Ternoa: The team is actively testing the connection between AggLaye and the test network, and plans to launch the main network in the first quarter of 2025

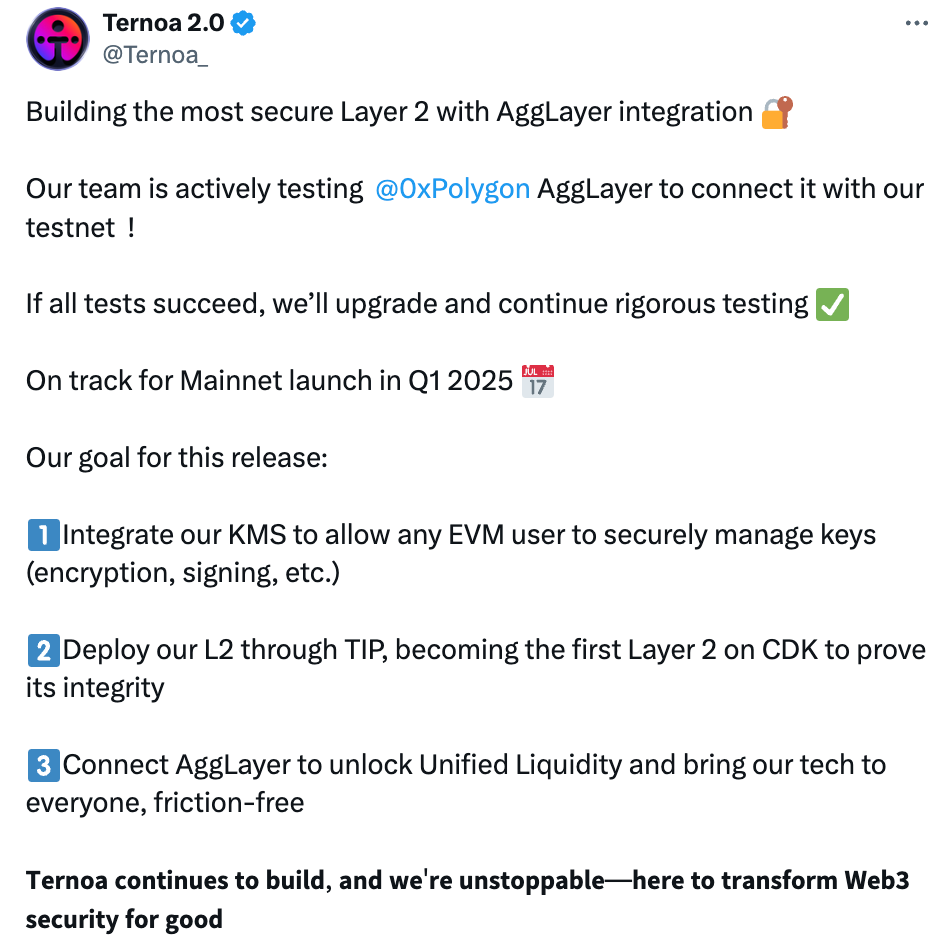

Building the most secure Layer 2 with AggLayer integration

Our team is actively testing @0xPolygon AggLayer to connect it with our testnet !

If all tests succeed, we’ll upgrade and continue rigorous testing

On track for Mainnet launch in Q1 2025

Our goal for this release:

Integrate our KMS to allow any EVM user to securely manage keys (encryption, signing, etc.)

Deploy our L2 through TIP, becoming the first Layer 2 on CDK to prove its integrity

Connect AggLayer to unlock Unified Liquidity and bring our tech to everyone, friction-free

𝗧𝗲𝗿𝗻𝗼𝗮 𝗰𝗼𝗻𝘁𝗶𝗻𝘂𝗲𝘀 𝘁𝗼 𝗯𝘂𝗶𝗹𝗱, 𝗮𝗻𝗱 𝘄𝗲'𝗿𝗲 𝘂𝗻𝘀𝘁𝗼𝗽𝗽𝗮𝗯𝗹𝗲—𝗵𝗲𝗿𝗲 𝘁𝗼 𝘁𝗿𝗮𝗻𝘀𝗳𝗼𝗿𝗺 𝗪𝗲𝗯𝟯 𝘀𝗲𝗰𝘂𝗿𝗶𝘁𝘆 𝗳𝗼𝗿 𝗴𝗼𝗼𝗱

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HYPE Surpasses TRX in Fee Generation; Questions Arise About Long-Term Dominance

INIT is live! Bullish or bearish? Join to share 3,432 INIT!

XRP Network Explodes with 67% Growth—Here’s What It Means for the Price

VIPBitget VIP Weekly Research Insights

In 2025, the stablecoin market shows strong signs of growth. Research indicates that the market cap of USD-pegged stablecoins has surged 46% year-over-year, with total trading volume reaching $27.6 trillion, surpassing the combined volume of Visa and Mastercard transactions in 2024. The average circulating supply is also up 28% from the previous year, reflecting sustained market demand. Once used primarily for crypto trading and DeFi collateral, stablecoins are now expanding into cross-border payments and real-world asset management, reinforcing their growing importance in the global financial system. More banks and enterprises are starting to issue their own stablecoins. Standard Chartered launched an HKD-backed stablecoin, and PayPal issued PYUSD. The CEO of Bank of America has expressed interest in launching a stablecoin once regulations permit (via CNBC). Fidelity is developing its own USD stablecoin, while JPMorgan Chase and Bank of America plan to follow suit when market conditions stabilize. Meanwhile, World Liberty Financial (backed by the Trump family) has introduced USD1, backed by assets such as government bonds and cash.