Standard Chartered says bitcoin price could fall further to $50,000

As bitcoin’s price has dipped below the $60,000 mark and is currently hovering around $57,000, it could fall further to around $50,000, according to Standard Chartered Bank.

"BTC's proper break below $60K has now reopened a route to the $50-52K range," Geoffrey Kendrick, head of Standard Chartered Bank 's forex and digital assets research, said Wednesday in a statement to The Block. "The driver seems to be a combination of crypto-specific and broader macro."

Crypto-specific concerns include five consecutive days of outflows from U.S. spot Bitcoin exchange-traded funds and a poor response to the recent launch of spot Bitcoin and Ether ETFs in Hong Kong, Kendrick said.

With consecutive outflows from U.S. spot Bitcoin ETFs, and currently, the average ETF purchase price being below $58,000, there is a risk of liquidation, according to Kendrick. "More than half of the spot ETF positions are underwater and so the risk of liquidation of some of them must be considered as well," he said.

Regarding Hong Kong spot ETFs, their volume was low, which has contributed to the recent Bitcoin price fall, according to Kendrick.

Beyond crypto-specific issues, broader macroeconomic trends are also weighing on Bitcoin's price dynamics, Kendrick said. Liquidity measures, particularly in the U.S., have deteriorated rapidly since mid-April, he noted, adding that assets like crypto, which often thrive on liquidity, are feeling the impact of these tightening conditions.

"Of course, liquidity matters when it matters, but with a backdrop of strong U.S. inflation data and less likelihood of Fed rate cuts, it matters at the moment," Kendrick said, concluding: "Re-enter BTC in the $50-52k range or if US CPI on the 15th is friendly."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

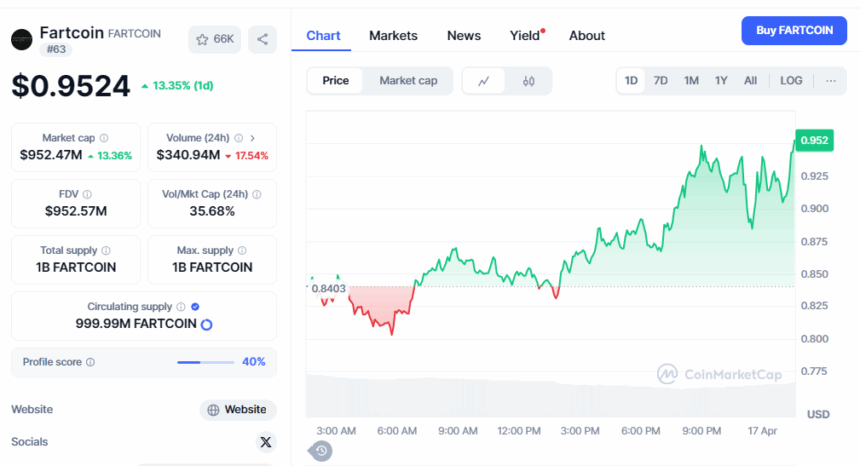

Fartcoin Pumps More 12% As Whales Keep Buying; Can it Break $1 by Sunday?

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?

Bitcoin Slips Below Trendline—Can $82.8K Hold the Line?

Bitcoin’s Bull Score Index Hits 58 Days Below 50: What’s Next?