.

Saylor Leaks MicroStrategy’s ‘Exclusive Relationship’ with Bitcoin

Charles Hoskinson is under relentless social media troll attacks.

Troll Attacks Drive Cardano Chief to Consider Social Detox

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin dips below $100,000, memecoins plummet as market responds to US tariffs

The crypto market has dipped in response to President Trump’s plan to enact steep tariffs on imported goods from Canada, Mexico, and China beginning on Tuesday.Canada and Mexico have ordered retaliatory tariffs in response, while China promised “corresponding countermeasures” and said it would file a lawsuit with the WTO.Memecoins were particularly hard-hit by the downturn, with many top coins seeing double-digit percentage drops. Trump’s memecoin has fallen nearly 30% over the past week.

Ethereum Price Dips, Yet Increased Buying Activity Indicates Promising Future

Despite Bearish Trends, Increased Buying Activity Hints at Potential Breakout for Leading Altcoin, Ethereum

Overview: SOL vs ETH – Deciphering Key Aspects of the Solana-Ethereum Ratio

Untangling the SOL/ETH Dynamics: An In-Depth Look at Solana's Potential for Recovery Following Its Recent 25% Decline

Two Whales Messed Up on Two Different Altcoins – Forced to Sell at a Huge Loss on the Last Drop

According to Onchain data, two different crypto whales sold their positions after losing on two altcoins. Here are the details.