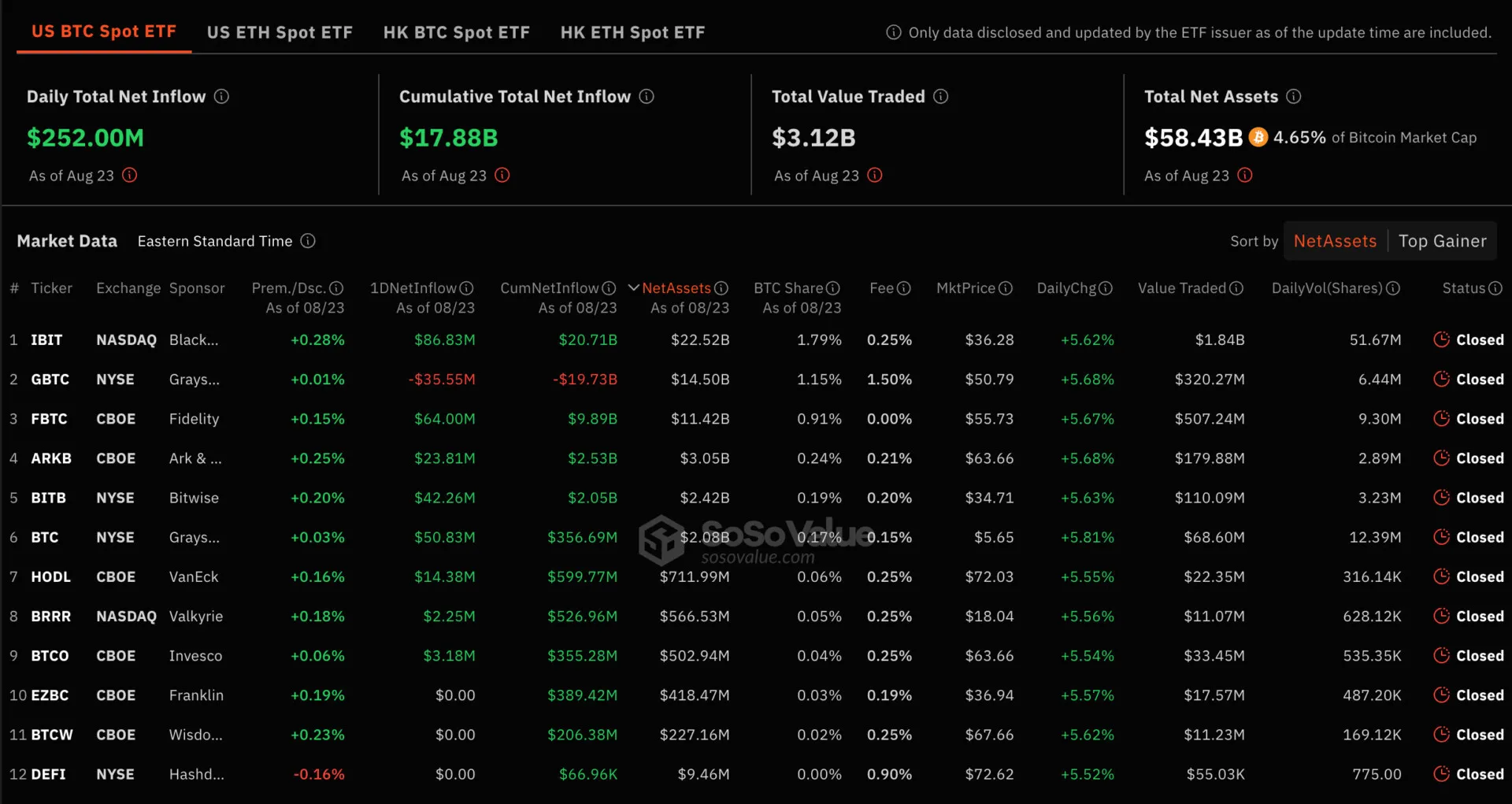

Bitcoin spot ETFs see $252M inflow, highest since July 23

By:By Jai Hamid

Bitcoin spot ETFs just saw a huge inflow of $252 million yesterday, the biggest since July 23. Despite some funds like Grayscale’s GBTC seeing outflows, others like BlackRock and Fidelity pulled in big money.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Bitcoin's Bull Run Reloads: Analyst Expects BTC to Break All-Time Highs

Cointime•2025/04/28 18:33

XRP price rises 10% in a week as long-term holders reduce selling

Coinjournal•2025/04/28 18:33

CSPR price jumps more than 130% ahead of Casper 2.0 upgrade

Coinjournal•2025/04/28 18:33

SUI price eyes $4 but faces risks from upcoming event

Coinjournal•2025/04/28 18:33

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$94,563.36

+0.25%

Ethereum

ETH

$1,793.66

-0.60%

Tether USDt

USDT

$1

+0.00%

XRP

XRP

$2.29

+1.69%

BNB

BNB

$604.33

-0.01%

Solana

SOL

$147.78

-1.37%

USDC

USDC

$1

+0.04%

Dogecoin

DOGE

$0.1780

-1.78%

Cardano

ADA

$0.7042

-0.49%

TRON

TRX

$0.2479

-0.18%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now