Volume 205: Digital Asset Fund Flows Weekly Report

From CoinShares Research Blog by James Butterfill

Digital Asset Inflows Surge to $2.2bn Amid US Election Optimism

- Digital asset inflows hit US$2.2bn, the largest since July, driven by optimism over a potential Republican US election win.

- US inflows reached US$2.3bn, while other regions saw minor outflows, likely due to profit-taking.

- Bitcoin led with US$2.13bn in inflows, while Ethereum and several altcoins saw smaller gains; multi-asset products broke their 17 consecutive week inflow streak seeing US$5.3m in outflows.

Digital asset investment products saw inflows of US$2.2bn, marking the largest weekly increase since July this year. We believe this renewed optimism stems from growing expectations of a Republican victory in the upcoming US elections, as they are generally viewed as more supportive of digital assets. This, in turn, has led to positive price momentum. As a result, trading volumes in investment products surged by 30%, while price appreciation and inflows have brought total assets under management close to the US$100bn threshold.

Regional flows paint a very polarised picture, with the US seeing US$2.3bn of inflows, while almost every other country saw minor outflows, most notable of which were Canada, Sweden and Switzerland with US$20m, US$18m and US$15m respectively. We believe this may be due to minor profit taking outside the US.

Bitcoin was the main beneficiary, seeing inflows of US$2.13bn, with recent price appreciation prompting inflows into short-bitcoin of US$12m, the largest since March this year.

Ethereum also saw inflows of US$58m, while some altcoins saw inflows, such as Solana (US$2.4m), Litecoin (US$1.7m) and XRP (US$0.7m). Multi-asset products saw outflows of US$5.3m, ending a 17-week streak of consecutive inflows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin traders eye ‘huge’ US jobs data as BTC price risks $95K dip

BTC price strength faces further risks as prediction markets see a giant beat on US January jobs.

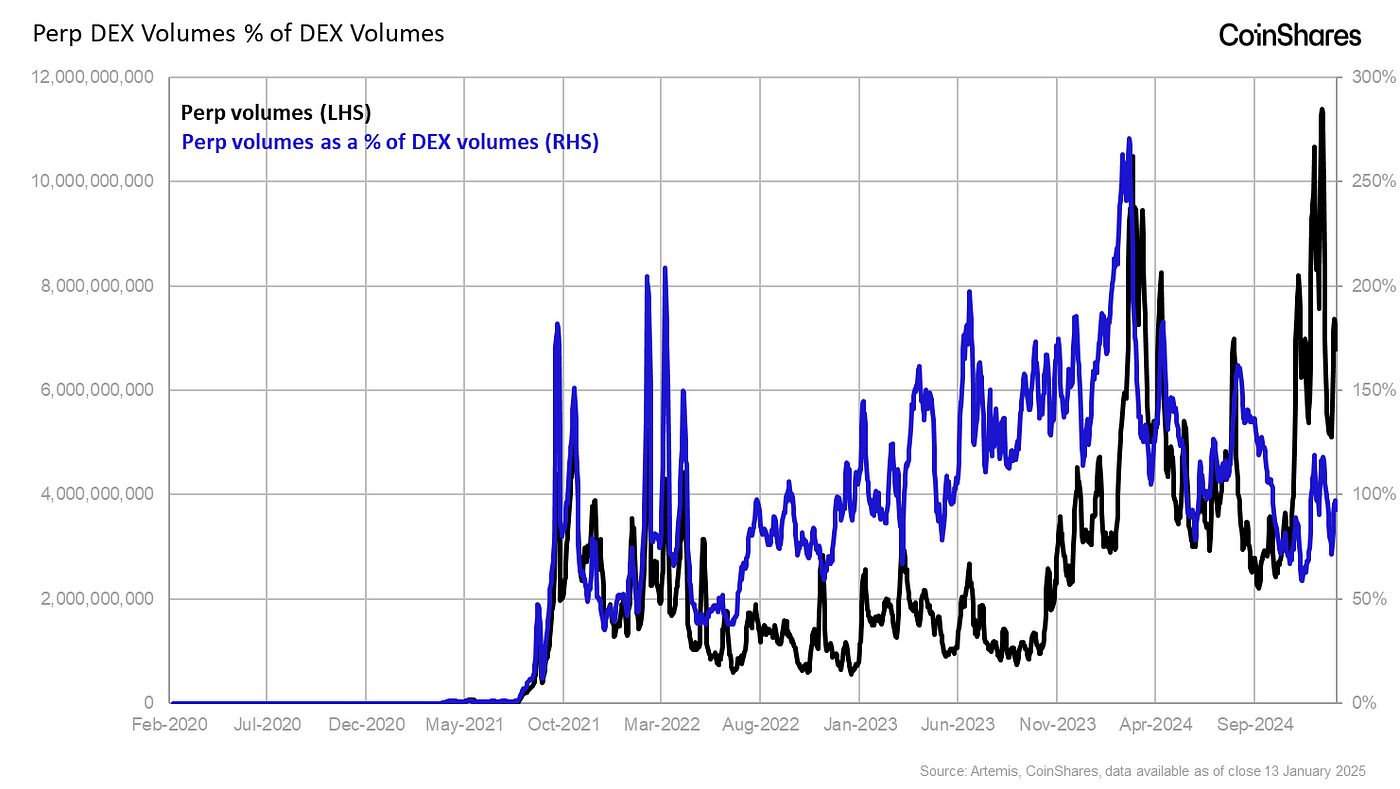

The Perpetual DEX Sector: A Great Leap Forward

Engage now, or forever hold your peace

Speakers at yesterday’s Ondo Summit in Manhattan urged the industry to engage with regulators as crypto policy efforts unfold

ETH Price Outlook: Will Pectra Upgrade Reinstate Ethereum’s ‘Ultra Sound Money’ Status?